East Asia’s petrochemical industry is entering its largest restructuring in decades, with planned closures of aging naphtha cracking facilities in China, Japan and South Korea expected to remove more than 13 million tons of ethylene capacity by 2027.

The long-awaited shakeout could finally restore balance to a sector that has been battling overcapacity for most of the past decade, analysts said.

“If all goes to plan, regional ethylene capacity will fall by 13.5 million tons a year from forecasts by 2027,” said an industry executive on Wednesday. “That could be the turning point that allows the industry to finally exit years of losses.”

The expected cuts, equivalent to more than the combined production of nine major Korean producers, including LG Chem Ltd. and Lotte Chemical Corp., underscore the scale of the shift, analysts said.

China, Japan and Korea account for 45% of the global ethylene production.

SIGNS OF A REBOUND

Ethylene, a building block for plastics, fibers and packaging, is the sector’s key profitability measure.

Signs of an industry rebound are already looming.

The spread between ethylene and its main feedstock, naphtha, has climbed 21% over the past three months to $211 a ton, according to Korea’s industry ministry. The spread rose 33.2% from the average in January.

While still below the $250 threshold typically needed for profits, the recovery has fueled expectations that petrochemical firms such as Lotte Chemical and LG Chem could swing back into the black as early as next year.

China’s planned retrenchment will have the biggest impact.

Beijing’s National Development and Reform Commission and four other ministries have signaled plans to eliminate crackers more than 20 years old.

Analysts expect about 7.4 million tons of capacity to be retired from China’s annual production capacity of 78.2 million tons by 2027, with further cuts possible if plants with capacity below 300,000 tons a year are consolidated, according to a research report by Seoul-based Shinyoung Securities Co.

KOREAN FIRMS TO UNVEIL REVAMP ROADMAP IN OCTOBER

Industry restructuring is also underway in Korea, where a detailed plan to cut ethylene by as much as 3.7 million tons is due out next month.

Korea is one of the world’s largest importers of naphtha, an oil product that is broken down into chemicals used in plastics for automobiles, electronics, clothing and construction.

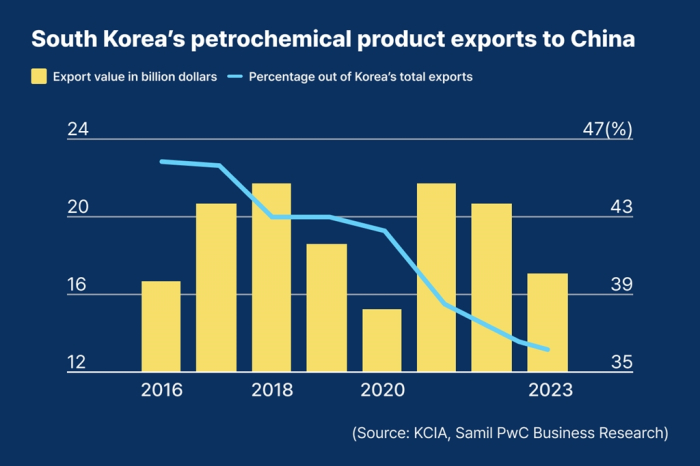

However, Korean companies have been among the hardest hit by Beijing’s aggressive capacity buildout. With Chinese plants producing generic products at significantly lower costs, Korean firms have been under increasing financial strain.

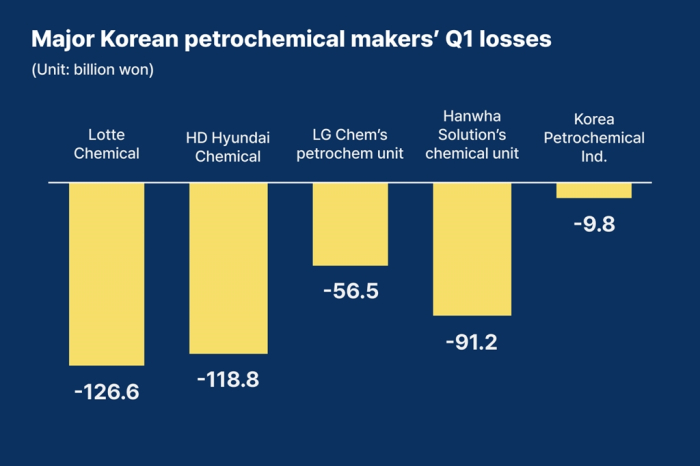

Last month, Korea’s 10 largest petrochemical companies agreed to restructure their operations, including up to 25% cuts to their naphtha-cracking capacity, as the government called for rigorous restructuring to save the bleeding sector from total collapse.

Under their plan, petrochemical makers aim to reduce their annual naphtha-cracking capacity by between 2.7 million and 3.7 million tons, which means shutting down as much as 25% of the country’s annual capacity of 14.7 million tons.

The government said it won’t provide any state support unless petrochemical firms draw up sweeping self-rescue measures, including specific production cuts and fresh equity injections by controlling shareholders.

JAPAN’S PLAN

Japan, which has already been rationalizing its petrochemical sector since 2014, plans to cut an additional 2.4 million tons by 2028.

“If the reduction plans by the three countries are implemented as scheduled, that would be the biggest consolidation in industry history, reducing around 8% of global capacity,” said Shinyoung Securities analyst Shin Hong-ju.

The wave of closures comes as the petrochemical cycle turns.

After the COVID-19 boom of 2020–2021 spurred overbuilding, producers have entered an investment lull and are now seeing demand pick up again.

The industrywide reduction plans are boding well for petrochemical firms’ earnings.

Lotte Chemical is forecast to swing to an operating profit of 241.9 billion won in 2026 from an estimated loss of 685.2 billion won this year.

LG Chem is projected to post a total operating profit of 3.22 trillion won next year, with its petrochemicals arm turning to a profit of 127.6 billion won from this year’s estimated loss of 243.5 billion won.

By Woo-Sub Kim

duter@hankyung.com

In-Soo Nam edited this article.