Blackstone and Partners Group have been named the most preferred global private equity managers by South Korea’s leading asset owners, while Ares and Neuberger Berman were selected as the top firms in private debt, a survey shows.

In the infrastructure field, Brookfield and Schroders ranked as top performers, according to a recent survey conducted by The Korea Economic Daily Global Edition (KED Global). In real estate, Blackstone and Bain Capital were the most favored managers.

In September, KED Global surveyed investment professionals from South Korea’s major pension funds, including the National Pension Service (NPS), the Government Employees Pension Service (GEPS) and the Korean Federation of Community Credit Cooperatives.

Asset managers from the sovereign wealth fund Korea Investment Corp. (KIC), along with professionals from leading domestic securities firms, also took part in the poll.

BRAND TRUST, CLIENT ENGAGEMENT EMERGE AS KEY FACTORS

The poll marked the first survey of its kind carried out by a Korean news outlet. KED Global will conduct the survey quarterly and aggregate the results to name the year’s best global asset managers.

Respondents were asked to select their two preferred global asset managers in each category, based on customer service, asset management capabilities and brand trust, as well as innovation in products and services.

The poll found that investment execution remains the decisive criterion across categories, while brand credibility and client engagement are emerging as key differentiators in the competitive mid-cap private equity and private debt niches.

The middle market for private debt and infrastructure has become more crowded with new names emerging on the list, reflecting growing interest in the segment.

This survey is expected to provide a useful reference for evaluating and selecting external asset managers for Korean institutional investors.

The following outlines the survey findings by investment segment:

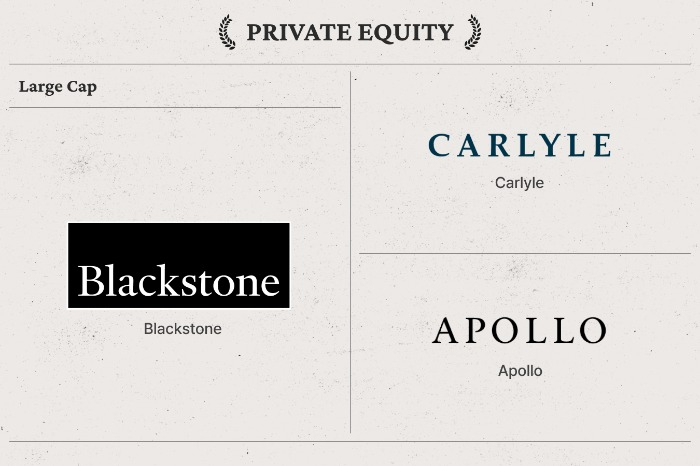

PRIVATE EQUITY

Large-cap:

Blackstone received the highest marks for investment capability. The Carlyle Group and Apollo are jointly ranked second. KKR & Co. and EQT placed fourth and fifth, respectively, with CD&R close behind.

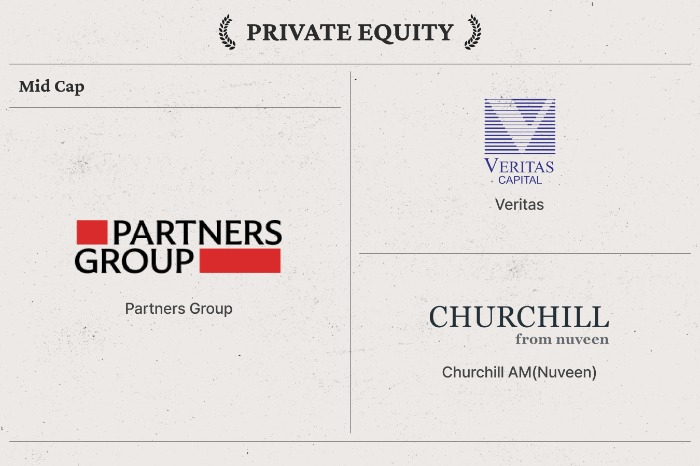

Mid-cap:

Partners Group led the segment, followed by Veritas and Churchill Asset Management, an affiliate of Nuveen. Runner-up Veritas Asset Management matched Partners Group in customer service and brand reputation. Summit Partenrs came in fourth.

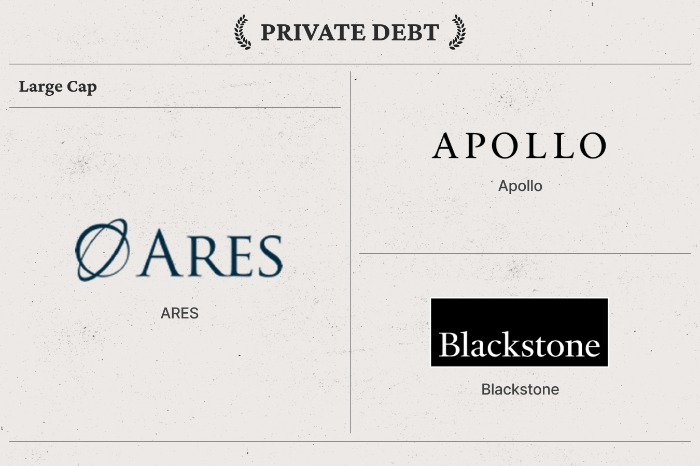

PRIVATE DEBT

Large-cap:

Ares won the most votes in this category, primarily recognized for its strength in investment capability. Apollo Global Management and Blackstone followed, with Blackstone earnining dominant scores for brand trust among the three.

Oaktree Capital Management was just behind the top three. Pimco ranked fifth in overall votes and earned high scores for its investment capabilities. Golub Capital followed closely.

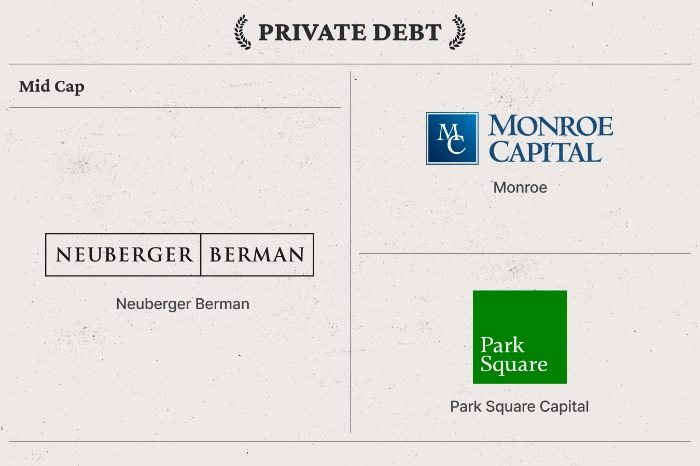

Mid-cap:

Neuberger Berman top recognition for both investment capability and brand credibility. Monroe Capital and Park Square Capital ranked second and third, respectively.

Fourth-ranked Crescent Capital Group, placed fourth, received moderate scores for brand reputation.

Balbec Capital, specializing in distressed and non-performing loans and Europe-based Eurazeo ranked high among the mid-cap private debt managers favored by leading Korean institutional investors.

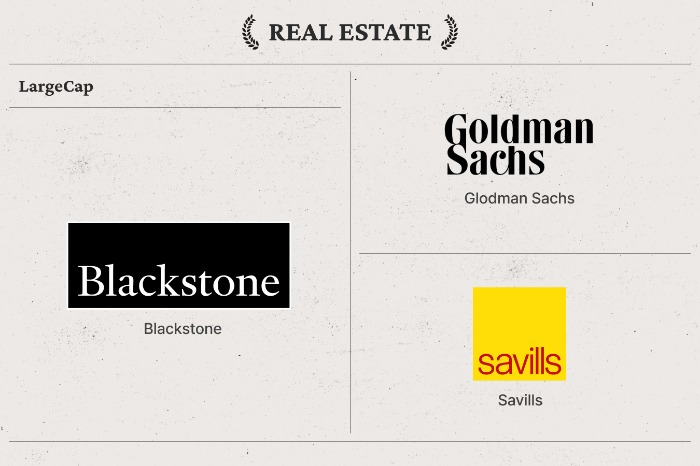

REAL ESTATE

Large-cap:

Blackstone ranked highest, widely credited with its investment capability, followed by Goldman Sachs. Third-placed Savills won the strongest scores for brand credibility among the three. Ares secured the fourth-largest share of votes and CBRE followed closely.

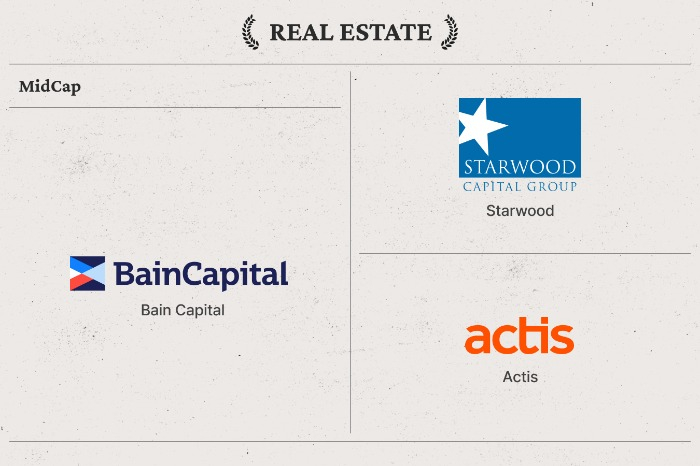

Mid-cap:

Bain Capital secured the top spot with the highest scores for brand credibility, followed by Starwood and Actics, which shared second place.

Kayne Anderson ranked fourth, matching Starwood’s score in brand trust, underscoring its rising profile among Korean institutional investors.

With $18 billion in real estate assets under management, Kayne Anderson is zooming in on medical offices, senior housing and student housing.

INFRASTRUCTURE

Large-cap:

Brookfield topped the list with strongest recognition for asset management capability among all firms included in the poll in the category. Macquarie and Ares followed as runner-ups, rounding out the top three.

Fourth-placed Allianz performed well in brand credibility. Goldman Sachs secured fifth place.

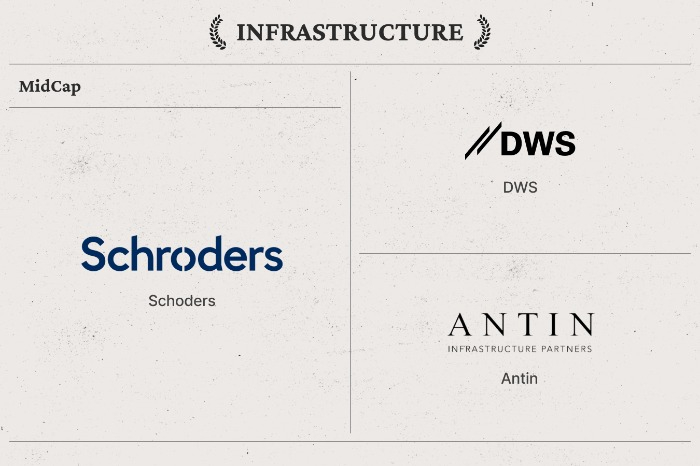

Mid-cap:

Schroders led the pack, earning the highest scores for brand trust. The segment was diverse in terms of the asset managers’ nationalities.

Second-placed DWS, headquarters in Frankfurt, outperformed the London-based asset manager in terms of investment capability.

France-based Antin Infrastructure Partners and Netherlands-based CVC DIF were tied for third place. Dublin-based Rubicon Capital Advisors came in just behind.

FUND OF FUNDS:

Hamilton Lane and Neuberger Berman jointly secured the top spot, with HabourVest ranking close behind in third place.

Adams Street Partners, StepStone and Pantheon shared fourth place. Adam Street received the highest marks for brand trust among the fund-of-funds management firms on the list.

For details, click below: