SK Innovation E&S (SKI E&S), the natural gas business unit of South Korea’s SK Innovation Co., is set to begin an LNG trading business on a full scale by securing 10 million tons of natural gas annually from the Barossa gas field off Australia.

During a recent tour of the Barossa gas field with Korean brokerage analysts, SKI E&S executives unveiled the company’s LNG business roadmap.

“With the business operation of the Barossa gas field in the third quarter, our total LNG trading volume will rise to 6.3 million tons this year, up 19% from last year,” said a company executive. “By 2030, we expect our LNG trading volume, including gas from Barossa, to reach 10 million tons.”

Formerly SK E&S, SKI E&S is a company created through a merger with SK Innovation Co., the parent of Korea’s largest oil refiner SK Energy Co. and battery maker SK On Co. last November.

SKI E&S, Korea’s top city gas supplier, is mainly engaging in the LNG business as well as renewable energy sources such as solar, wind power and hydrogen.

SK Group, Korea’s second-largest conglomerate, is in the middle of corporate restructuring to reduce the number of its affiliates and explore new growth drivers.

BAROSSA GAS PROJECT

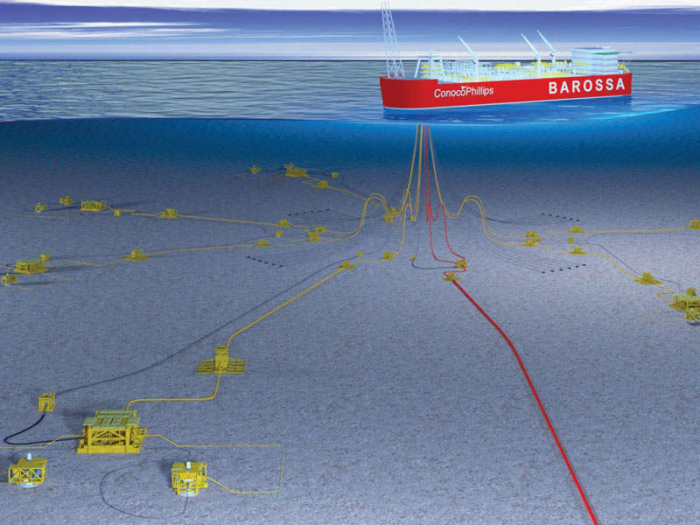

SK E&S has been working on the Barossa gas field project off Australia’s Northern Territory with other shareholders including Australia’s oil and gas company Santos Ltd. and and Japan’s JERA Co. since the Korean company acquired a 37.5% stake in the Barossa and Caldita fields in 2012.

SKI E&S is now the second-largest shareholder of the Barossa project after Santos, which owns a 50% stake. SK has invested 3 trillion won ($2.1 billion) in the project. Its development process is 88% completed and commercial operations are set to begin as early as September, according to the company.

The Barossa gas field is estimated to hold 70 million tons of natural gas. SKI E&S plans to bring to Korea 1.3 million tons a year of natural gas out of the planned annual extraction volume of 3.5 million tons.

TO EXPAND INTO UPSTREAM OPERATIONS

SKI E&S plans to broaden its business scope from downstream operations, where it has traditionally focused on distributing LNG for domestic power generation, city gas and industrial fuel, to upstream operations, which involve securing natural gas directly from gas fields.

The global LNG market is structured into three segments: upstream (gas extraction), midstream (storage, transportation and trading), and downstream (supplying end-users).

While a handful of global firms dominate the entire value chain, most LNG companies worldwide largely focus on downstream operations, purchasing gas from international suppliers.

COMPETING WITH GLOBAL ENERGY GIANTS

SKI E&S plans to leverage multiple sources to meet its 10-million-ton LNG target, including production from the Barossa field, which will start at 1.3 million tons annually, and the company’s acquisition of the Woodford gas field in the US, which will add 1 million tons a year.

Global energy firms such as BP and Shell trade between 15 million and 20 million tons of LNG annually.

If SKI E&S meets its 2030 goal, it will operate on an equal footing with energy giants in the global LNG market, industry officials said.

SKI E&S said its primary focus is to meet Korea’s domestic energy demand before trading surplus LNG on the international market.

BLUE HYDROGEN, CARBON CAPTURE

Looking ahead, SKI E&S plans to integrate its LNG strategy into a broader energy transition initiative, including blue hydrogen production and carbon capture and storage (CCS).

The company intends to use LNG-derived methane to produce hydrogen while capturing and storing the resulting carbon emissions – a process known as blue hydrogen production.

“Our expansion into upstream LNG operations is just the beginning,” said an SKI E&S official. “We aim to establish a comprehensive energy value chain that includes LNG, carbon capture and hydrogen.”

SK has been in a carbon capture and storage project at the Bayu-Undan gas field, located off the south coast of Timor-Leste.

By Sang-Hoon Sung

uphoon@hankyung.com

In-Soo Nam edited this article.