South Korea’s three leading shipbuilders – HD Shipbuilding & Offshore Engineering Co., Hanwha Ocean Co. and Samsung Heavy Industries Co. – have kicked off a task force under the initiative Make America Shipbuilding Great Again (MASGA) to help revitalize the US shipbuilding industry with Korea’s leading vessel construction technologies.

According to sources in the Korean shipbuilding industry on Sunday, the three Korean shipbuilding giants will lead a working group in partnership with the Korea Offshore Shipbuilding Association (KOSHIPA), a non-profit organization established in 1977 to advance Korea’s shipbuilding industry. All three shipbuilders are KOSHIPA members.

The task force is intended to serve as a bridge between South Korean shipbuilders and the government to coordinate the development of the MASGA initiative.

It is expected to evolve into a formal South Korea-US shipbuilding alliance committee, consisting of private-sector and government experts from both countries, to oversee the partnership.

It is designed and offered by South Korea to revive the dormant US shipbuilding industry with South Korea’s leading shipbuilding technologies. The initiative aligns with one of the key national projects promoted by the US administration under President Donald Trump.

Under the project, South Korea will create a $150 billion shipbuilding fund, and the task force will determine investment priorities.

Proposed initiatives include building US-based shipyards, training American shipbuilding workers, strengthening the US supply chains in the shipbuilding industry and expanding maintenance and repair operations.

SOUTH KOREA IS FLOATED AS A US NAVAL SHIP MRO BASE

According to the Korean shipbuilding industry, the task force is expected to pursue a two-track strategy, focusing on naval MRO and commercial shipbuilding cooperation separately in the two countries.

One key initiative is the establishment of a US naval ship construction and maintenance, repair and operations (MRO) base in South Korea.

As part of the plan, the South Korean government and the country’s three major shipbuilders are considering acquiring and repurposing smaller domestic shipyards to serve as specialized dockyards for US naval vessels.

K Shipbuilding Co., currently up for sale, is the leading candidate.

Once a rising star in Korea’s shipbuilding industry under the STX Group, the mid-sized shipbuilder is aiming to reposition itself as a key player in the growing warship MRO segment.

It introduced the world’s first onshore shipbuilding technology, the Skid Launching System (SLS), in 2004 when it operated as now-debunked STX Offshore & Shipbuilding.

The system enables ships to be constructed on land and launched using a skid-based berth, enhancing efficiency and safety. In 2008 alone, it delivered 28 ships using a single dock with this method.

The technology is one reason the three Korean shipbuilding giants are considering K Shipbuilding for the US naval MRO base.

With support from the top three shipbuilders, the shipyard could build at least 12 additional ships annually, officials said.

Its location in Jinhae, South Gyeongsang province, within the perimeter of US missile defense systems, also offers a strategic advantage, analysts said.

The mid-sized shipbuilder also operates a dry dock, which is large enough to construct or repair a USS Gerald R. Ford-class aircraft carrier, which is 1,106 feet long.

Another candidate is HJ Shipbuilding & Construction Co., a key player in specialized vessel construction, including express patrol boats, fishery research vessels, diving support vessels and more.

It is also the country’s major provider of MRO services for battleships.

SOUTH KOREA WILL TRANSFER KNOW-HOW TO THE US

Under the dual-track approach, the MASGA project will focus on restoring US shipbuilding capabilities through both modernization and technology transfer.

Using the proposed fund, Korean shipbuilders may construct new US-based shipyards or acquire existing local ones.

These facilities are expected to focus on the construction of commercial ships, such as container carriers and tankers, areas where Korean firms have long demonstrated global leadership. This foundation could later be extended to naval shipbuilding.

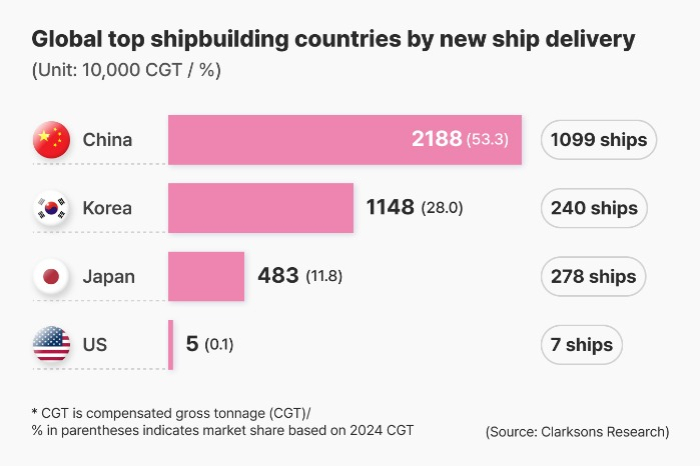

The US emerged as a shipbuilding powerhouse after World War II, boasting more than 70 shipyards across the nation that produced approximately 1,000 ships annually.

In the past, it controlled about 90% of the global commercial shipbuilding market, but today holds just 0.1%, with only about 10 shipyards remaining, which together produce fewer than 10 ships per year.

HANWHA TO LEAD THE PACK

Hanwha Ocean is expected to spearhead the US-focused MASGA initiatives targeting the revival of commercial shipbuilding.

Last December, it acquired US shipbuilder Philly Shipyard, now Hanwha Philly Shipyard, for $100 million. It plans to invest additionally in the US shipyard to expand its annual production capacity from 1.5 ships to 10 ships by 2035.

It will also pursue additional acquisitions or new shipyard construction in the US.

HD Shipbuilding & Offshore Engineering, an intermediate shipbuilding holding firm under HD Hyundai Co., will build medium-sized liquefied natural gas (LNG) dual-fuel container ships jointly with Tampa Ship, a US shipyard and an affiliate of Edison Chouest Offshore (ECO), by 2028.

The Korean company, controlling multiple shipyards including the world’s No. 1 shipbuilder HD Hyundai Heavy Industries Co., will provide support to the US shipyard in vessel design, procurement of specialized equipment and transfer of advanced shipbuilding technology.

Samsung Heavy, meanwhile, is seeking to collaborate with a US shipbuilder to participate in the Delfin LNG initiative, a deepwater port and floating liquefied natural gas (FLNG) export project in the Gulf of Mexico, off the coast of Louisiana.

The company is one of the global top FLNG builders.

“We are reviewing various opportunities to jointly build such facilities with a US shipyard and expand our related business in the country,” said an official from Samsung Heavy.

By Jin-Won Kim

jin1@hankyung.com

Sookyung Seo edited this article.