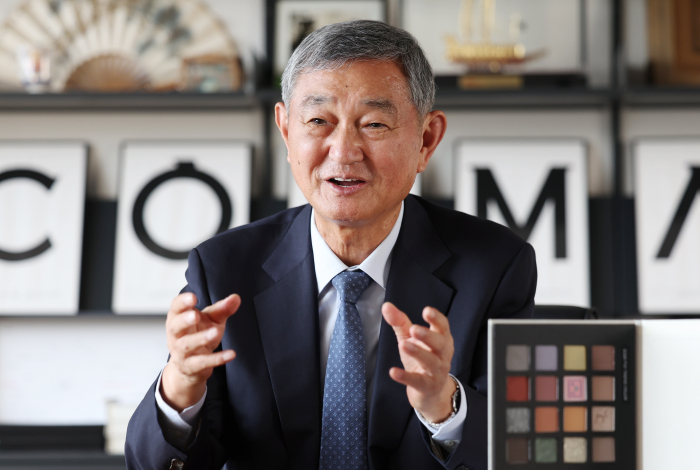

Singapore’s sovereign wealth fund GIC and Morgan Stanley have snapped up shares of Korean beauty and cosmetics companies, betting the high-performing stocks still have room to climb.

GIC bought 122.7 billion won ($88 million) worth of shares in Cosmax BTI Inc. between Sept. 16 and 17, raising its stake to 5.005%, according to a regulatory filing on Wednesday.

The stock purchase made it the third-largest shareholder in the holding company of Cosmax Inc., South Korea’s biggest cosmetics original development and design manufacturer (ODM), after the company itself and the National Pension Service.

With Cosmax forecast to maintain its record-breaking revenue growth this year, Cosmax BTI’s share price has spiked 112.72% to 18,060 won so far this year by Thursday’s market close.

The holding company’s share price outperformed the 44.69% gain in the benchmark Kospi index over the same period.

APR

As the South Korean stock market has extended its record-setting bull run in September, Morgan Stanley returned to APR Co., known for its Medicube skincare line and AGE-R beauty devices, after taking profits over the past few months.

As of Sept. 23, the US investment bank holds a 5.03% stake in APR, making it the third-largest shareholder, according to its public disclosure. Between Sept. 18 and 23, the firm purchased 36,038 shares of APR, valued at around 8 billion won.

Its ownership had fallen below 5% compared with a 5.13% stake at the end of June, indicating it took profits on a stock that has soared 337.38% year to date.

Under the Korean Capital Market Act, shareholders who increase their stake in a listed company to over 5% are required to report the change to the Financial Supervisory Service through a public disclosure.

In the first half of this year, APR posted its largest half-year operating profit of 139.1 billion won. According to market tracker FnGuide, APR’s revenue is projected to nearly double in 2025 from the year before.

Analysts said the stock has further upside potential.

Three out of seven brokerage houses covering APR have revised upward their target prices, citing its triple-digit sales growth in the US and Japan.

d’ALBA GLOBAL

On Monday, Seoul-based VIP Asset Management Co. said its ownership of d’Alba Global Co. has increased to 5.12% from 4.96% following additional purchases between Sept. 12 and 29.

In the first half of this year, d’Alba Global raked in its strongest half-year revenue.

EXPORTS

South Korea’s cosmetics exports have climbed 13.56% through August this year, compared to the year prior, according to Hankyung Aicel, the alternative data platform of Hankyung Aicel.

In the first 20 days of this month, the country exported $605 million worth of cosmetic products on a preliminary basis, up 25.7% on-year. Europe and the Middle East account for the bulk of the shipments, representing 58% and 40% of total exports, respectively.

For all of 2025, South Korea’s exports of cosmetics are projected to rise 13.56% to $7.05 billion on-year in 2025, according to KED Aicel.

“In most countries, consumption peaks between late October and November,” said Kim Myung-joo, an analyst at Korea Investment & Securities Co.

“Their exports will rise significantly around the Black Friday discount sales at the end of November,” she added.

Analysts said Korea products remain price competitive thanks to their high quality and functionality, even in an era of inflation.

“Driven by the global popularity of Korean content, demand for K-beauty products is expected to continue to rise,” said Hyung Kwon-hoon, an analyst at SK Securities Co.

Hugel Inc., South Korea’s largest maker of botulinum toxin products used to treat overactive muscles and facial wrinkles, also reported its largest half-year sales in the January-June period this year.

Aesthetic device makers PharmaResearch Co. and Classys Inc. also posted their strongest half-year revenue in the first half.

By Han-Gyeol Seon

always@hankyung.com

Yeonhee Kim edited this article.