Samsung Biologics Co., the world’s largest contract drugmaker, has become South Korea’s third most valuable stock on the country’s main bourse, buoyed by strong sales growth and the expected windfall gains from the Trump administration’s push for biotechnology to keep China in check.

Shares of the biotechnology unit of Korea’s top conglomerate Samsung Group rose as much as 7% to an intra-day high of 1,165,000 won ($804) on Friday, marking its third consecutive day of gains.

The main bourse’s benchmark Kospi index fell 0.6%.

Samsung Biologics has risen 23% year to date.

The company’s market capitalization has risen to 82.8 trillion won ($57.2 billion) from 67.5 trillion won at the end of 2024.

With the market cap, Samsung Biologics overtook LG Energy Solution Ltd. to become the country’s third most valuable company after Samsung Electronics Co. and SK Hynix Inc.

RECORD-HIGH EARNINGS

Last month, Samsung Biologics said it posted its largest-ever annual sales and operating profit, driven by a steady stream of profitable drug-making contracts for pharmaceutical firms.

The company posted 1.32 trillion won in operating profit on consolidated sales of 4.55 trillion won in 2024 – the first Korean biopharma to break above the 4 trillion won sales threshold.

Market analysts expect Samsung’s sales revenue to reach 5.5 trillion won this year.

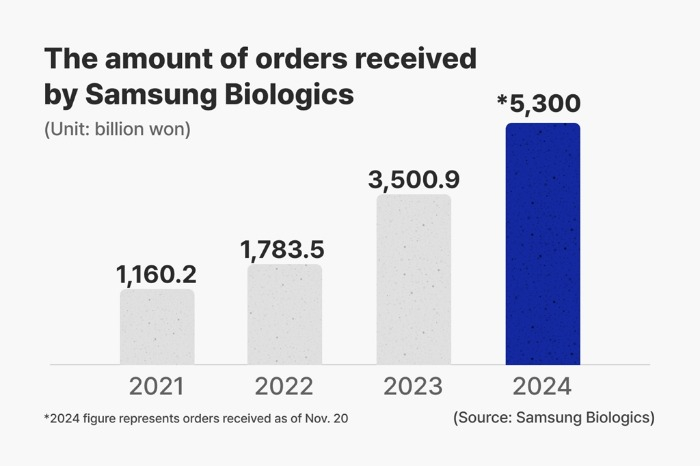

The company’s contract value for 2024 stood at 5.4 trillion won, a record annual high. Since its founding in 2011, its cumulative orders have exceeded 25 trillion won.

Samsung Biologics has partnered with 17 of the world’s top 20 pharmaceutical companies to make medicines for them under contract in the antibody drug segment, including cancer treatment, autoimmune disease therapies and biosimilars.

Samsung said it has contracts with virtually all major pharmaceutical companies, as the remaining three firms are biosimilar makers, meaning partnerships with them would create a conflict of interest.

CONTINUING GROWTH MOMENTUM

Analysts said the company will likely enjoy continued growth momentum, driven by factors such as US restrictions on China and the removal of legal risks surrounding Samsung Group Chairman Jay Y. Lee.

Cleared of all criminal charges against him in accounting fraud and stock manipulation cases on Monday, Lee vowed to make aggressive investments in growth sectors, including biotechnology.

Seoul-based Sangsangin Securities recently raised its target price for Samsung Biologics to 1,310,000 won from 1,260,000 won, citing a clear upward trend in the company’s contract volume and research pipeline expansion.

“Its revenue and operating profit are set to grow further this year,” said the brokerage in a research note.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.