RedotPay, a Hong Kong-based blockchain fintech company, has arrived in South Korea with its cryptocurrency-based credit card service, poised to disrupt the country’s payment market, tightly controlled by traditional credit card companies and mobile payment services.

According to the cryptocurrency industry on Friday, RedotPay’s crypto debit cards are now available for use in Korea.

“I have noticed that a considerable number of Koreans have RedotPay cards issued through social media platforms,” said an official from the payment market.

“Given Koreans’ relatively more open attitude toward cryptocurrencies and their familiarity with mobile payment services, the company appears to be seeking to expand its business in Korea.”

Korea is one of the most active countries in the global cryptocurrency retail market, with over 16 million people holding crypto accounts in a population of nearly 52 million, according to data from the National Assembly’s Strategy and Finance Committee.

RedotPay has recently opened its Korean website.

All stores and restaurants that use Visa as a payment network in Korea accept RedotPay’s physical or virtual cards as a payment option.

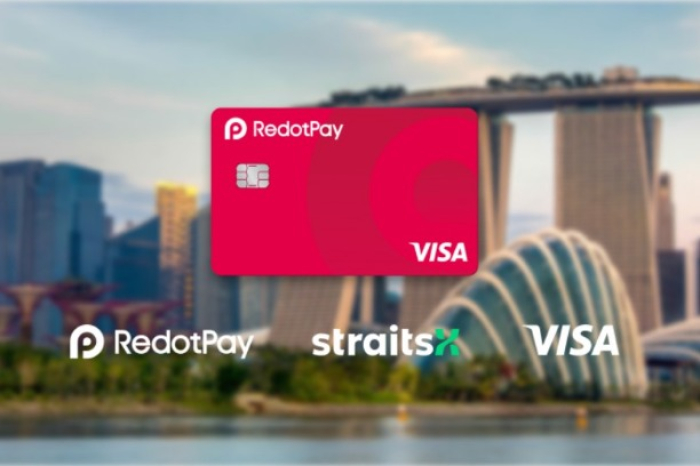

RedotPay and Visa Inc. formed a partnership with StraitsX, a BIN sponsor, in February to enable more consumers to use RedotPay’s upgraded credit card services around the world.

As its payment technology is even compatible with Apple Pay in Seoul, RedotPay cards could emerge as a groundbreaking payment solution, posing a threat to traditional credit card and mobile payment services currently commanding the Korean payment market.

Apply Pay is currently available only to Hyundai Card users in Korea.

USER-FRIENDLY EXPERIENCE

Founded in 2023, RedotPay is headquartered in Hong Kong, providing crypto payment products by leveraging blockchain technology.

Since the RedotPay card program was soft-launched in late 2024, its users have reached more than 4 million worldwide.

It supports Bitcoin and Ethereum, as well as USDC and USDT, which are stablecoins holding a stable value equal to a US dollar. Deposit is also available via Bitcoin, Ethereum, Solana, BSC, Polygon, Tron, Arbitrum and others, according to the company.

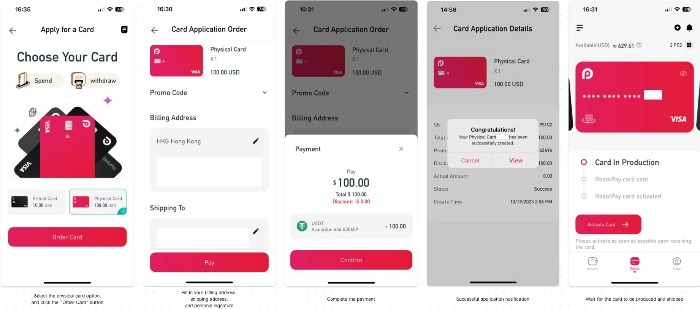

Currently, RedotPay offers stablecoin-based debit card services in Korea, enabling easy issuance of its cards for local users after verifying only a few things – users’ real names, birthdates, addresses and identification cards.

Its virtual card is immediately issued after a user pays $10, or it takes about two weeks to get a physical card with a payment of $100.

When a RedotPay user pays with the crypto card at a store, stablecoins are paid directly from the digital wallet in real-time.

RedotPay’s proprietary real-time conversion technology also enables Korean users to get refunds for their payments in USDC or USDT via the platform after payment cancellations within only a few minutes.

The company explained that this feature bridges the gap between digital assets and traditional commerce, making crypto spending as seamless as using a conventional debit or credit card.

IT COULD BE A GAME CHANGER

Its easy-to-use payment experience is expected to attract users rapidly and could become a game changer in the Korean payment market, largely controlled by conventional credit card companies and mobile payment services, said industry observers.

Local payment gateway (PG) companies and fintech startups developing foreign exchange services could also take a hit from the services.

“The stablecoin-based card allows its users to possess and spend US dollars without paying exchange fees,” said Kim Yong-beom, chief executive officer of Hashed Open Research, a Korean policy think tank exploring the impact of technology development on social changes.

“This could upend the payment market at home and abroad.”

According to global asset manager ARK Investment, the annualized global transaction value of stablecoins hit $15.6 trillion in 2024, about 119% and 200% that of Visa and Mastercard, respectively.

To stay competitive against the rapid ascent of crypto payments, global payment companies like Visa and Mastercard Inc. are actively seeking to develop crypto-based payment services in partnerships with international cryptocurrency exchanges.

By Mi-Hyun Jo, Hyun-Ju Jang and Jin-Seong Kim

mwise@hankyung.com

Sookyung Seo edited this article.