HD Korea Shipbuilding & Offshore Engineering Co. (HD KSOE), an intermediary shipbuilding holding company of HD Hyundai Co., will invest up to 300 billion won ($206 billion) to develop small modular reactor (SMR)-powered ships by 2030.

The investment decision comes about a month after the parent of the world’s largest shipbuilder HD Hyundai Heavy Industries Co. unveiled its first nuclear-propelled container ship model, poised to be a game changer in the carbon-zero shipping industry.

According to shipbuilding industry sources on Monday, HD KSOE recently issued 600 billion won worth of exchangeable bonds, of which 200 to 300 billion won will be spent to develop an SMR as a vessel propulsion power by 2030.

The remaining will be used to develop hydrogen fuel cells for land power grids by 2027 and those for ships by 2028.

The latest investment is significantly larger than HD KSOE’s usual annual investment of about 100 to 160 billion won in its entire research and development.

NEW GROWTH ENGINE

The investment decision comes amid growing expectations that nuclear-powered vessels will be trailblazers in marine transportation requiring cleaner energy systems.

The sea shipping industry is responsible for about 3% of global carbon emissions caused by human activity, according to the European Commission.

To meet the stricter carbon-free rules set by the International Maritime Organization (IMO), ocean carriers have to operate more environment-friendly ships powered by low-carbon fuels like liquefied natural gas (LNG) and blue hydrogen.

Of green marine fuel options, nuclear power, especially SMR, has emerged as a cleaner alternative propulsion force, which can also extend a vessel’s life cycle and operation without refueling.

In anticipation of a rise in demand for cleaner nuclear-propelled ships, HD Hyundai invested $30 million in TerraPower LLC, a US nuclear power venture founded by Bill Gates, in 2022.

Since then, the two have forged partnerships to develop offshore next-generation nuclear power systems, including a floating nuclear power plant (FNPP) designed to supply nuclear energy from offshore to both shorefront and inland locations.

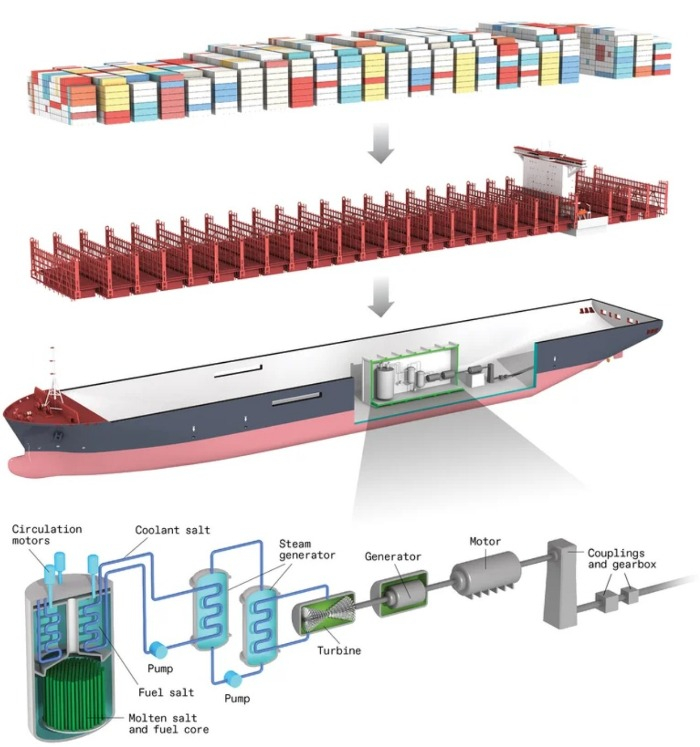

Last month, HD KSOE finally premiered its first nuclear-propelled container ship model on the global stage.

Its design model was an SMR-powered container ship with a capacity of 15,000 twenty-foot equivalent units (TEU), which won approval in principle (AIP), a certificate of the feasible novel design of a marine vessel or technology concept meeting the rules of the American Bureau of Shipping (ABS).

Because nuclear-powered vessels do not require engine exhaust systems or fuel tanks, HD KSOE’s nuclear-powered ship offers more space than conventional ships with a large occupied engine room.

SMR for ships that HD KSOE plans to develop is a molten chloride fast reactor (MCFR), a type of molten salt reactor (MSR) with molten chloride salt fuel serving as both the fuel and the coolant.

Considered as the fourth-generation reactor, its life expectancy is 20 to 30 years, and its compact reactor size is another advantage.

TerraPower plans to start operating MCFR systems in 2030.

TO WIDEN THE TECHNOLOGY GAP WITH CHINESE RIVALS

SMR technology is still in its early development stage with many pending technology, regulatory and safety issues, but it is considered safer and cleaner than existing large nuclear power plants.

Once SMR technology matures, SMR-powered ships are expected to pave the way for a more efficient and eco-friendly shipbuilding era.

By advancing into the market with the higher technological barriers, HD Hyundai is hoping to widen the technological gap with Chinese shipbuilders, which have been rapidly closing in on the Korean rivals in shipbuilding technology.

China-made ships accounted for 70% of the global commercial vessel market in 2024, overwhelming Korean rivals’ 16%. Even China’s Jiangnan Shipyard Co. unveiled its SMR ship model in 2023.

The biggest hurdle to the development of SMRs for ships, however, remains – the price and safety issues, industry observes said.

It costs between 1 trillion won and 3 trillion won to build an onshore SMR with a power capacity ranging from 100 to 300 megawatts MW(e).

HD KSOE plans to develop a 70-MW SMR for ships, which is estimated to cost hundreds of billions of wons.

Considering that it costs about $250 million to build a container ship with a 15,000-TEU capacity, the cost of building an SMR-powered ship is still too high.

SMR’s safety issue also must be addressed before it is commercially used as a vessel power.

By Hyung-Kyu Kim

khk@hankyung.com

Sookyung Seo edited this article.