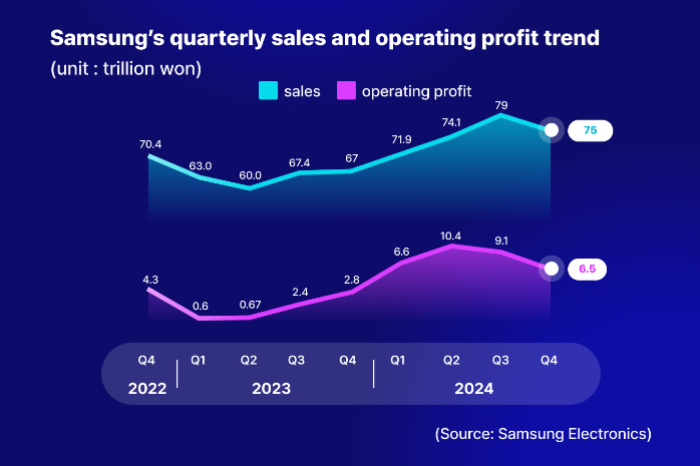

Samsung Electronics Co. flagged weaker-than-expected earnings for the last quarter of last year due to a fall in memory chip prices and soft demand for its smartphones and other mobile devices.

South Korea’s largest memory chip producer on Wednesday reported in a regulatory filing that its preliminary operating profit for the fourth quarter ended in December 2024 stood at 6.50 trillion won ($4.5 billion), more than doubling from a year ago.

Compared to the previous quarter, the profit shrank 29.2%.

Sales for the quarter added 10.7% on-year to 75 trillion won but fell 5.2% against the prior quarter.

Samsung’s preliminary profit fell short of market expectations of 7.97 trillion won tallied by Seoul-based financial data firm FnGuide Inc., which also forecast its sales at 77.40 trillion won.

The company blamed the disappointing earnings for the quarter on the weak demand for conventional memory chips for PC and mobile devices, as well as its hefty spending on research and development (R&D) and a production capacity ramp-up, which more than offset the company’s highest-ever memory sales on brisk sales of high-performance memory products.

Non-memory chip demand also softened across the board including mobile devices, leading to a fall in utilization rate, Samsung said in a statement.

Sales of mobile devices also stagnated without new models amid intensifying competition.

For the whole year of 2024, the company’s operating profit nearly quintupled to 32.73 trillion won from 2023 on sales of 300.08 trillion won, up 15.9%, according to Samsung’s filing.

HOPE FOR HBM SUPPLY TO NVIDIA

Samsung Electronics’ shares traded up more than 2% on Wednesday morning.

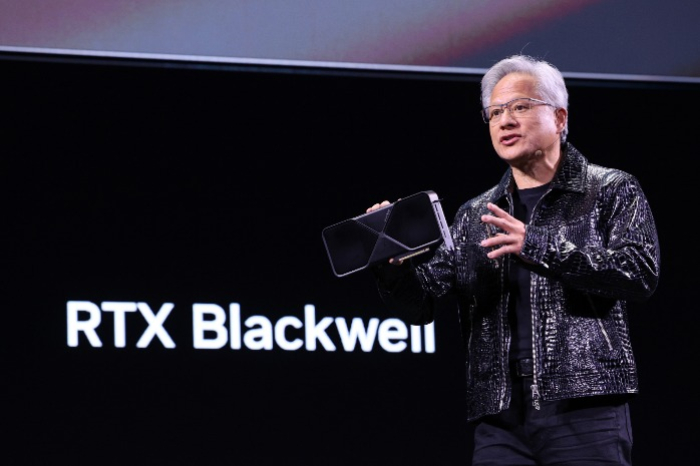

Overnight, Nvidia Corp. Chief Executive Jensen Huang hinted that the Korean chip giant will soon be able to supply its high-bandwidth memory (HBM) chips to the world’s most valuable AI chip company.

“They are working on it. They’re going to succeed. No question,” Huang said at a press event on Tuesday on the sidelines of the CES 2025 in Las Vegas. “I have confidence that Samsung will succeed with HBM. I have confidence like, tomorrow is Wednesday.”

Samsung’s HBM3E chips have been undergoing Nvidia’s qualification tests since last year but have not yet received the US AI chip giant’s nod.

Doubt about the Korean memory giant’s HBM quality has loomed as its smaller cross-town rival SK Hynix Inc. has been supplying its HBM chips to Nvidia for years. It even kicked off the mass production of industry-leading 12-layer HBM2E chips for Nvidia.

Huang, however, expressed his confidence in the revival of Samsung in HBM technology, reminding that Samsung was the first chip company to create HBM.

“Originally, the very first HBM memory that Nvidia has ever used was from Samsung,” said Huang.

But he added that Samsung has to engineer a new design for HBM chips.

In October, Samsung hinted that the sale of its high-end HBM3E chips to Nvidia would start soon but it has not happened yet.

Since reporting poor earnings for the third quarter, Samsung’s semiconductor unit has gone through a business reorganization to resuscitate its competitiveness under the direction of Jun Young-hyun, vice chairman and head of Samsung’s semiconductor business.

He vowed to take drastic steps to improve profitability and regain memory leadership after apologizing for “not meeting market expectations, causing concerns about our technological competitiveness and the company’s future” with the third-quarter earnings.

GRIM MEMORY OUTLOOK

Samsung’s HBM chip supply to Nvidia is vital to its earnings this year as the outlook for the global conventional memory business looks gloomy for the first half of this year.

Global market intelligence TrendForce forecast that the price of conventional dynamic random access memory (DRAM) chips will fall by 8% to 13% in the first quarter of this year amid the rapid ascent of Chinese DRAM chips in the global market.

Samsung Electronics will report its detailed earnings results for the fourth quarter on Oct. 31.

By Jeong-Soo Hwang and Chae-Yeon Kim

hjs@hankyung.com

Sookyung Seo edited this article.