The South Korean won slid to its weakest level in seven months on Wednesday, briefly touching 1,470 against the dollar, as foreign investors pulled funds from local stock markets and a tumbling Japanese yen dragged regional currencies lower.

The dollar-won exchange rate has returned to levels seen during the country’s period of political turmoil triggered by then-President Yoon Suk Yeol’s short-lived declaration of martial law.

Bank of Korea Governor Rhee Chang-yong cautioned that markets are “overreacting” to external uncertainties. He signaled that the central bank is ready to intervene if volatility intensifies.

HEAVY FOREIGN KOSPI SELLING, JAPANESE PM’S COMMENTS

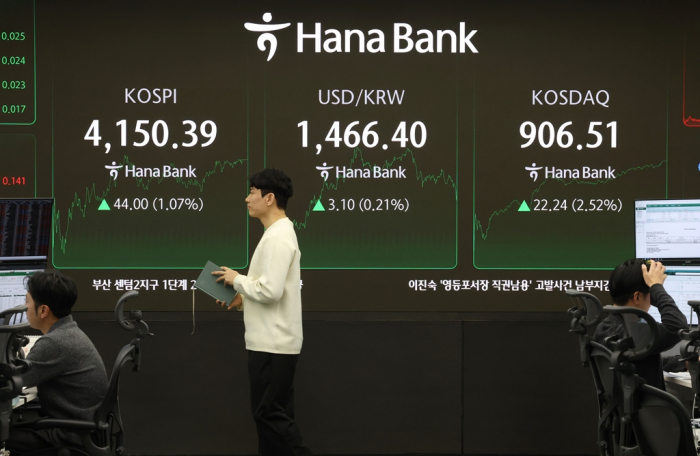

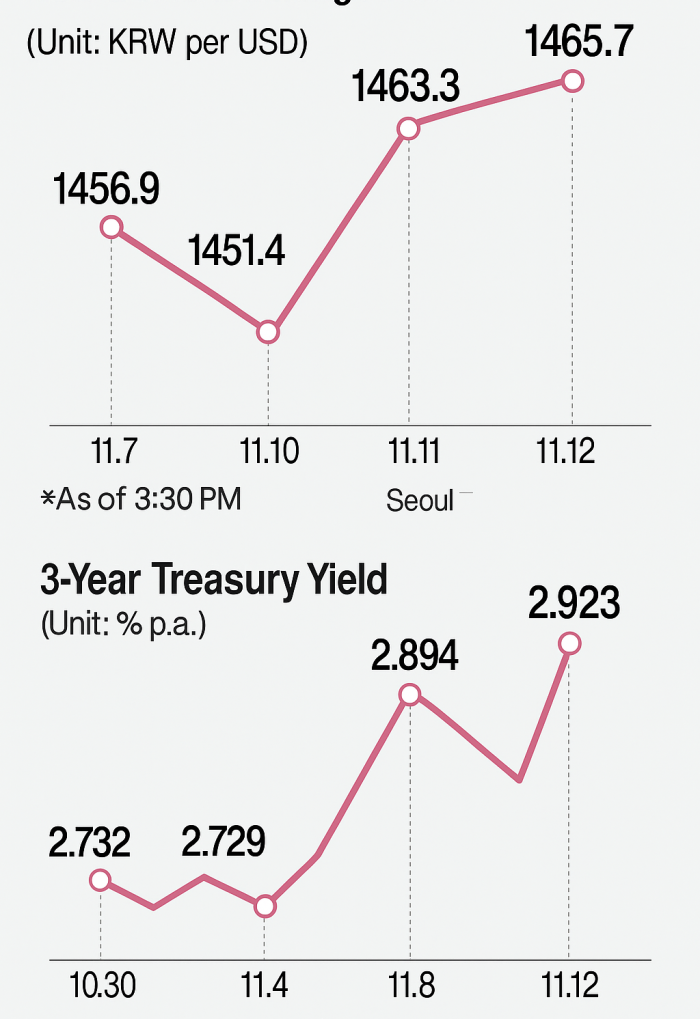

The won closed at a seven-month low of 1,465.7 per dollar in Seoul’s onshore market, down 2.4 won from the previous day’s close.

The currency opened slightly firmer at 1,461 won but soon reversed course as risk aversion swept through local markets.

The exchange rate touched an intraday low of 1,470.0 per dollar, posting the won’s weakest since April 9, when the dollar-won rate hit 1,484.1 amid escalating US-China tensions.

Analysts attributed the softer won to foreign investors’ heavy selling in the stock market.

Foreign investors sold a net 427.8 billion won worth of shares on the main bourse, accelerating capital outflows from Korean equities.

Analysts said foreigners are on a selling spree to book gains from their investment in Korean equities.

Continued dollar demand from Korean retail investors for overseas assets, including US stocks, has also added downward pressure on the won.

The won’s weakness was amplified by the yen’s decline, with the Japanese currency hovering around 154 yen to the dollar as Tokyo’s fiscal stance continued to prioritize stimulus over debt consolidation.

Comments from Japanese Prime Minister Sanae Takaichi, highlighting growth support over fiscal restraint, deepened expectations of prolonged monetary easing, analysts said.

The won has been trading at levels reminiscent of December 2024, when the declaration of martial law fueled political uncertainty and drove the exchange rate as high as 1,442 on Dec. 3.

It stayed between 1,410 won and 1,480 won for about five months before strengthening to the 1,300 won range this May.

But the currency has now spent 31 consecutive trading days above the 1,400 won per dollar level.

Economists in Seoul said the won could reach 1,500 by year-end if the current trend continues.

BOK CHIEF WARNS OF EXCESSIVE VOLATILITY

In an interview with Bloomberg News in Singapore on Wednesday, BOK Gov. Rhee pointed to a series of external headwinds, including volatility in US artificial intelligence stocks, economic ramifications of the US government shutdown, Japan’s policy uncertainty, US-China trade tensions and the yet-to-be-finalized US-Korea investment packages, as factors driving the won’s weakness.

“Markets appear excessively sensitive to these uncertainties,” he said, adding that authorities stood ready to act if swings became disorderly.

His remarks prompted a brief pullback of the dollar versus the won during the afternoon trading in Seoul, as currency traders took the BOK governor’s remarks as a verbal intervention to stabilize the foreign exchange rate.

BOND YIELDS SURGE ON BOK CHIEF’S HINTS OF POLICY SHIFT

Government bond yields climbed across the curve as investors interpreted Rhee’s comments on monetary policy as hinting at a possible shift in policy direction.

The three-year treasury yield rose 9.2 basis points to close at 2.923% in Seoul – a new high for the year – while the 10-year yield gained 8.1 basis points to 3.282%. The five-year note climbed 9.7 basis points to 3.088%.

During the Blomberg interview, Rhee said the “intensity, timing and even the direction” of future policy rate adjustments would depend on incoming data – a remark that some traders read as signaling the end of the easing cycle.

Although Rhee reiterated that the central bank’s official stance remained focused on maintaining an accommodative policy “given the still-negative output gap,” markets largely ignored the caveat.

The BOK later sought to play down speculation, saying the governor’s comments reflected a “data-dependent” principle rather than a signal of policy tightening.

“The focus should remain on maintaining an accommodative monetary stance,” said a BOK official.