South Korea’s major law firms saw rapid growth in revenue last year as the economic slowdown sparked business overhauls at top conglomerates, with some leading companies grappling with management disputes.

While Kim & Chang solidified its No. 1 spot in the domestic legal service market, second-ranked Lee & Ko made significant strides with high-profile M&A deals.

It led the merger between SK Innovation Co. and liquefied natural gas supplier SK E&S Co. that created Asia’s largest energy company, excluding state-run utilities

Lee & Ko surpassed the 400 billion won ($276 million) milestone in annual revenue for the first time among other leading Korean law firms, excluding Kim & Chang.

“Business restructuring and the tightening of financial and fair trade regulations drove our revenue growth,” Kim Sang-gon, lawyer and head of Lee & Ko. “This trend is expected to continue this year.”

Including patent services and overseas operations, Lee & Ko’s revenue came in at 432.4 billion won in 2024.

The number of M&A deals it handled reached 56, slightly short of Kim & Chang’s 59, although the value is slightly less than half that of Kim & Chang. The figures are based on the calculations by Market Insight, The Korea Economic Daily’s capital market news outlet.

Lee & Ko also handled legal cases for Hur Young-in, chairman of food-focused SPC Group, and former Hanssem Group Chairman Choi Yang-ha, who were acquitted of charges related to embezzlement and fair trade violation, respectively.

SK AND LOTTE GROUPS’ RESTRUCTURING

Bae, Kim and Lee notched up a 5.5% increase to 391.8 billion won in revenue last year. It provided legal services for the sale of SK Rent-A Co. and Lotte Rental Co. to Affinity Equity Partners.

It also mediated the legal fight between Hugel Inc. and Medytox Inc. over a botox strain and Kybo Life Insurance Co.’s dispute with financial investors regarding put options.

It has been adivising MBK Partners on the buyout firm’s takeover attempt for Korea Zinc Inc. If successful, it could be the first hostile takeover of a domestic company.

“Demand for legal services will continue to grow this year as companies are restructuring businesses and taking measures to respond to tougher financial regulations, as well as changing policies in the US,” said a lawyer at one of the top law firms.

FAMILY DISPUTES

Yulchon posted a 12.9% growth on-year to 370.9 billion in revenue. It joined the team of legal advisors for SK Group Chairman Chey Tae-won’s years-long divorce case against Roh So-young, which is awaiting a Supreme Court decision.

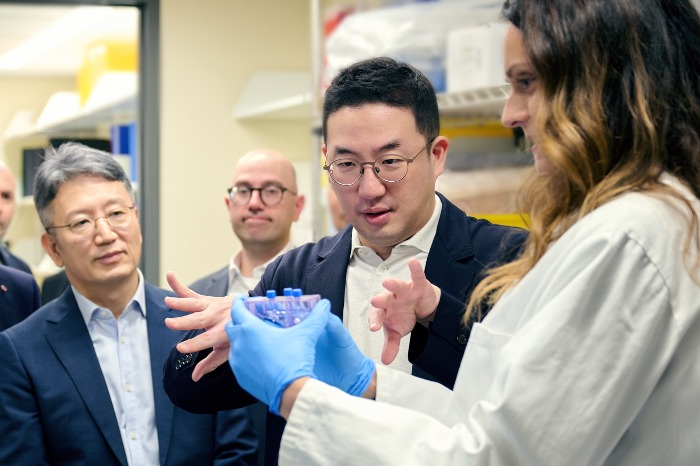

It also represents LG Group Chairman Koo Kwang-mo in a legal battle over the inheritance of the group’s late chairman Koo Bon-moo’s wealth with his mother and two sisters.

Yulchon was a legal advisor of the 2.7-trillion-won sale of Ecorbit Co, South Korea’s No. 1 landfill company, to a consortium of IMM Private Equity and IMM Investment.

The law firm earned a reputation following a court ruling in December 2024, where its client — a domestic automotive parts maker — was cleared of charges under the Serious Accidents Punishment Act after a fatal accident at its workingplace. It was the first such case in the country that ruled in favor of an employer in relation to the Act.

MBK’S TAKEOVER ATTEMPT FOR KOREA ZINC

Shin & Kim saw a 15.7% growth to 369.8 billion won in revenue last year.

Hankook Tire & Technology Co.’s 1.17-trillion-won purchase of a controlling stake in Hanon Systems Corp. from Hahn & Co. boosted its fee income.

Shin & Kim is also working as an advisor for MBK in the management dispute with Korea Zinc and Hanmi Pharmaceutical Group’s family feud for control of the group.

YEARS-LONG DISPUTE SURROUNDING NAMYANG DAIRY

Hwanwoo’s revenue spiked up 20.1% to 250.0 billion won in 2024. Including sales from its patent and overseas operations, revenue exceeded 270.0 billion won.

It has been working for the never-ending dispute between Hahn & Co. and Namyang Dairy Products Co. Advisory services for derivative financial products such as equity linked securities also generated significant fee income.

By Lan Heo and Seo-Woo Jang

why@hankyung.com

Yeonhee Kim edited this article.