South Korea’s foreign authorities said on Friday they will ease foreign exchange regulations to allow more dollars into the domestic financial market, a day after the Korean won fell to its weakest level against the greenback in more than 15 years.

While unveiling a spate of measures aimed at improving foreign currency liquidity in the local market following an emergency economy-related government meeting, the Ministry of Economy and Finance said it will “closely monitor the foreign exchange market and gauge the impact of the new measures” before further loosening foreign currency rules.

The meeting, chaired by First Vice Finance Minister Kim Beom-seok, was attended by senior officials from the Financial Services Commission, the Financial Supervisory Service and the Bank of Korea.

Government officials said easing foreign exchange regulations would facilitate corporate and bank borrowings abroad and help defend the won’s fall against the dollar.

On Thursday, the Korean currency dropped to its weakest level in 15 years, weighed down by risk-averse sentiment after the US Federal Reserve’s cautious stance on more interest rate cuts, as well as domestic political uncertainty stoked by President Yoon Suk Yeol’s short-lived martial law order on Dec. 3 and his subsequent impeachment.

Earlier on Thursday, the won fell to 1,453.0 per dollar – the lowest since March 16, 2009, before recouping losses and ending the day at 1,452.0 in Seoul trade. On Friday, the won closed at 1,451.7 per dollar in the domestic market.

The won, down 11% year-to-date, is the worst-performing emerging Asian currency of the year. Currency dealers said the local currency is heading toward its worst year since 2008.

TO LIFT CEILINGS OF FX FORWARD FUTURES POSITIONS

Under the measures announced on Friday, the ceiling of forward foreign exchange futures positions would be raised to 75% of capital holdings for local banks and 375% for Seoul branches of foreign banks, from the current 50% and 250%, respectively.

The forward exchange position refers to the difference between forward foreign currency assets and liabilities.

The government is taking the move for the first time since the policy was introduced in 2010.

Easing the limits is expected to help lenders secure foreign currency liquidity more efficiently, the ministry said.

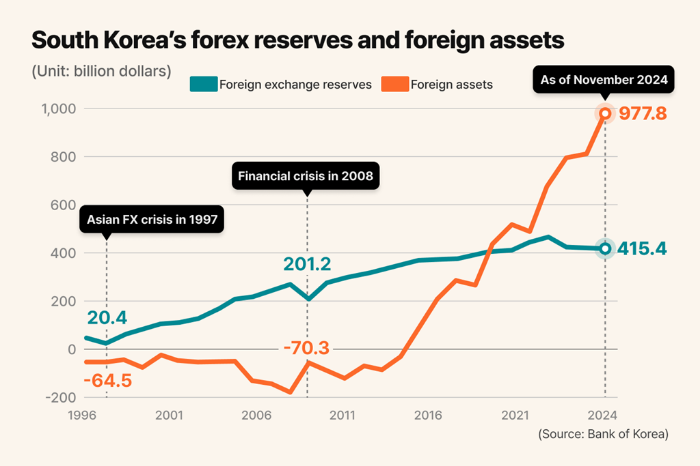

Hit hard by capital flight during the 1997-1998 Asian foreign exchange crisis and the 2007-2008 global financial crisis, Korea has had a tight grip on foreign exchange borrowings even as it has encouraged overseas investments.

At the end of November, the country held a record high of a net $977.8 billion in foreign assets abroad, after turning a net creditor in 2014. Its foreign exchange reserves stood at $415.4 billion last month.

DOLLAR LOANS FOR FACILITY INVESTMENT

The government will also allow companies to take out loans in foreign currencies and exchange the funds for the won, if they are used for investing in facilities such as equipment, property and land purchases.

Small business owners with exposures to higher foreign exchange risks, will be excluded from the new measures.

The ministry said it will expand non-dollar trade settlements by allowing companies to settle business transactions with partner country currencies.

To assist domestic companies in raising overseas capital, the government plans to simplify procedures for issuing bonds on the Luxembourg Stock Exchange, known as LuxSE.

“Strict regulations restrain the efficiency of foreign exchange management, and there is a need to take into account worsened foreign exchange liquidity conditions after recent events,” the finance ministry said in a joint statement with the central bank and financial regulators.

FX SWAP LIMIT HIKED, STRENGTHENED FX STRESS TESTS DELAYED

Moreover, the foreign exchange swap limit between the Bank of Korea and the National Pension Service will increase from the current $50 billion to $65 billion, with the maturity of existing swap contracts extended to the end of 2025 from the end of this year.

Strengthened regulations on foreign currency liquidity stress tests, introduced in June, will be deferred.

Since June 2011, the Financial Supervisory Service has conducted stress tests to assess financial institutions’ foreign currency liquidity under crisis scenarios.

The regulatory body began implementing stricter stress test standards this June, however, punitive measures for institutions failing to meet the new criteria will be delayed to June 2025 from the end of this year.

The delay is expected to provide financial institutions sufficient time to adapt to the new standards while maintaining market stability, according to the joint statement.

“Increased FX loans are expected to enhance FX liquidity in the market, potentially lowering the Korean won-US dollar exchange rate,” said a ministry official.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.