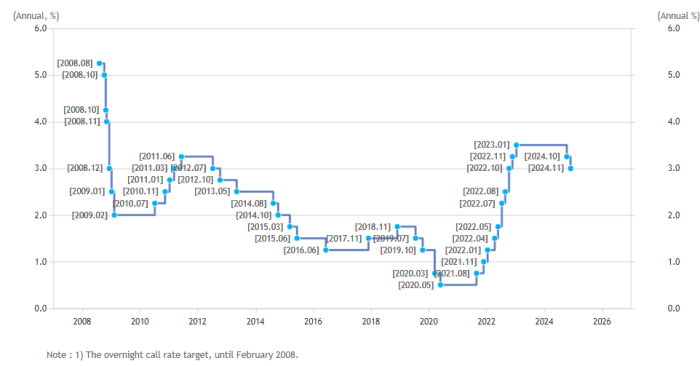

South Korea’s central bank lowered interest rates for a second straight meeting on Thursday in a surprise move and left the door open for another cut in the next three months to prop up Asia’s fourth-largest economy losing growth momentum amid the growing trade headwinds from US President-elect Donald Trump’s protectionism.

The Bank of Korea (BOK) lowered its policy interest rate by a quarter percentage point to 3.00%. The central bank had been expected to freeze the base interest rate at 3.25%, a survey by The Korea Economic Daily showed earlier this week.

It was the first back-to-back rate cut since the global economic crisis dented the country in early 2009.

“Three out of the six monetary policy board members, excluding me, said it is necessary to leave the door open the lowering the policy interest rate below 3% in the next three months,” BOK Governor Rhee Chang-yong told reporters after the unexpected easing.

Those policymakers of the seven-member committee, which Rhee chairs, saw high uncertainties over domestic and overseas economic conditions, as well as growth prospects, he said.

South Korean government bond yields fell across the board in the morning after the remarks.

The highly liquid South Korean government’s three-year bond yield slid 8.9 basis points (bps) to 2.652%, while the five-year debt yield lost 7.6 bps to 2.707% on Thursday morning, according to the Korea Financial Investment Association. The 10-year yield skidded 6 bps to 2.820%.

“The policy board is likely to cut interest rates at its first meeting in 2025 on Jan. 16, four days before Trump’s inauguration to address downside risks,” said Kiwoom Securities Co. in a note. “Another cut in February cannot be ruled out as the BOK has completely shifted its focus to downside risks in the economy.”

CUTS GROWTH, INFLATION FORECASTS

The BOK downgraded its forecasts for economic growth and inflation this year and next.

The central bank expects the economy to expand 2.2% and 1.9% in 2024 and 2025, respectively, 0.2 percentage point lower than its previous predictions.

“Export competition with major countries looks to be intensifying, while we also took note of uncertainties ahead in the trade environment after Trump’s election victory,” Rhee said.

South Korea may suffer higher tariffs as Trump pledged to impose tariffs of over 60% on imports of Chinese goods, industry sources said.

The South Korean economy barely avoided a technical recession in the third quarter with a 0.1% growth on sluggish exports.

The BOK also slashed its consumer inflation forecasts by 0.2 percentage point to 2.3% and 1.9% for this year and next, respectively.

ASIA’S WORST-PERFORMING CURRENCY WON

Despite those downgrades, two monetary policymakers including BOK Senior Deputy Governor Ryoo Sangdai said the central bank needed to leave the policy interest rate unchanged due to the weaker local currency.

The South Korean won was the worst-performing Asian currency with a near 8% loss against the dollar so far this year.

Rhee said the central bank plans to increase currency swap lines with the country’s National Pension Service (NPS), the world’s third-largest pension fund, to stabilize the won.

ING lowered its outlook for the won currency, expecting the dollar/won to trade within a range of 1,375-1,475 in 2025, compared with its previous trading range prediction of 1,350-1,400, as the bank forecast a 25 bps rate cut by each quarter next year to bring down the policy rate to 2.00%.

The local currency traded at 1,393 per dollar at 2 am on Thursday, according to BOK data.

By Jin-gyu Kang

josep@hankyung.com

Jogwoo Cheon edited this article.