POSCO, the world’s seventh-largest steelmaker, is seeking to invest in smaller rival Hyundai Steel Co.’s first overseas plant in the US, in exchange for local production of its own steel products in the country to mitigate hefty 25% US tariffs on steel imports.

If the two strike a deal, it would mark Korea’s top two steelmakers’ first joint investment and production project abroad.

According to the steel industry on Sunday, POSCO Holdings Inc., parent of Korea’s top steelmaker POSCO, is in talks with Hyundai Motor Group, the parent of Korea’s No. 2 steelmaker Hyundai Steel, for POSCO’s investment in Hyundai Steel’s first US plant, which is slated to open in 2029.

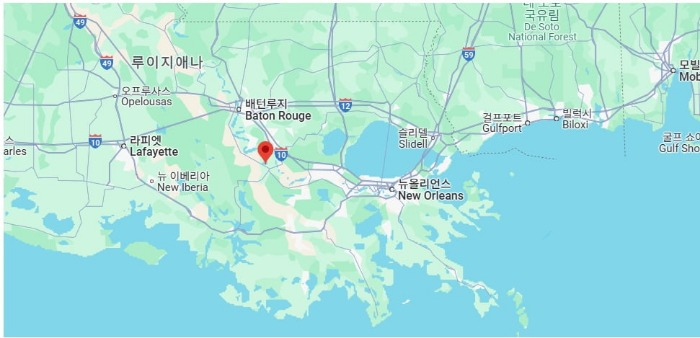

Earlier this year, the Korean auto titan vowed to invest 8.5 trillion won ($5.9 billion) in building the first overseas plant of Hyundai Steel in Louisiana.

Recently, it said it would finance roughly half of the total investment in the plant through equity investments by Hyundai Motor affiliates and external investors, and the remaining capital through debt financing.

The two steelmakers are said to be ironing out the deal’s details, including the size and method of POSCO’s investment in the US steel mill.

If they reach an agreement, it would mark the first overseas collaboration of Korea’s steel archrivals.

Their cooperation could also expand beyond steel production into joint research and development projects for future steelmaking technologies, market analysts expected.

HEFTY US STEEL TARIFFS DRIVE FOES’ TIE-UP

POSCO and Hyundai Steel have been long-time foes in the steel market, and their competition has further intensified since 2004 when the latter jumped into the blast furnace market, which had previously been dominated by the former.

But rising US duties on steel imports and the country’s stricter steel trade regulations have led the two archrivals to consider collaboration in overseas markets.

Building local steel mills in the US is one of the best solutions for the climbing tariffs, but it costs too much.

If POSCO and Hyundai Steel partner to invest and produce abroad, it could be a win-win for them as POSCO could make inroads into the US market without its local steel plant, while Hyundai Steel could reduce its financial burden.

Korea’s top steelmaker has been considering building overseas production sites, especially one in the US, for years to shore up its falling sales.

But it scrapped a plan to build a local steel-manufacturing plant in Alabama due to high labor costs about 10 years ago. It has also shelved a recent plan to invest stakes in a local steel maker in the US and set up a joint venture.

Against the backdrop, Hyundai Steel’s announcement to build a steel plant in the US has come as a shock to POSCO, but also as an opportunity that could prime its US venture pump.

To Hyundai Steel, inviting its bigger rival POSCO with extensive know-how in steel production and fat coffer as an ally is not a bad deal amid intensifying competition from cheaper China-made steel products.

HURDLES REMAIN

But their collaboration would not come without hurdles.

POSCO is said to be demanding that it be allowed to use a few lines in Hyundai Steel’s US plant to produce its own steel products in exchange for its equity investment.

Hyundai Steel is said to be hesitant to accept this, according to sources.

Also, about 10 major multinational steelmakers, including the world’s No. 2 steelmaker ArcelorMittal, have expressed their intention to make equity investments in Hyundai Steel’s US operation.

This means another investor would invest instead of POSCO.

Still, industry observers believe a POSCO-Hyundai Steel alliance is likely, driven by their shared goal to counteract rising trade protectionism and the flood of cheaper Chinese steel products.

If the two sides reach an agreement, the Louisiana plant could significantly reduce tariff exposure for both companies.

Once the plant becomes operational in 2029, Hyundai Steel is expected to supply tariff-free steel to the US plants of its automotive affiliates, Hyundai Motor Co. and Kia Corp., which are expected to churn out a combined 1.2 million vehicles annually in the world’s No. 1 economy.

POSCO, in turn, could gain a local base to produce steel products and supply them to US customers, such as General Motors Co. and Ford Motor Co.

Beyond joint production, their tie-up could pave the way for their collaboration in research and development of future technologies, particularly in the areas of sustainable and eco-friendly steelmaking technologies, said industry experts.

By Woo-Sub Kim, Jin-Won Kim and Hyung-Kyu Kim

duter@hankyung.com

Sookyung Seo edited this article.