For decades, or probably for centuries, Yonsei University has been associated with the image of the ivory tower – a place for academics – in South Korea.

One of the country’s most prestigious private universities, Yonsei is now fast gaining a reputation for its appetite for mergers and acquisitions – one that would be more familiar in the offices of a mid-tier conglomerate than a lecture hall in Sinchon, the academic town in Seoul.

With student numbers shrinking, tuition fees frozen, and endowments under pressure, the university is turning to the M&A market to generate new revenue streams – and perhaps, to reinvent the modern university business model altogether, analysts said.

Yonsei is quietly building a reputation as a savvy operator in consumer health products, expanding its portfolio to include hangover cures, dairy desserts, and soon, soy milk.

According to investment banking sources on Thursday, the university is acquiring the soy milk business of Erom, a plant-based health drinks maker founded by Hwang Sung-ju, a doctor-turned-entrepreneur, in a deal worth 35 billion won ($26 million).

The transaction, slated for completion later this year, will see Erom spin off its soy-based drinks unit while retaining its functional food and supplement operations. Key manufacturing technology and assets will be included in the sale, according to people familiar with the matter.

M&A BEGAN IN 2021 WITH DEAL TO BUY NATURAL WAY

This is not Yonsei’s first M&A activity in the consumer wellness business.

In 2021, the university teamed up with Seoul-based private equity firm Reverent Partners to buy Natural Way, the maker of Korea’s best-selling hangover remedy Sangkwaehwan.

Since the acquisition, Natural Way’s sales and profits have soared. Last year, it pulled in over 115 billion won in revenue with 10.9 billion won in operating profit. The Yonsei-owned company is targeting a public listing by 2026.

The acquisition of Irom’s soy milk business is led by the Yonsei Foundation, the university’s governing body, and is expected to be folded into Yonsei Milk, a previously modest dairy affiliate that has recently become a breakout hit in Korea’s fast-moving consumer goods sector.

The brand’s “cream-filled bread,” launched in 2023, sparked a social media frenzy and led to widespread sell-outs at convenience stores.

Last year, Yonsei Milk posted 345.1billion won in revenue, up 13% from the previous year. It has begun exporting its dairy products to Asian markets under the rising “K-dairy” banner.

UNIVERSITY WITH A DEAL TEAM

Yonsei’s increasingly sophisticated M&A strategy has caught the attention of industry watchers.

Most Korean universities confine their for-profit activity to licensing out research or investing through low-risk tech holding companies.

Yonsei, by contrast, is building a direct investment platform that operates more like a corporate development division. The Yonsei Foundation scouts M&A targets, conducts due diligence and executes acquisitions with board approval.

Sources close to the foundation said it is actively reviewing multiple 100 billion won-class transactions tied to existing income streams – from funeral services to wedding halls and now food and beverage.

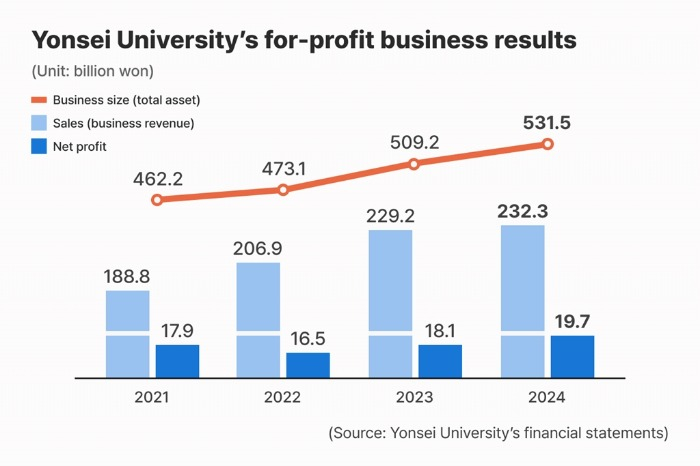

As of 2024, total assets under Yonsei’s for-profit business division stood at 531.5 billion won.

Part of what enables such agility is the absence of a dominant family owner –unlike many Korean private university foundations, which often operate as de facto family-run entities.

“Yonsei’s governance structure is far more institutional,” said a banker in Seoul. “This makes capital deployment decisions smoother and more credible to external partners.”

CHANGING MINDS AT GOVERNMENT

Under Korean law, universities require Ministry of Education approval for asset acquisitions involving significant financial commitments, such as debt financing or capital injections.

By law, 80% of income generated through university business ventures must go back into university operations.

Until recently, the ministry had taken a cautious stance on profit-oriented activities by school foundations.

However, as demographic headwinds intensify and universities across the country grapple with shrinking enrollments and stagnant budgets, that thinking has begun to change.

“There’s a growing recognition that well-managed commercial ventures can support the core mission of higher education,” said a policy adviser familiar with the ministry’s stance. “Strategic M&A may become a lifeline for universities navigating demographic decline.”

Not everyone agrees, however.

When Korea University, Yonsei’s long-standing rival, considered a foray into private equity investing through an alumnus-led fund years ago, the plan was rejected by its board. Concerns ranged from reputational risk to a lack of in-house investment expertise, sources said.

By Da-Eun Choi and Jun-Ho Cha

max@hankyung.com

In-Soo Nam edited this article.