South Korea’s economy grew faster than initially estimated in the second quarter, helped by stronger exports and firmer construction investment, the Bank of Korea (BOK) said Wednesday.

The country’s gross domestic product (GDP) expanded 0.7% from the previous quarter, up from a preliminary estimate of 0.6% released in July.

The revision reflects a sharper 4.5% increase in exports compared to the earlier estimate of a 4.1% rise, fueled by strong global demand for semiconductors and petrochemicals.

Analysts attributed the solid exports to Korean companies’ rush to front-load their shipments before hikes in US tariffs.

Construction investment also proved more resilient than first thought, while facility investment declined more steeply.

MORE OPTIMISTIC ABOUT 2025

The improvement followed a 0.2% contraction in the first quarter and ended South Korea’s longest stretch of near-stagnant growth since the 1997 Asian financial crisis, during which Asia’s fourth-largest economy grew less than 0.2% in four consecutive quarters.

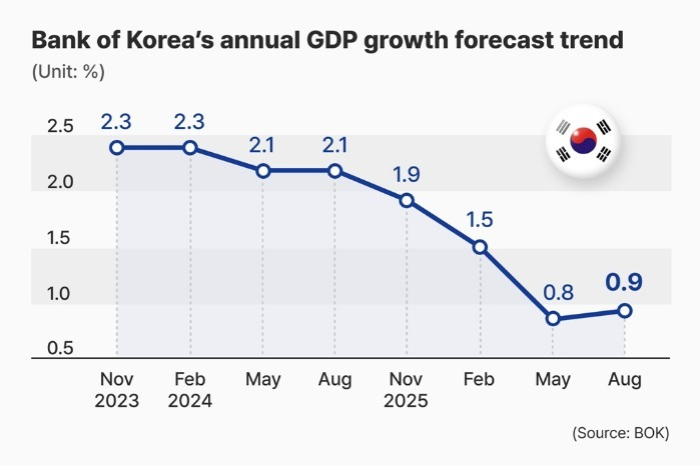

Last week, the BOK raised its full-year growth forecast for 2025 to 0.9% from 0.8%, citing the impact of two supplementary budgets worth 45.6 trillion won ($32.9 billion) aimed at bolstering household consumption.

The revision marks the BOK’s first upward adjustment this year, after a series of cuts.

In February, the central bank lowered its 2025 GDP growth forecast to 1.5% from 1.9% earlier, and again to 0.8% in May.

The new growth outlook brings the central bank in line with the Finance Ministry’s projection of 0.9% announced a week earlier.

The latest BOK forecast remains below the OECD’s 1% projection, but above the 0.8% expected by the the International Monetary Fund (IMF), the Korea Development Institute (KDI) and the Asian Development Bank (ADB).

TARIFFS CLOUD EXPORT OUTLOOK

Global investment banks are more upbeat about the Korean economy.

Earlier last month, Goldman Sachs said it expects the Korean economy to expand 1.2% this year, up 0.1 percentage point from its previous forecast.

JPMorgan, long one of the more bearish observers of the Korean economy, also inched up its forecast to 0.7% from 0.6%, citing stronger-than-expected second-quarter growth.

Citi raised its forecast to 0.9% from 0.6%.

Despite signs of stabilization, policymakers remain cautious.

Last week, the BOK held its benchmark interest rate steady at 2.5% for a second straight meeting last week, pointing to risks from rising household debt and housing prices alongside global economic headwinds.

South Korea’s exports to the US, a key market, tumbled by double digits in August – the first decline since the COVID-19 pandemic – underscoring the toll from Washington’s tough tariff regime.

Analysts warn Korea’s US-bound exports face mounting barriers, with Washington weighing new chip tariffs under Section 232 of the US Trade Expansion Act, widening steel duties and tightening supply-chain rules.

Despite agreeing in principle to reduce tariffs on imports of Korean vehicles to 15% from 25%, the US has yet to formalize the deal, leaving Korean automakers facing higher costs for now.

By Jin-gyu Kang

josep@hankyung.com

Sookyung Seo edited this article.