Carve-outs, take-private deals, industrial upgrading and demographic shifts are expected to revive Asia’s private equity market from a slowdown since 2021.

Valuations have adjusted downward, creating more attractive entry points, while ongoing corporate restructuring is set to boost buyout demand. The reopening of IPO windows will pave the way for improved exit opportunies, amid rising market liquidity.

Portfolio rebalancing by global investors, currently underweight in the region, is expected to bolster the region’s buyout market, driven by its solid fundamentals, StepStone said.

Asia private equity funds have outperformed the MSCI AC Asia Index by 4-8% internal rate of returns across most vintages since 2010, delivering more stable returns than public markets, even during macro downturns, Vincent Hsu, partner at StepStone Group, said during a roundtable discussion hosted by The Korea Economic Daily on Nov. 7 .

“The sustained performance premium highlights the structural advantages of private markets in Asia, including access to early growth, founder transitions and operational value creation. This reinforces the case for strategic allocation to Asia PE as a long-term return driver.”

StepStone notes a shift toward sectoral focus, especially in technology, industrial upgrading, healthcare and consumer services, along with increased secondary transactions for liquidity management.

On the downside, the depreciation of most Asian currencies may heighten foreign exchange risk, requiring investors to adopt selective hedging strategies.

By country, attractive carve-out opportunities from family-run conglomerates are emerging in South Korea.

“In Korea, typical playbook here for private equity has generally been the chaebol carve-outs. There are big hopes that the value-up program or reforms can actually mirror what you saw in Japan,” Hsu said.

Chaebol is a Korean term referring to large, family-run conglomerates established in the early to mid-1900s.

In February, StepStone co-invested in SK Microworks, a unit of South Korea’s No. 2 conglomerate, with Seoul-based private equity firm Hahn & Co.

In Japan, take-private opportunities are on the rise as listed small and medium-sized enterprises, which represent around 70% of total employment, trade at attractive valuations.

Strengthening corporate governance standards and growing activist shareholder engagement are adding further momentum to private equity activity and value creation.

In India, private equity exit values are increasing, supported by favorable demographics and a rapidly consumer base, with roughly 40% of the population aged between 20 and 40.

“In India, there’s more exit opportunities … Japan is a bright spot for Asian private equity. There are a lot of tailwinds because of the improvement in corporate governance as well as… more activist shareholders.”

In China, IPO activities are rebounding to levels nearing the 2021 peak. However, the market remains under correction due to regulatory uncertainty and weaker investor sentiment, Hsu cautioned.

In Australia, strong buyout opportunities are emerging in the lower- to mid-market segment, particularly across healthcare, technology and business-to-business services.

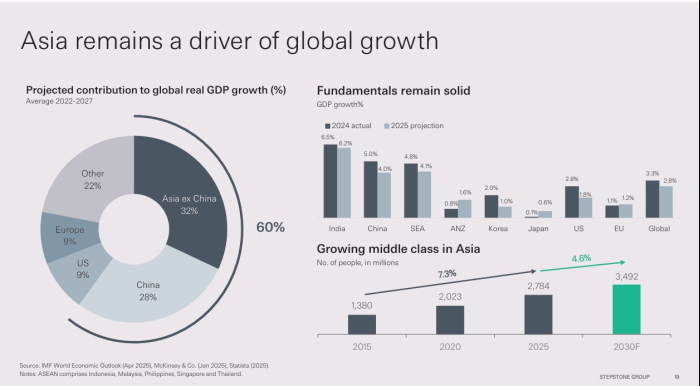

Asia contributes about 60% of global inflation-adjusted GDP growth between 2022 and 2027, with China alone accounting for around 28%, according to the IMF World Economic Outlook.

StepStone has invested about $14 billion in Asia’s PE market since 2019. It reviews over 4,000 investment opportunities annually across private equity, real estate, infrastructure, and private debt through primaries, secondaries, and co-investments.

Global PE distributions in 2025 are around 5% of net asset value, well below the long-term average of 21%, reflecting slower exits, according to StepStone.