South Korea’s exports of used cars by its homegrown auto brands are expected to hit a historic high this year, thanks to their improved brand reputation and the weak Korean currency against the US dollar, making high-quality cars shipped from the country cheaper abroad.

According to the Korean alternative data platform KED Aicel on Sunday, the country shipped $426 million worth of secondhand passenger cars overseas in the first 20 days of April this year.

This is 86.8% higher than the same period of last year, raising expectations that the country’s used car exports for April could surpass the previous monthly records of $548 million in February and $603 million in March.

It is also highly anticipated that the country’s annual used passenger car exports would hit a fresh record for the fourth consecutive year in 2025.

The surge in Korean used car exports is largely propelled by insatiable demand from Russia and countries in the Middle East, especially Syria in the middle of post-war reconstruction since the fall of the Bashar al-Assad regime last December, found KED Aicel.

Russia, which has been struggling to import new cars from Europe following its attack on Ukraine in 2022, has also expanded imports of used cars from Korea and Japan.

“The Korean used car market has entered an unprecedented boom, fueled by rising demand from Syria amid its national reconstruction following the end of the civil war, alongside continued disruptions from the Russia-Ukraine war,” said Shin Hyun-do, head of a local private organization providing insights and data on the country’s used car market.

RUSSIA AND THE MIDDLE EAST LEAD

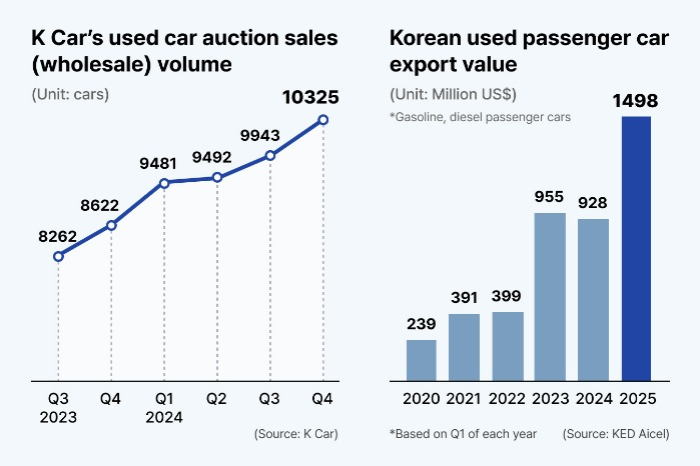

According to KED Aicel data, the export value of Korean used passenger cars – both gasoline and diesel-fueled cars – amounted to $1.5 billion in the first quarter ending March this year, the highest ever for the period.

It was also 61% higher than a year ago.

In 2024, passenger cars made up a dominant 93% of Korea’s total used car exports.

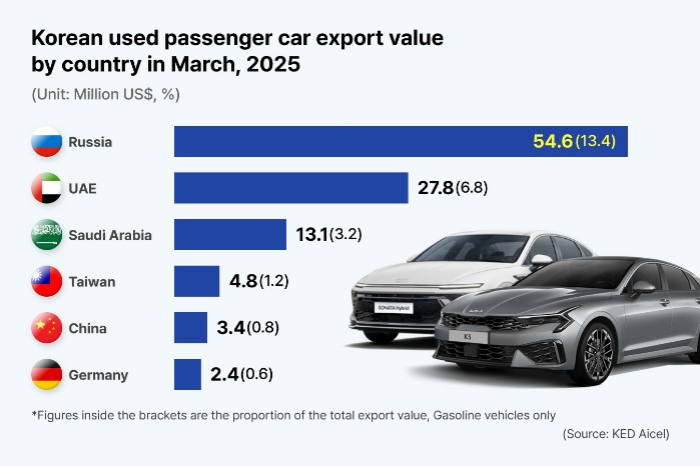

Their shipments to Russia hit the highest value of $54.6 million, making up 13.4% of Korea’s total used car exports, followed by the United Arab Emirates with 6.8% and Saudi Arabia with 3.2%.

The final destination of most cars shipped to the UAE and other Middle Eastern countries is Syria, said used car market experts.

“The used car auction market is enjoying a heyday as buyers seeking to export used cars to the Middle East have increased since the end of the civil war in Syria,” said Yim Yong-hwan, head of an auction sale team of Korea’s leading used car online platform operator, K Car Co., in Osan.

Russia has emerged as a key export destination for Korean used cars since it attacked Ukraine, which has put a stop to new car shipments from Europe to the country.

“Russia has become the biggest export market for Korean used cars, driven by a surge in rerouted imports of nearly new, high-end cars,” said Kim Chun-kon, deputy president of the Korea Institute for Industrial Economics & Trade’s research division.

BETTER BRAND REPUTATION

Industry observers also attributed the improved brand reputation of Korean automakers such as Hyundai Motor Co. and Kia Corp. on the global stage to the rise in Korean used car exports.

The total export value of Korean used cars, including passenger and commercial vehicles, as well as trucks, expanded to $4.84 billion in 2024 from $4.56 billion in 2023 and $2.81 billion in 2022 on a customs clearance basis.

According to Russia-based Autostat, of ABTOCTAT in Russian, the best-selling car model in the country last year was the Toyota Camry, trailed by the Kia Sportage and the Hyundai Creta.

“Demand for cars made by Japanese and Korean brands remains high in the Russian used car market,” said an official from the Korea Trade-Investment Promotion Agency’s (KOTRA) St. Petersburg branch.

The official expected Korea’s outbound shipments of used cars will remain solid for a while following an anticipated rise in new car prices due to the higher tariff barriers.

CHEAPER SHIPPING COST IS A BOON

A fall in sea freight rates has also spurred used car exports from Korea.

The Shanghai Containerized Freight Index (SCFI), which topped 5,000 in early 2022, has dipped below 1,500 this year.

Korea has exported about 80% of its used car exports via container ships.

Coupled with the improved brand reputation of Korean cars and the weaker Korean won value against major currencies, the cheaper delivery costs have made even the export of cars in poor condition profitable, said Shin.

Korean used car companies are rushing to reinforce their export infrastructure to ride the current boom.

Hyundai Glovis Co., the logistics unit of the world’s third-largest carmaker Hyundai Motor Group, will build an integrated system that can handle the entire export process of used cars, encompassing car purchases and cargo loading, to meet growing global demand, said an official from Hyundai Glovis.

Lotte Rental Co., Korea’s No. 1 car rental and lease firm, recently acquired by Hong Kong-based private equity firm Affinity Equity Partners, is also ramping up efforts to export its rental fleet from its UAE branch to third-party countries, anticipating soaring demand for Korean used cars as geopolitical risks have eased in parts of the Middle East, including Syria, said a company official.

By Tae-Ho Lee

thlee@hankyung.com

Sookyung Seo edited this article.