South Korea’s leading hypermarket operator Homeplus Co., wholly owned by North Asia-focused private equity firm MBK Partners, on Tuesday filed for corporate rehabilitation with a Seoul court amid growing market concerns about its financial squeezes.

Homeplus filed for the court-led rehabilitation program with the Seoul Bankruptcy Court after a series of credit rating downgrades, MBK said.

Last week, Korea Investors Service Inc., a Moody’s affiliate, lowered the credit rating of Homeplus’ corporate bonds to A3 minus from A3, citing the lack of efforts to improve its financial health.

MBK and Homeplus officials said filing for the rehabilitation program is a “preemptive move to avoid a liquidity crisis.”

If the court approves MBK’s request, Homeplus’ financial liabilities to creditors will be frozen until the hypermarket operator works out a restructuring plan under the court’s guidance.

Supplier payments and employee wages, however, will continue to be paid without disruption.

Homeplus’ 126 retail outlets across the country, including its hypermarkets, its supermarket chain Homeplus Express and online channels, will also operate as usual.

MBK’S BIGGEST LEVERAGED BUYOUT

With Homeplus set to come under court protection, MBK Partners faces mounting scrutiny over its LBO-driven investment strategy. Korea’s private equity sector is closely watching to gauge the ramifications of MBK’s move.

In 2015, MBK acquired 100% of Homeplus for 7.2 trillion won ($4.9 billion) from British retailer Tesco Plc, in its biggest acquisition and the largest leveraged buyout (LBO) transaction in Asia at the time.

MBK financed the deal with 2.2 trillion won in equity and the remaining 5 trillion won through acquisition financing.

MBK’s filing for court-led rehabilitation program reignited concerns over the risks of highly leveraged acquisitions.

Analysts said MBK’s aggressive LBO strategy could go awry if Homeplus’ restructuring doesn’t work out.

DOWNGRADE TRIGGERS MANDATORY EARLY LOAN REPAYMENT

Last week, credit rating agencies downgraded Homeplus’ corporate bonds and commercial paper ratings, citing declining profitability, a heavy debt burden and growing uncertainty over its long-term competitiveness.

“Despite efforts to improve operational efficiency and revamp key stores, attracting customers and restoring sales remain challenging,” said Korea Investors Service.

The rating downgrade triggered a mandatory early repayment of some loans, industry officials said.

LOSSES SNOWBALLED AMID UPHILL BATTLE VS RIVALS

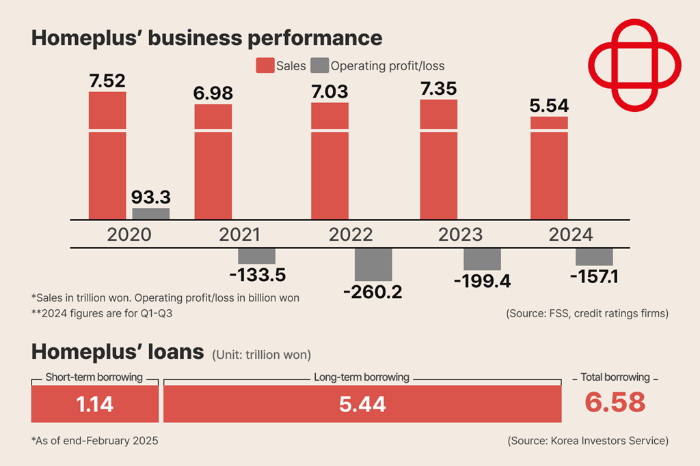

Homplus has continuously posted operating losses amid heated competition against local rivals such as Shinsegae Inc.’s E-Mart Inc., the country’s largest discount store chain, GS Retail and Lotte Shopping Co. as well as fast-growing Korean and Chinese online shopping malls, including Coupang and AliExpress.

Between 2021 and 2023, Homeplus suffered annual losses exceeding 200 billion won.

For the first three quarters of 2023, the retailer reported 157.1 billion won in net loss, continuing its downward trajectory.

Homeplus has been reducing debt by selling off prime retail locations, but with most of its valuable real estate already divested and South Korea’s property market in a slump, cash generation has become increasingly difficult, analysts said.

As of November 2024, Homeplus’ net debt stood at 5.31 trillion won, with its debt-to-equity ratio of 1,408.6%.

MERITZ GROUP’S EXPOSURE UNDER SCRUTINY

In May 2023, MBK and Homeplus secured a 1.3 trillion won 3-year loan from Meritz Financial Group and affiliates, including Meritz Securities Co., to refinance maturing acquisition debt and cover operational costs.

The loan agreement contained an early repayment trigger if Homeplus’ credit rating fell below A3 minus.

With Homeplus poised to enter court-led restructuring, Meritz Securities, which underwrote a 1.2 trillion won refinancing package for the retailer in 2024, has come under scrutiny.

Meritz Financial Group said on Tuesday its loan recovery should be at no risks as it holds secured 5 trillion won worth of collateral on Homeplus’ assets.

“All of Homeplus’ real estate assets are held in a trust as collateral, and Meritz Group holds the senior beneficiary rights to this trust,” said a Meritz Securities official.

UNION CRITICISM

Unionized workers at Homeplus have long criticized MBK Partners for its management practices.

Following the recent credit downgrades, the union said “indiscriminate” asset sales had failed to improve the company’s financial health.

“Instead of injecting additional capital, MBK has relied on Homeplus’ operating income to service its debt,” said a Homeplus union leader. “Such a strategy was bound to lead to financial difficulties.”

By Jun-Ho cha, Da-Eun Choi and Jeong-Cheol Bae

chacha@hankyung.com

In-Soo Nam edited this article.