Blackstone and HarbourVest Partners are South Korean institutional investors’ preferred private equity firms, according to a survey by Korea Investors. BGO was named the best real estate manager and Ardian was picked as the preferred general partner (GP) for infrastructure investment. Including the top investment managers, a total of 33 alternative asset managers were named as Best Asset Managers by Korean Investors this year.

To see the list of Best Asset Managers by Korean Investors, click on the logo below.

SELECTION STANDARDS

The surveyed limited partners (LPs) chose their best GPs across five asset classes – private equity, private debt, real estate, infrastructure and absolute returns – for performance, operation and client services. To prevent big-name houses from dominating the list, the award winners were separated into large-cap and mid-cap firms.

The subcategory awards focus on specific criteria. Best Performance was awarded to outperforming managers in risk-adjusted returns. Operational Excellence was given to those who excel in risk management, communication and key person employment. The Best Client Service prize was awarded to GPs who provided great services tailored to LPs’ needs.

The Best of the Best winners are those firms that received the most votes across the subcategory in each asset class.

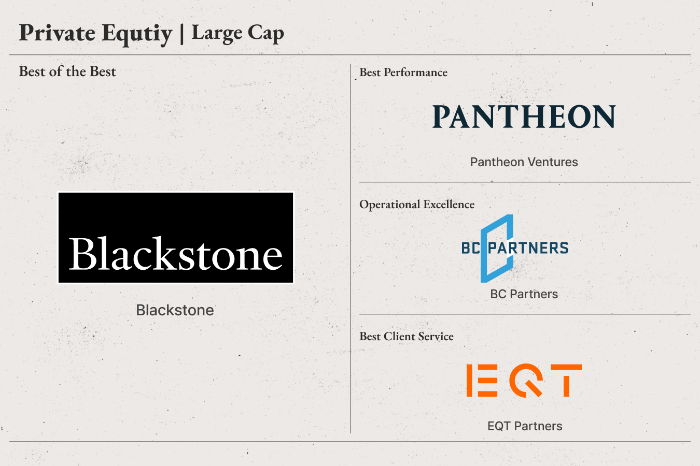

Among large-cap private equity managers, Blackstone was chosen as South Korean LPs’ preferred GP. With approximately $1.1 trillion in assets under management (AUM), its business spans private equity, real assets, hedge funds, credit, secondaries, insurance solutions and life sciences. In 2024, it took a majority stake in JJ Tools Co., a South Korean industrial cutting tool maker and unloaded Geo-Young Corp., the country’s largest medicine wholesaler, marking its first investment exit in the country.

Pantheon Ventures was given the Best Performance award. Founded in 1982, Pantheon manages $68 billion in discretionary AUM as of June 30, 2024. The global multi-strategy private markets investor is one of the largest European fund of fund managers. It has invested in private equity primaries, secondaries and co-investments.

BC Partners was selected for the Operational Excellence award. Established in 1986, the British buyout firm has raised 11 successive funds totaling over €30 billion of committed capital. It focuses on control buyouts of businesses in Europe and North America with enterprise values typically greater than €300 million.

EQT Partners, under the umbrella of the Wallenberg family, was named the Best Client Service winner. The Swedish firm manages €269 billion in assets via 50 active funds as of December 2024, making it the world’s third-largest private equity firm by AUM. Last year, EQT was the winner of Operational Excellence award in the infrastructure category.

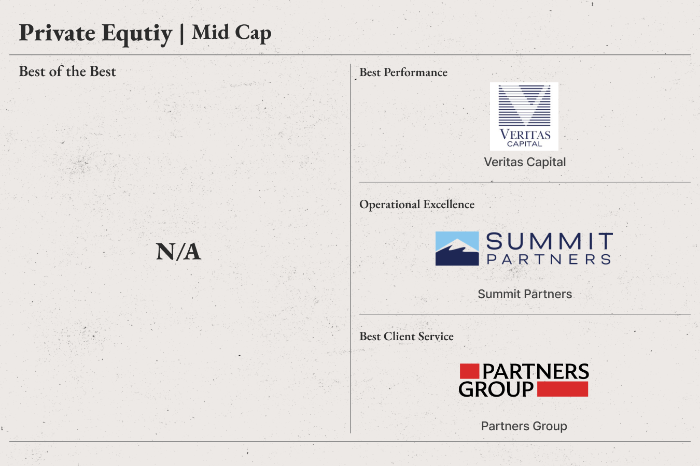

In the mid-cap segment, there wasn’t a Best of the Best winner this year.

The Best Client Service prize was given to Veritas Capital. With over $45 billion in AUM, it focuses on companies that provide critical products, software and services, primarily technology and technology-enabled solutions, to government and commercial customers worldwide.

Summit Partners was named the Operational Excellence winner. As a leading growth-focused investment firm, the US private equity firm seeks to invest in category-leading, profitable growth companies worldwide. With offices in North America and Europe, Summit Partners raised $9.5 billion for its 12th US growth equity fund in 2024. It won the Best Client Service award last year.

Partners Group was chosen as the Best Client Service winner. It is one of the largest listed private equity firms in Europe headquartered in Switzerland, managing over $152 billion in assets as of Dec. 31, 2024. Since 1996, the firm has invested over $234 billion in private equity, private real estate, private debt and private infrastructure.

Among fund of funds (FoF) managers, HarbourVest Partners won the Best of the Best award. Based in Boston, Massachusetts, the firm manages more than $138 billion in private equity, co-investments, private credit, infrastructure and real assets as of Sept. 30, 2024. It has been named as one of South Korean LPs’ preferred private equity managers since 2021.

Stepstone Group was chosen as the Best Performance winner. The Nasdaq-listed investment firm oversees $682 billion of private capital allocations, including $176 billion of AUM as of Sept. 30, 2024. It won the Best Client Service prize as a FoF manager in 2024 for the third consecutive year, after winning the Best Performance prize as a private equity firm in 2021.

Lexington Partners won the Operational Excellence award. Founded in 1994, the New York-based investment firm has a total capital of over $76 billion. It is the global secondary private equity and co-investments specialist investment manager of Franklin Templeton. In 2024, Lexington Partners was named the Best of Best FoF manager by South Korean LPs.

Neuberger Berman was named the Best Client Service winner. From offices in 39 cities across 26 countries, Neuberger Berman manages $508 billion in assets spanning equities, fixed income, private equity, real estate and hedge funds. Founded in 1938, it is an employee-owned, private and independent investment manager.

The Best of the Best prize was awarded to Ares Management. Listed on the New York Stock Exchange, it offers primary and secondary investment solutions across credit, private equity, real estate and infrastructure. Its global platform had $484 billion of AUM as of Dec. 30, 2024. The firm won the same distinction for five consecutive years.

Apogem Capital was chosen for Operational Excellence. It offers a full range of capital solutions focused on the middle market. As a wholly owned subsidiary of New York Life, Apogem was formed in 2022 through the combination of GoldPoint Partners, Madison Capital Funding and PA Capital. With $40 billion in AUM, its investment approach spans private credit, private equity, GP stakes, private real assets and long/short equity.

Oaktree Capital Management won the Best Client Service award. Founded in 1995, the firm has grown to manage approximately $202 billion in assets as of Dec. 31, 2024. It emphasizes an opportunistic value-oriented and risk-controlled approach to investments in credit equity and real estate.

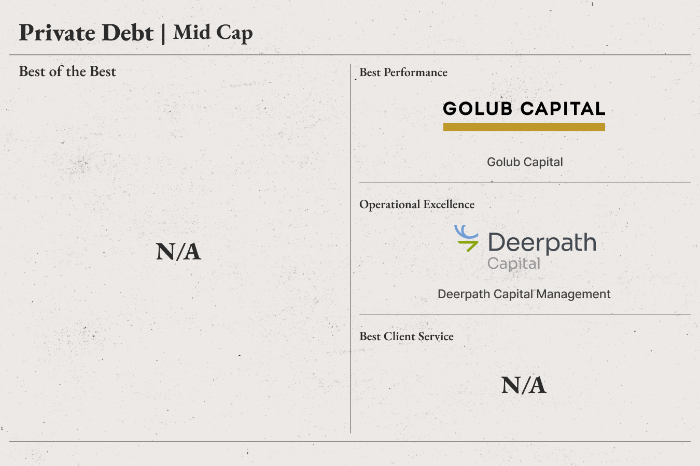

Golub Capital was bestowed with the Best Performance prize as a mid-cap private debt manager. Founded in 1994, it is a leading direct lender and experienced private credit manager. With more than $75 billion in capital under management, it also invests in broadly syndicated loans and manages a series of collateralized loan obligations. It has been chosen as a top private debt manager by South Korean LPs since 2021.

Deerpath Capital Management received the Operational Excellence award. Deerpath has pursued a focused strategy of originating senior loans for lower middle-market companies to be a leading middle-market direct lending firm. Since its inception in 2007, it has deployed over $12 billion of invested capital in more than 1,000 investments.

Among large-cap real estate investment firms, BGO was recognized as a Best of the Best winner. With approximately $85 billion in AUM as of Sep. 30, 2024, the firm invests in and manages real estate assets across primary, secondary, and co-investment markets. It has built a track record in the asset management of office, industrial, multi-residential, retail and hospitality property. BGO is a part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life.

Bridge Investment Group was named the Best Performance real estate manager for the second consecutive year. Headquartered in Salt Lake City, Utah, the firm is diversified across specialized asset classes and manages approximately $49.2 billion in assets as of Sept. 30, 2024. It focuses on select verticals across real estate, credit, renewable energy and secondaries strategies. It won the Best Client Service in 2022 and 2023.

The Operational Excellence award was given to Patrizia. Headquartered in Ausburg, Germany, the firm manages €56 billion in assets and specializes in real estate and infrastructure assets. Its portfolio spans residential, commercial, logistics, and infrastructure assets. Founded in 1984, the firm operates in 27 locations worldwide and is listed on the Frankfurt Stock Exchange.

AEW Capital Management was chosen as the Best Client Service winner. With over 40 years of experience, it is one of the world’s largest real estate investment advisors. AEW and its affiliates manage $86.4 billion in private real estate, equity debt and listed securities across North America, Europe and Asia as of Sept. 30, 2024.

Among mid-cap real estate managers, 3650 Capital won the Best Performance prize. Headquartered in Miami, Florida, 3650 (pronounced “thirty-aix fifty”) Capital is an alternative commercial real estate lender, special servicer and solutions provider, servicing portfolio loans for borrowers while providing a full suite of financing products.

The nod for Operational Excellence was given to Henderson Park. Since its formation in 2016, the firm has invested over $14 billion in real estate assets. Its current portfolio is diversified across various sectors such as multifamily, hospitality, student housing, logistics, office and retail investments, including several real estate development projects.

Harrison Street Real Estate Capital was chosen as the Best Client Service winner. Since its inception in 2005, the Chicago-headquartered firm has invested over $70 billion across senior housing, student housing, healthcare delivery, life sciences, data centers and storage real estate, as well as social, utility and digital infrastructure.

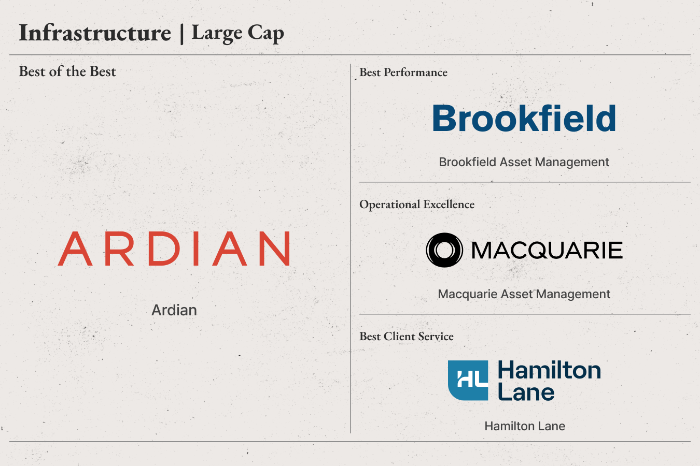

Ardian was named the Best of the Best infrastructure investment firm in the large-cap category. With assets of $176 billion managed or advised globally, the firm won the Best Client Service prize as an infrastructure investment firm last year. With a global presence in 19 offices worldwide, it invests in infrastructure, fund of funds, private debt, direct funds including expansion, mid-cap buyout, growth, co-investment and real estate.

The Best Performance award was given to Brookfield Asset Management. The Canadian firm with over 100 years of history as a global investor manages over $1 trillion in assets across renewable power and energy transition, infrastructure, private equity, real estate, credit and insurance solutions. It won the Best Performance prize last year and the Best of the Best in 2023.

Macquarie Asset Management won the Operational Excellence award. With approximately $633.7 billion in assets, its portfolio spans real assets, real estate, credit and equities and multi-asset. Last year, it was picked as the most preferred general partner (GP) for infrastructure investment.

Hamilton Lane was bestowed the Best Client Service award. Dedicated exclusively to private markets investing for more than 30 years, the firm has more than $947 billion in AUM, composed of more than $131 billion in discretionary assets and approximately $816 billion in non-discretionary assets, as of Sept. 30, 2024. Hamilton Lane was chosen as the Best Client Service winner for FoF investment last year, after being named the Best of the Best FoF manager for three years since 2020.

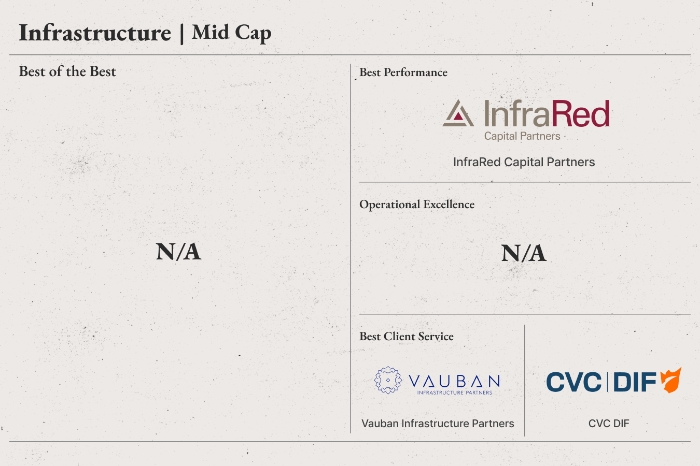

There wasn’t the Best of the Best winner among mid-cap infrastructure investment firms in 2023 and 2024 in a row.

InfraRed Capital Partners won the Best Performance prize in the mid-cap infrastructure category. The firm manages $13 billion of equity capital in listed and private funds across both core and value-added strategies. It is part of SLC Management with $144 billion in AUM, institutional alternatives and traditional asset management business of Sun Life with $1.51 trillion in AUM.

For the Best Client Service award, Vauban Infrastructure Partners and CVC DIF were jointly picked.

Vauban Infrastructure Partners focuses on European core infrastructure investments. The Paris-headquartered firm targets predominantly European brownfield mid-market assets. It has raised €10 billion across eight funds in infrastructure and has invested in over 80 assets in mobility, energy transition, social and digital infrastructure. It was selected as the Best Performance winner in 2024 and won the Best of the Best prize in 2023.

CVC DIF has €19 billion of assets under management. It is the infrastructure strategy of CVC that manages €200 billion in assets as of Dec. 31, 2024. It focuses on core and core plus markets with longer-term contract coverage, while also employing a value-add strategy.

There wasn’t a Best of the Best winner in the absolute return category.

Citadel won the Best Performance prize. As one of the most profitable hedge fund investors, it deploys capital across five core strategies: equities, fixed income and macro, credit and convertibles, commodities and quantitative strategies. Citadel manages $65 billion investment capital as of Jan. 1, 2025. The Miami-based firm won the same distinction in 2024 and 2023. In 2021, it received the Best of the Best award.

GoldenTree Asset Management was chosen for Operational Excellence. The firm specializes in credit management in sectors such as high yield bonds, leveraged loans, private credit, distressed debt, structured products, emerging markets, private equity and credit-themed equities. GoldenTree manages nearly $57 billion in assets. It won the Best Client Service award in 2024, 2022 and 2021.

Man Group was named the Best Client Service winner. The London Stock Exchange-listed firm is one of the largest hedge fund investors, managing $174.9 billion in assets. Its investment capabilities span the public and private markets, with a mix of long-only and alternative approaches across all major asset classes. Man Group was the winner for Best Performance in 2024, Best Client Service in 2023 and Best Communication in 2021.

By Yeonhee Kim

yhkim@hankyung.com

Jennifer Nicholson-Breen edited this article.