LG Electronics Inc. is extending its voluntary retirement across the company, broadening it beyond its struggling television division as the South Korean electronics giant seeks to prop up profitability and redirect resources to future growth.

The program, open to both office and production workers across divisions spanning home entertainment, home appliances, vehicle components and heating and ventilation systems, targets employees in their 50s and underperformers, according to people familiar with the matter on Wednesday.

Eligible workers will receive up to three years’ salary in severance, along with tuition support for children. Applications will be accepted through mid-October.

The company last carried out a broad buyout program in 2023.

The latest staff reduction comes as the company is grappling with weakening profitability amid intensifying competition from Chinese rivals, while bracing for headwinds from US tariffs and the global economic slowdown, which would deal a blow to Korean exports.

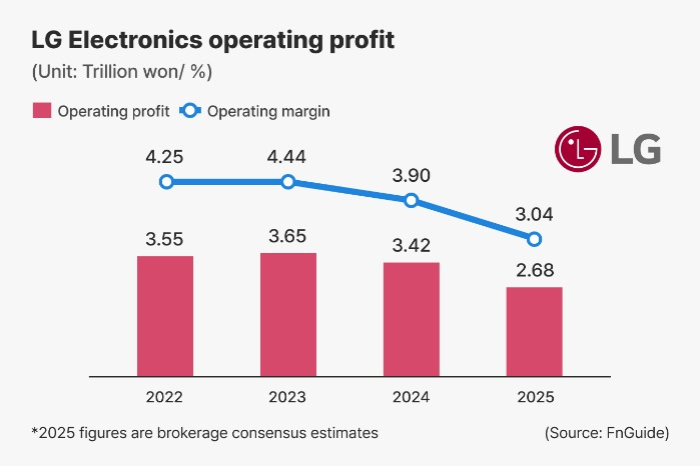

Analysts project LG Electronics would report 2.68 trillion won ($1.9 billion) in operating profit this year, down 21.5% from the previous year, despite a rise in sales to 88.13 trillion won.

This would bring down LG’s operating margin to 3.04% in 2025, a steep fall from 10.6% recorded in 2020.

The broader program has also come after fewer-than-expected TV staff have voluntarily left the company.

FROM HOME APPLIANCES TO B2B

Last month, LG Electronics opened a voluntary buyout program to employees at its TV division after the Media and Entertainment Solutions (MS) division, overseeing the TV business, swung to an operating loss of 191.7 billion won in the second quarter, on sales of 4.39 trillion won, making it the only unit in the red.

Companywide operating profit also nearly halved in the quarter from a year ago, hit by softer appliance demand and higher logistics and materials costs linked to global conflicts and tariffs.

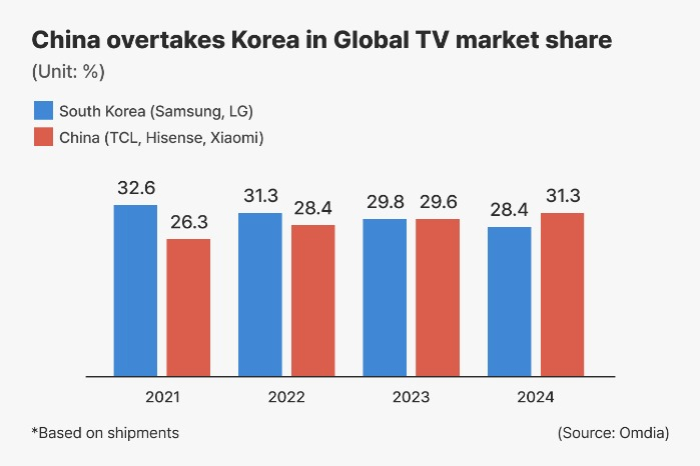

Global TV prices dropped 2.5% on average in the first half of this year from end-2024 after a 3.8% retreat last year, dragged down by aggressive pricing from Chinese brands.

LG’s share of global TV shipments slipped to fourth place in the first quarter, with 10.7%, trailing behind Samsung at 19.2%, TCL at 13.7% and Hisense at 11.9%, according to research firm Omdia.

Analysts warn more headwinds lie ahead, as Washington’s higher tariffs on Korean exports – from cars to appliances – erode competitiveness against Japanese rivals.

WORKFORCE SHIFT

Industry analysts expect LG to use the staff reduction to accelerate generational change and sharpen competitiveness.

The company booked record sales of 87.7 trillion won last year, but operating profit fell 6% to 3.42 trillion won and is projected to slip further this year, despite the revenue growth.

LG Electronics Chief Executive Cho Joo-wan, speaking last week at the IFA trade fair in Berlin, said investments in talent must go hand in hand with spending on facilities and research, hinting at the redistribution of the workforce across the divisions.

“A virtuous cycle that allows investment in outstanding human resources is necessary,” he told reporters.

Analysts say the company is seeking to slim down money-losing units while reinvesting in future businesses such as the artificial intelligence-driven platform business and business-to-business like vehicle electronics and heating, ventilation and air conditioning (HVAC).

With a relatively high average workforce age, LG has long been under pressure to refresh its ranks to speed up its plan to enhance new growth engines.

LG’s restructuring highlights broader strains in Korea’s appliance sector.

Its crosstown rival, Samsung Electronics Co., has recently widened voluntary retirement offers in the Visual Display division, which makes TVs, expanding eligibility beyond senior managers and initiating a management review of the business.

The company has also launched a management review of the division – the first in a decade – amid concerns that its 19-year run as the world’s top TV maker is under threat.

Industry estimates suggest the unit’s operating profit will fall to around 600 billion won this year, down from 1.11 trillion won in 2024.

By Chae-Yeon Kim and Eui-Myung Park

why29@hankyung.com

Sookyung Seo edited this article.