South Korea’s HS Hyosung Advanced Materials Corp. is seeking to sell its tire steel cord business to secure funds for its new growth ventures such as electric vehicle materials, hydrogen and artificial intelligence.

According to investment banking industry sources on Thursday, the company plans to open a preliminary bidding process by the end of February to unload its steel cord business.

The value of the business is estimated at 1.5 trillion won ($1 billion), given its 2023 sales revenue of 860 billion won ($598 million) and 140 billion won in earnings before interest, taxes, depreciation and amortization – an earnings matrix commonly known as EBITDA.

Sources said the sale is part of its business restructuring to focus on new growth ventures.

Hyosung’s steel cord division generates about 40% of its total profit.

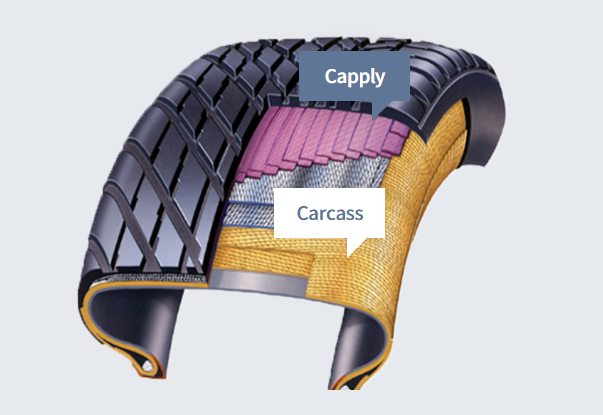

Tire cords are materials used to reinforce a tire’s durability, driving performance and safety as they maintain the shape of the tires and support vehicle weight.

VICE CHAIRMAN CHO HYUN-SANG’S VISION

Steel cord is made by bundling multiple thin wires together, which helps tires absorb shocks and improve ride comfort.

HS Hyosung Advanced Materials is the only company in the world that produces all three major tire reinforcements: steel cord, nylon tire cord, and polyester (PET) tire cord.

Through the sale of the steel cord business, which is less relevant to its main specialty fiber business, Hyosung wants to secure funds for investments, sources said.

Hyosung’s steel tire cord division is a leading player in North America and Europe.

The company is led by Vice Chairman Cho Hyun-sang, the third son of the Hyosung Group founder.

Cho, who heads HS Hyosung Group, spun off from textile-to-chemicals conglomerate Hyosung Group last July, has vowed to foster EV materials, hydrogen and AI as the group’s new growth engines.

By Jun-Ho Cha

chacha@hankyung.com

In-Soo Nam edited this article.