South Korea’s mergers and acquisitions market shrank further in 2024 as leading business groups such as Lotte, SK and GS shifted to unload assets to secure cash amid sluggish exports, softening Korean won and political uncertainties.

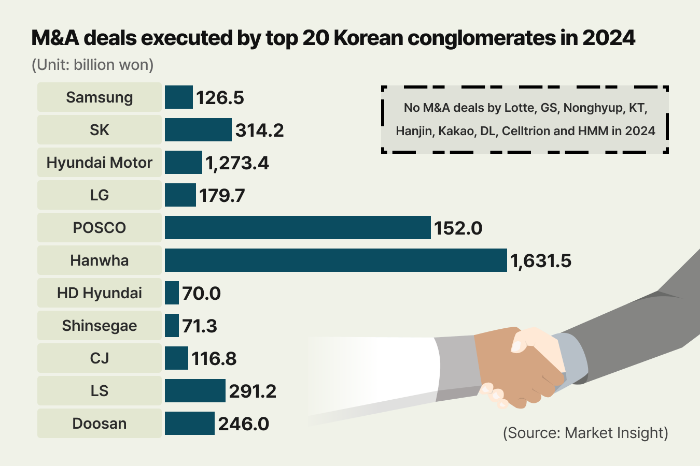

M&A deals executed by top 20 South Korean conglomerates sank to their lowest level in seven years in terms of value in 2024, according to a study by Market Insight, the capital market news outlet of The Korea Economic Daily.

Buyouts and minority stake investments by the 20 business groups amounted to 4.82 trillion won ($3.3 billion) in 2024, marking their lowest level since the 3.64 trillion won in 2017, the study found.

The 2024 figure is down 21.9% from the year prior when their M&A deals slumped by almost two thirds.

That bucked the trend of the global M&A market that logged a 10% rise to $1.6 trillion in the first nine months of this year, according to Boston Consulting Group.

On the buy side, the sharp decline in the Korean currency and lackluster domestic stock market challenged fundraising plans, putting them off from chasing acquisitions and massive investments.

Investments in semiconductor, rechargeable battery and bio companies, deemed as next-generation growth drivers for Korean companies, almost come to a stop this year, said investment bankers.

“As business dynamics declined (in South Korea), it becomes difficult to even narrow down investment candidates,” said a private equity firm official.

Hyundai Motor Group was the only South Korean conglomerate that spent a billion-dollar-level in an overseas company this year. It injected an additional 1.3 trillion won into Motional, its loss-making self-driving joint venture with Aptiv PLC, to raise its stake.

Nine of the top 20 business groups, classified by the Korea Fair Trade, did not carry out an M&A deal this year.

Lotte Group in a liquidity shortage concentrated on selling assets, including its car leasing unit Lotte Rental Co., in an about-turn from its buyout spree over the past few years.

In search of better returns, MBK Partners, one of active buyout firms in North Asia, targeted Korea Zinc Inc. with an aim of boosting its enterprise value by governance improvement.

“The deal drought is expected to continue next year. Coupled with the economic slowing, the impeachment (of President Yoon Suk Yeol) and the beginning of Donald Trump’s second term added to the uncertainty,” said an investment banker.

By Ji-Eun Ha and Jong-Gwan Park

Hazzys@hankyung.com

Yeonhee Kim edited this article.