Samsung Electronics Co. and SK Hynix Inc. are poised to ride a fresh wave of demand from OpenAI Inc.’s landmark partnership with Advanced Micro Devices Inc. (AMD), a deal expected to fuel a prolonged boom in memory chip demand amid the global race to scale up artificial intelligence computing power.

Earlier this week, OpenAI and AMD announced that the ChatGPT creator will deploy 6 gigawatts of the US AI accelerator maker’s Instinct graphics processors over multiple years and across multiple generations of hardware, with an initial 1-GW rollout beginning in the second half of 2026.

OpenAI described the pact as worth “billions,” without disclosing a figure.

AMD Chief Financial Officer Jean Hu said the agreement would be “tens of billions of dollars in revenue” and add to earnings per share.

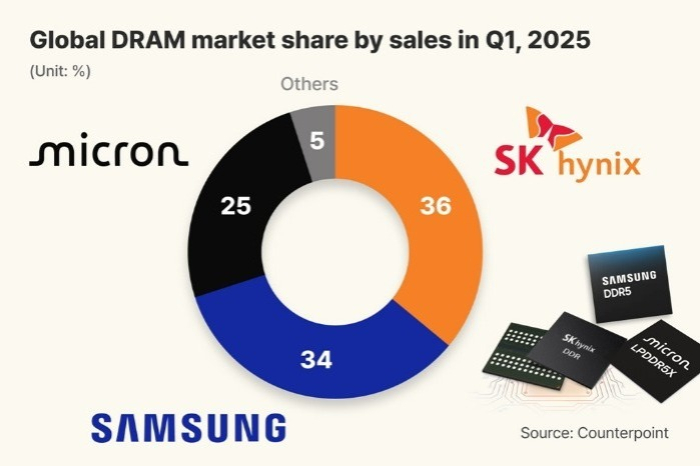

Analysts say the deal could translate into sizable orders for Samsung Electronics and SK Hynix, the world’s two largest suppliers of high-bandwidth memory (HBM) chips, the key components in training and running advanced AI models.

CHANCE FOR SAMSUNG TO CLOSE THE GAP WITH SK HYNIX

Industry experts estimate the value of AMD’s OpenAI contract at $60 billion to $90 billion.

Given that HBM accounts for 10% to 15% of an AI accelerator’s total cost, Korea’s two chipmakers could capture as much as 15 trillion won ($10.6 billion) in related sales.

Samsung Electronics could have an edge, thanks to its closer ties with AMD, while SK Hynix has built its business around AMD’s bigger rival, Nvidia Corp.

Industry observers see Samsung Electronics as a strong contender for sixth-generation HBM4 chip orders when AMD begins rolling out its next-generation MI450 for OpenAI.

Still, the competition is fierce.

The world’s largest HBM producer, SK Hynix, has been rapidly ramping up its HBM production capacity to further widen the gap with its followers.

American memory giant Micron Technology Inc. also plans to mass-produce HBM4 memory chips in 2026 for Nvidia’s next-generation AI platforms after shipping its samples to key customers since mid-2025.

“It is unclear who will secure the first HBM4 deal or how much each supplier will contribute,” said an official from the Korean semiconductor industry.

AI BOOM EXTENDS MEMORY SUPERCYCLE

Regardless of how the orders are divided, analysts say the OpenAI-AMD alliance underscores relentless appetite for AI hardware, reinforcing expectations of an extended memory upcycle.

JP Morgan forecast in a recent report that the market for AI-focused memory chips will more than double to $112 billion in 2027 from $43 billion in 2025, with AI-related sales accounting for over half of all memory revenue, versus the current 33%.

As AI applications shift from training to inferencing, demand is also rising for general memory products, such as graphics double data rate (GDDR) and low-power double data rate (LPDDR) used in modules.

Demand for NAND flash, the core component of solid-state drives (SSDs), is also increasing as cloud service providers are shifting from traditional hard disk drives (HDDs) to SSDs, especially enterprise SSDs (eSSDs).

Last Wednesday, Samsung and SK Hynix signed letters of intent with OpenAI to supply HBM semiconductors for the US start-up’s so-called Stargate initiative, a $500 billion effort to build a global network of hyperscale AI data centers by 2029.

The deal is expected to cement the Korean memory giants’ role at the core of the emerging AI infrastructure build-out.

Since the agreement was reached, Samsung Electronics and SK Hynix shares zoomed, ending the last session up 3.5% at 89,000 won and 9.9% at 395,500 won, respectively, on Thursday last week.

The Korean financial markets have been closed since last Friday for the weeklong Chuseok, or mid-autumn harvest festival, holiday, and will reopen Oct. 10.

By Jeong-Soo Hwang

hjs@hankyung.com

Sookyung Seo edited this article.