Hana Financial Group is moving to take full ownership of its asset management arm, a step aimed at strengthening its position in South Korea’s rapidly growing retirement and exchange-traded fund markets.

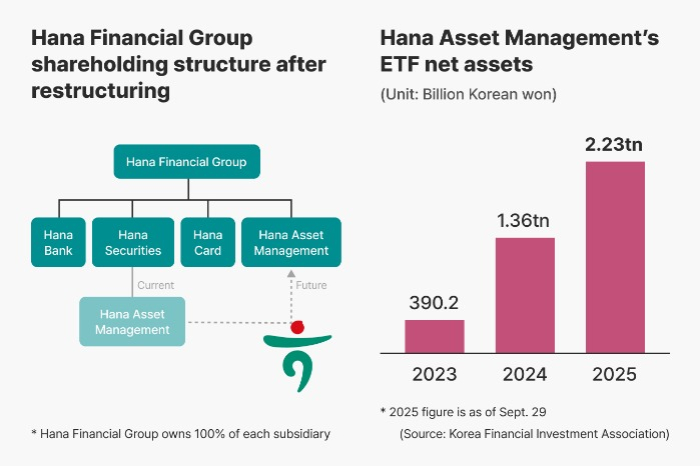

The company, one of South Korea’s top five financial holding firms, plans to acquire a 100% stake in Hana Asset Management Co. held by Hana Securities Co., according to people familiar with the matter on Wednesday.

Once completed, the transaction would place the unit directly under Hana Financial’s control, with regulatory approval expected to be sought later this year.

The move underscores Hana’s effort to broaden its nonbanking operations, where it lags behind domestic rivals.

KB Financial Group and Shinhan Financial Group each wholly own their asset managers, while NH Financial Group Inc. controls 70% of NH-Amundi Asset Management Co., a joint venture with France’s Amundi.

Those firms lead Korea’s ETF market.

FOCUS ON RETIREMENT AND ETFS

With Hana Asset as a direct subsidiary, Hana Financial is expected to invest more aggressively in the firm’s retirement and ETF businesses.

Korea’s retirement market is forecast to more than double to 1,000 trillion won ($713.8 billion) by 2035, up from 430 trillion won in 2024, while the ETF market has lately expanded to 250 trillion won from 120 trillion won in 2023.

Hana Bank is the country’s fourth-largest retirement fund provider but has relied heavily on third-party products.

Since Hana Asset launched its first target-date funds (TDFs) last year, the bank has been seeking to raise the share of in-house products to 70%.

Target-date funds, which automatically adjust their asset mix as investors near retirement, have become a core product in the market.

Though a late entrant, Hana Asset’s six TDFs have posted some of the industry’s strongest one-year returns, with five topping their peer group.

Last year, Hana Financial also introduced a retirement product designed to manage retirees’ assets, including inheritance and healthcare needs.

BUILDING A CORE GROWTH ENGINE

Hana Asset has gained momentum since severing ties with UBS two years ago.

The Swiss bank previously held a 51% stake, but Hana Securities acquired that stake in October 2023, giving it full control.

Since then, Hana Asset’s ETF assets under management have more than quintupled, from 390 billion won at the end of 2023 to 2.23 trillion won as of September.

The planned restructuring would elevate Hana Asset as a strategic growth driver within the group, giving the holding company a stronger foothold in segments where rivals already enjoy a head start.

By Hyun-Ju Jang and Han-Shin Park

blacksea@hankyung.com

Sookyung Seo edited this article.