The Incheon Free Economic Zone (IFEZ) Authority said on Monday that it attracted $309.6 million in reported foreign direct investment (FDI) in the first quarter, marking its second-highest quarterly performance since its establishment in 2003.

The figure represents 51.6% of the authority’s annual target of $600 million, placing the agency on track to once again exceed its FDI goal following a record-setting year in 2024.

The robust performance comes despite ongoing global trade tensions and persistent geopolitical uncertainties, underlining sustained investor confidence in the Korean business hub west of Seoul.

Total cumulative FDI since the zone’s inception has now surpassed $15.86 billion – a testament to its long-standing appeal to foreign investors in sectors ranging from biopharmaceuticals to advanced materials and cultural content.

Much of this year’s early success stems from large-scale reinvestments by key players in the zone’s strategic industries.

SARTORIUS, LOTTE BIOLOGICS, TOK AM, HELLERMANNTYTON

Sartorius Korea Operations, the Korean unit of Sartorius AG, a German-based global pharmaceutical and laboratory equipment supplier, filed a $250 million investment to expand its research, production and testing infrastructure – building on a previously confirmed $300 million commitment.

Lotte Biologics Co. pledged a $28.7 million injection into its bio-campus in Songdo, while TOK Advanced Materials Co. committed $24.5 million to enhance its EUV photoresist development capabilities.

Lotte BioLogics’ pledged investment of $28.7 million this year follows its $55 million spending in 2023-2024 to build its first biotech plant in Songdo – the bio hub of the country.

Through its investment, TOK aims to create an optimal environment for cutting-edge technology development and the production of components used in semiconductor ultra-fine processes.

Other notable investors included HellermannTyton, a UK-based wire and cable connecting devices maker that has been continuously expanding its presence in the IFEZ since 2014.

THIS YEAR’S FDI TARGET RAISED

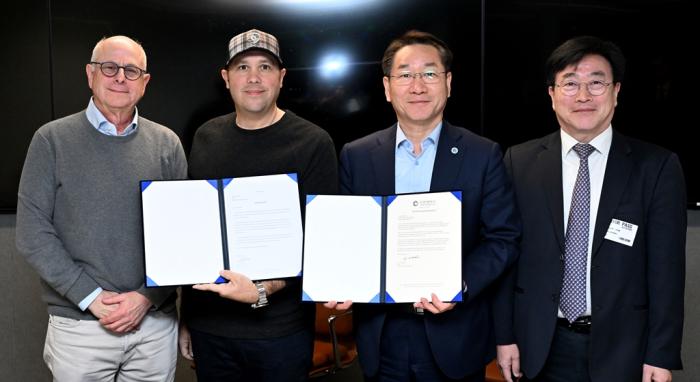

Upon taking office last year, IFEZ Commissioner Yun Won-sok raised the agency’s 2025 FDI target from $400 million to $600 million, initiating a more aggressive overseas investor outreach campaign.

His efforts culminated in a record-high $605.8 million in reported FDI in 2024.

“Cross-border investor interest remains high despite an unpredictable macroeconomic environment,” he said. “Our diversified investment strategy and bold revision of annual targets have played a central role in delivering good results.”

The IFEZ Authority is now executing its “2025 Comprehensive Investment Promotion Plan,” focusing on key sectors such as healthcare and biotech; advanced and strategic industries; and tourism, leisure and cultural content.

INTEREST OUTSIDE BIOTECH

Investment interest in IFEZ is also emerging for sectors other than biotechnology.

The agency has received letters of intent for investment in the southern end of Ganghwa Island and for the K-Con Land project – a cultural and content production cluster surrounding the Yeongjong and Cheongna regions.

IFEZ officials said they have had discussions with global media and entertainment companies, with follow-up visits signaling concrete interest.

To maintain momentum, IFEZ plans to leverage international forums ad events such as APEC and CES for investor engagement, as well as tap into the overseas Korean business network.

IFEZ officials said meetings with Japan’s advanced industry investors are also scheduled as part of an effort to attract fresh capital from key regional partners.

COMMISSIONER CALLS FOR ENHANCED TAX BREAKS

Commissioner Yun warned that outdated tax policy and regulatory constraints are undermining IFEZ’s competitiveness.

“Korea’s high corporate tax rates and the abolition in 2019 of tax relief for free economic zones are discouraging international investors from investing in Incheon and in Korea overall,” he said. “We urgently need to reinstate corporate tax breaks for foreign investors in free economic zones to stay competitive.”

He also emphasized the importance of cash grants – direct financial incentives negotiated with foreign investors based on their investment size – arguing that such tailored support is now a global standard in the race for high-value projects.

Established in 2003 as South Korea’s first and largest free economic zone, IFEZ has long called for regulatory reforms. But persistent restrictions, particularly those related to Seoul and its surrounding regions, continue to pose obstacles to attracting foreign investment, analysts said.

Yun has called on the central government to take bolder steps to enhance Korea’s appeal as a destination for foreign capital.

“The regulatory burden is still heavy,” Yun said. “We must create an environment in which investment flows freely – starting with policy innovation that meets global standards.”

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.