Bang Si-hyuk, founder and chairman of HYBE Co., the South Korean entertainment giant behind K-pop global sensations BTS and NewJeans, is embroiled in a controversy over his private shareholders’ contract with private equity firms, which is suspected to have dealt a big blow to the company’s stock immediately after its listing about four years ago.

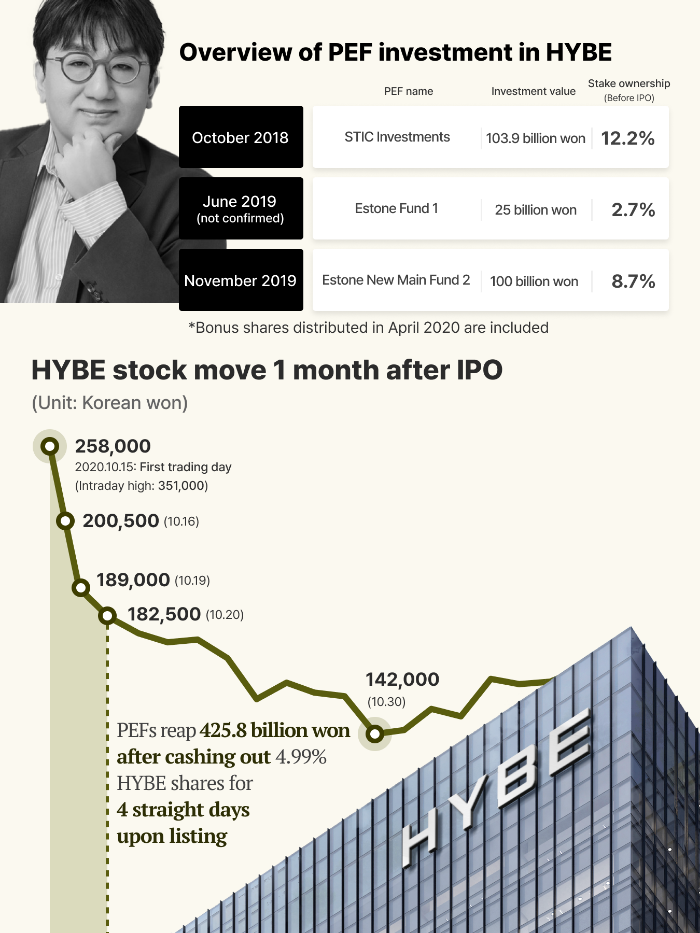

According to financial and investment banking industry sources on Thursday, Bang is confirmed to have reaped about 400 billion won ($287 million) from HYBE’s initial public offering thanks to his private shareholders’ agreement signed with local PEFs – STIC Investments Inc., Estone Equity Partners and New Main Equity – a few years before the company’s IPO in 2020.

The agreement stated the PEF with stakes in HYBE following their investment in 2018 and 2019 should share with Bang 30% of their profit from their exit if HYBE goes public as agreed.

Following PEFs’ investment in HYBE under the agreement, STIC Investments held a 12.2% stake in the Korean entertainment giant, which was called Bit Hit Entertainment at that time, and Estone and New Main Equity jointly owned 11.4%.

If HYBE fails to go public before their agreed time, Bang had to repurchase the PEFs’ stakes plus interest, according to the shareholders’ agreement.

CHEERS TURN INTO PANIC

On October 15, 2020, HYBE triumphantly debuted on Korea’s main bourse Kospi with its stock price more than doubling from the IPO price, 135,000 won per share, reflecting high expectations for the company behind global boy band sensation BTS.

But soon after the stock hit the intraday high of 351,000 won, it started retreating and ended its first trading day at 258,000 won, 4.4% lower than its opening price of 270,000 won.

The next day, it plunged 22.3% and dived 60% over a week to the 150,000 won level.

The stock’s freefall was largely driven by the PEFs’ massive selloffs of HYBE shares after its IPO.

Of the total 23.6% stake held by the PEFs, 15.1% were free from lock-in contracts, meaning that those shares could be unloaded any time after the IPO.

STIC, Estone and New Main cashed in on 4.99%, or nearly 1.8 million shares, of their holdings in HYBE in four straight days upon the IPO to collect 425.8 billion won in total.

HYBE stock and its retail investors were battered and bruised after the much-anticipated IPO, which benefited only Bang and the PEFs with profit-taking.

The IPO allowed STIC Investments to collect 961.1 billion won from its investment of 103.9 billion won in HYBE, while Estone and New Main were suspected to have raked in a similar amount from their investment of 125 billion won.

Under the shareholders’ agreement, suspected to be an earnout contract, between the PEFs and Bang, the HYBE founder was alleged of receiving about 400 billion won from the PEFs after the HYBE IPO.

UNUSUAL PRACTICE

It is unusual that a company’s largest shareholder takes profit for his or her own sake by signing a shareholders’ agreement just before an IPO, market analysts said.

At the center of the controversy is an absence of a proper report about the shareholders’ agreement between Bang and the PEFs to share profit from share divestitures after the IPO, said industry observers.

HYBE did not disclose the PEFs-Bang agreement to the Korea Exchange (KRX) during its IPO review process or in its stock prospectus reported to Korea’s Financial Supervisory Service (FSS).

HYBE said it decided not to report the agreement because its IPO underwriters and legal advisors concluded that the contract between certain major shareholders would hardly dent minority shareholders’ holdings.

When HYBE shares nosedived immediately after the IPO, the market was not aware of the contract between Bang and the PEFs.

An official who participated in the KRX’s HYBE IPO review process argued that a company and its IPO underwriter must report any special contract between large shareholders.

“None of the company and IPO underwriters notified the Bang-PEF contract,” said the official.

HYBE’s lead IPO underwriters were NH Investment & Securities Co., Korea Investment & Securities Co. and JP Morgan. Mirae Asset Securities Co. was the co-underwriter.

An FSS official who was a regulatory filing reviewer also said any investment agreement between a company’s largest shareholder and external investors is subject to a filing but the official did not recall any document disclosing the Bang-PEFs shareholders’ agreement before the IPO.

Legal advisors are, however, divided over whether it is a must for HYBE to report the shareholders’ agreement.

DEPARTURE OF NEWJEANS

Meanwhile, HYBE shares lost more than 5% during a trading session on Friday after NewJeans, a popular K-pop girl group, called on its label ADOR under music powerhouse HYBE to terminate its exclusive contract at a press conference on Thursday.

All of NewJeans’ five members agreed to leave the agency due to the company’s mistreatment, they said.

Their departure has been anticipated after a dispute between their former executive producer Min Hee-Jin and HYBE, which forced Min, also ADOR’s former chief executive, to leave the company earlier this month.

NewJeans expressed a desire to work with Min again and continue performing under a different group name.

By Jin-Hyoung Cho, Jun-Ho Cha and Seok-Cheol Choi

u2@hankyung.com

Sookyung Seo edited this article.