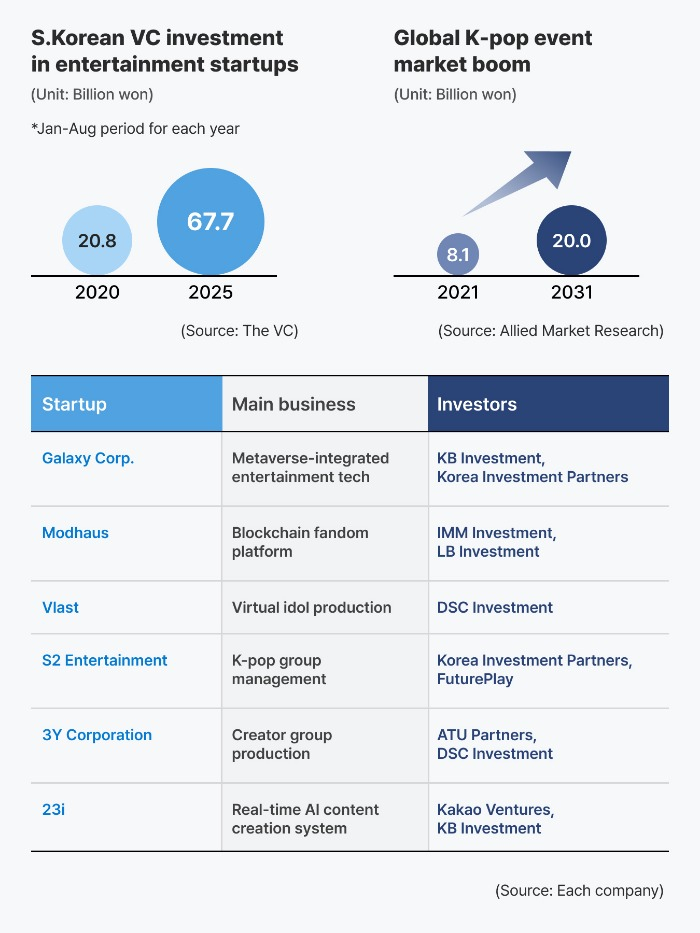

Once reluctant to touch entertainment, investors are now flooding K-pop startups with cash in hopes of capturing the next global breakout following KPop Demon Hunters.

The country’s leading venture capital firm, DSC Investment, recently invested in Vlast, the creator of virtual idol group Playve, and 3Y Corporation, the company behind the four-member girl band QWER, co-managed by Tamago Production.

The investment, however, wasn’t easy, an official with direct knowledge of the VC’s investment said earlier this week, adding that developing original intellectual property (IP) with an entertainment company carries significant risk.

“It took more than half a year of review,” the official noted. “But we decided to invest in the belief that the MZ generation’s content habits combined with fandom culture could create powerful synergies, and we were proven right.”

Playve’s EP, or extended play, album topped 1 million in first-week sales and has racked up 500 million YouTube views to date.

QWER has also emerged as a mainstream player in the K-pop scene, the official said.

In Korea, the term MZ generation refers to the millennial and Gen Z cohorts.

SHARP SHIFT IN INVESTMENT DECISION

Once overlooked as frivolous, K-pop companies are now attracting serious capital. The trend marks a sharp turn for DSC, which used to back mainly retail and tech startups such as Market Kurly, Musinsa and Dunamu.

For years, investors steered clear of K-pop and other cultural ventures, wary of narrow revenue streams and the difficulty of shifting strategy if a hit failed to materialize.

For underfunded entertainment startups, survival in a business dominated by giants was an uphill battle from the start.

But that is no longer the case, after several K-pop groups launched by startups achieved global success, attracting VC investment.

Modhaus, an entertainment startup behind K-pop girl group tripleS, recently raised 21 billion won ($15.1 million), with backing by four of Korea’s top 10 venture capital firms in terms of assets under management.

S2 Entertainment, which manages the K-pop act Kiss of Life, has raised 5.2 billion won from investors, including Korea Investment Partners.

Crit Ventures has invested in Regime International, the creative outfit led by DPR Ian of Korea’s hip-hop crew DPR Crew, while STIC Ventures backed iNKODE, founded by former TVXQ member Kim Jae-joong.

TECHNOLOGY AND CREATIVE MARKETING MAKE THE DIFFERENCE

In the past, taking K-pop content global required the deep pockets and management muscle of major entertainment companies.

Today, however, smaller rivals are proving they can compete on the world stage by leveraging technology and turning unique ideas into marketable concepts.

Modhaus recently invited fans of its K-pop group to take part in decisions ranging from spinoff projects and title tracks to album design and music video concepts.

Fans were given voting rights in exchange for photo cards of the group’s members. They cast their ballots on a dedicated blockchain-powered platform.

The virtual idol market is also rapidly expanding, fueled by advances in technology.

Real-time 3D motion capture and facial-tracking tools now allow members of virtual bands to sing, dance and interact much like human performers.

High-definition livestreaming and virtual reality technologies have also slashed the costs of stage planning and design.

Vlast and 23i are emerging as key players in this entertainment-technology niche.

Industry officials say the success of KPop Demon Hunters lies partly in a shifting public perception about virtual performers, a trend that bodes well for virtual entertainment groups.

GLOBAL PLATFORMS HOLD OUTSIZED POWER

Yet for Korean entertainment companies, replicating the success of Netflix’s animated musical K-pop Demon Hunters is no easy task without deep cash reserves and a fully developed ecosystem, industry observers said.

Most lack the funding to push their IPs into the global market, leaving them heavily reliant on global platform giants such as Netflix and YouTube for both production and distribution.

Some startups have sought to launch K-pop dedicated video-streaming services, but none have managed to crack a market dominated by the global behemoths.

Netflix, meanwhile, has expanded directly into the K-pop event market, moving closer to fans and threatening to erode Korean companies’ control over the ecosystem.

The US streaming giant has filed a trademark application for KPop Demon Hunters with the US Patent and Trademark Office, signaling its ambitions to extend the franchise into merchandise, concerts, conventions, fan meetings and virtual events.

A Korean entertainment industry official said the Korean government and investors need to work together with local entertainment companies to build a solid K-pop ecosystem — spanning IP creation, platforms and event infrastructure — if local players are to retain control.

By Eun-Yi Ko

koko@hankyung.com

Sookyung Seo edited this article.