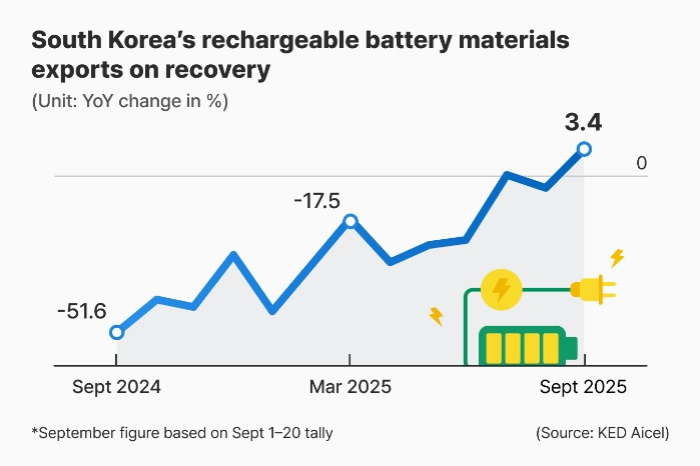

South Korea’s exports of rechargeable-battery materials rose for the first time in more than two years, buoyed by brisk demand for energy storage systems and raising hopes of a turnaround in the broader industry.

Outbound shipments of cathodes, anodes and separators totaled $467.7 million in the first 20 days of September, up 3.4% from a year earlier, according to data from KED Aicel.

It marked the first year-over-year gain since August 2023, when exports rose 6.2%.

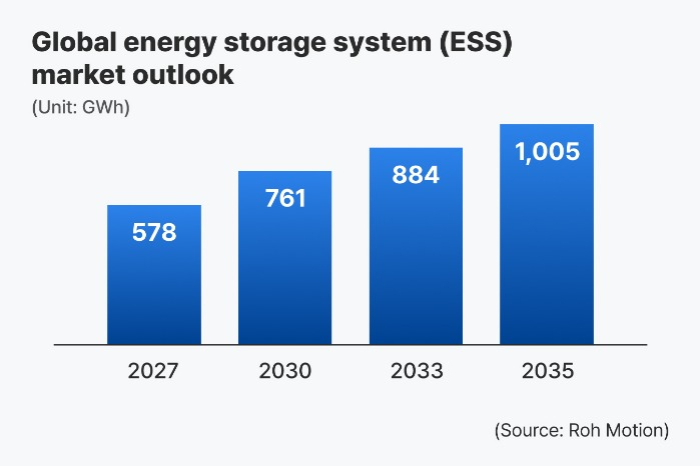

The rebound comes as the global market for large-scale energy storage systems, or ESS, surges, more than offsetting subdued electric vehicle battery sales stemming from a prolonged slump in the global EV market.

ESS units store energy from sources such as solar and wind for later use, and multi-gigawatt-hour projects have broken ground since last year in the US, China, Saudi Arabia, South Africa, Australia, the Netherlands, Chile, Canada and the UK.

ORDERS POUR IN

Korean battery majors have recently notched a string of billion-dollar ESS contracts.

LG Energy Solution Ltd. has bagged a series of ESS battery deals, including a $4.3 billion order won in July for lithium iron phosphate (LFP) storage batteries, while Samsung SDI Co. in March signed a 434.7 billion won ($312 million) supply deal with US clean energy giant NextEra Energy Inc.

Those orders come as ESS installations soar.

The US ESS market reached 23.7 gigawatt-hours through August, up 57% from a year earlier, according to Bernstein Research.

Globally, capacity is set to jump 68% this year to 348 GWh, powered by rising electricity demand from artificial intelligence data centers and a greater reliance on intermittent renewables.

Washington’s trade row with Beijing is another boon for Korean suppliers.

The US will raise tariffs on Chinese-made LFP storage batteries to 58% next year by 18 percentage points.

“Tariffs will inevitably erode the price competitiveness of Chinese ESS batteries, leaving Korean companies to fill much of the supply gap,” said Kim Hyun-soo, an analyst at Hana Securities Co.

Mirae Asset Securities Co. expects more ESS orders from the US, projecting an operating profit for Korean battery materials producer L&F Co. at 9 billion won in the third quarter after seven straight losses, and 90 billion won in 2026, which would mark its first profitable year since 2022.

MARKET CHEERS

Shares of Korean battery names have rallied on the rosy outlook.

L&F has surged more than 50% over the past three months, and cathode producer EcoPro BM Co. climbed 31%.

Over the same period, battery makers Samsung SDI and LG Energy Solution rose about 20% each, outpacing the Kospi’s 16% gain.

But not all are convinced. Goldman Sachs has warned that the end of US EV tax credits and looser emissions rules could deepen the slump in EV sales and limit how much the ESS boom can offset lost demand.

EV batteries still dominate the market, accounting for 68% of last year’s 1,545 gigawatt-hours of shipments, compared with 24% for storage systems, according to China’s EV Tank.

And Chinese battery makers are gaining ground in Europe as automakers pivot toward cheaper LFP-powered models.

“With European consumers showing a growing preference for budget EVs, Chinese battery makers are tightening their grip on the market,” said Jung Jin-soo, an analyst at Heungkuk Securities Co.

In response to the challenge, Korean companies are racing to expand LFP technology.

L&F has taken a 3.3% stake in US battery materials startup Mitra Chem for $10 million, with plans to begin mass production of LFP cathodes in the world’s third-largest EV market by 2027.

Earlier this month, the company raised 300 billion won through bond warrants to fund LFP production.

By Tae-Ho Lee

thlee@hankyung.com

Sookyung Seo edited this article.