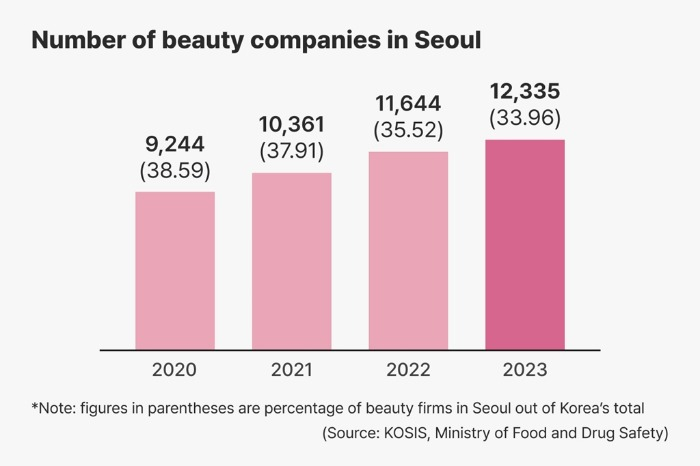

In South Korea’s M&A landscape, beauty companies are no longer waiting to go to market. They’re being courted before they even consider it.

The ongoing global craze for K-beauty is spilling over into the investment world, with aggressive deal-making activities driving up valuations and drawing unsolicited attention from private equity funds, strategic investors, and investment banks.

Several sought-after cosmetic and aesthetic medical device brands are receiving offers before their owners even contemplate a sale, said an industry watcher.

“It’s not just beauty. It’s K-beauty. There’s a premium for that now,” said a Seoul-based investment banker. “Even firms without plans to sell are being approached quietly by advisers and investors with ‘what if’ scenarios.”

‘REVERSE PITCH’

At the center of the pre-emptive frenzy is The SkinFactory Co., a personal care brand best known for its Kundal shampoo line.

Though its owner, Seoul-based private equity firm VIG Partners, has no immediate sale plan, multiple advisory firms have already pitched VIG on a possible exit, sources said.

One banker familiar with the matter described it as a “reverse pitch,” where the seller is the last to know they’re in play.

VIG, which acquired the company in 2020 for around 170 billion won ($122 million), has instead been focused on growing the business organically. But with rising market multiples and surging buying interest, unsolicited feelers are increasingly hard to ignore.

AESTHETIC DEVICES TOO

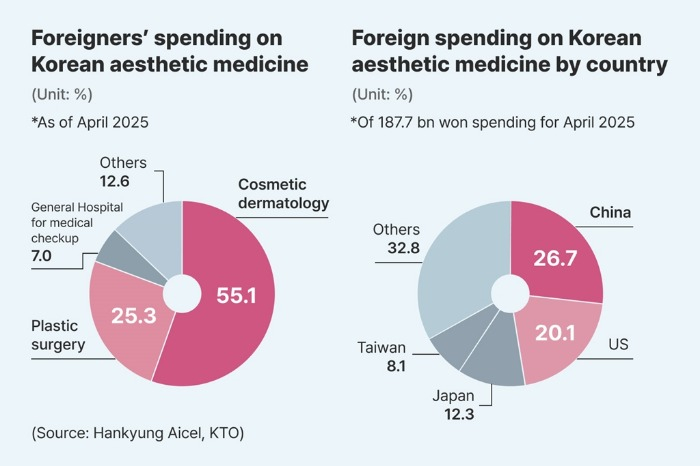

The situation is mirrored in Korea’s booming aesthetic medical device sector.

Vaim, a filler and injectables specialist backed by Premier Partners, has also attracted early interest from potential acquirers.

Premier bought a controlling 76% stake in Vaim in 2021 for 70 billion won and has since refrained from entertaining sale discussions. But as aesthetic equipment peers such as APR Co., Classys Inc. and ViOL see their stock prices surge on acquisition buzz, investor appetite for a possible acquisition is only growing, industry sources said.

Among the few deals now officially in motion is PerenneBell, owned by JKL Partners.

The company, which operates the natural cosmetics brand Some By Mi, has just begun its sale process, but advisers say interest is already running high, particularly from buyers eyeing its strong foothold in Southeast Asia.

JKL acquired the firm in December 2021 for 260 billion won and is now expected to command close to 600 billion, according to market estimates.

“It’s a seller’s market right now,” said a deal adviser in Seoul. “What’s unique in this cycle is the amount of pre-deal activities – calls, teasers, backchannel talks – even before a company is ready to consider a sale.”

RECENT NOTABLE DEALS

Recent notable deals have only stoked the frenzy.

A high-profile sale of Aekyung Industrial Co., the household and beauty goods conglomerate, has drawn robust bidding interest despite a valuation nearing 600 billion won for a 64% stake.

Even with a steep 40% control premium, shortlisted bidders included T2 PE, a Taekwang Industrial Co. affiliate; Hong Kong-based Anchor Equity Partners; Paul Capital; and Japan’s Lion Corp.

In another example, Seorin Company, acquired by Calyx Capital in 2023 for 235 billion won.

Seori, known for its derma skincare lines, was recently sold to a consortium of Godai Global Inc. and Company K Partners. The transaction, valuing Seorin at over 600 billion won, marks nearly a threefold valuation increase in just three years.

NEW KIND OF ‘SELL’ PRESSURE

Fund managers holding beauty portfolios are now facing a new kind of pressure: whether to hold on for further growth or cash in while valuations remain frothy.

“There’s a growing sense that now could be the best timing, and no one wants to miss the top,” said an investment banker.

“With deal sizes growing and fee pools expanding, even a hint of availability sparks a rush,” said another investment banker in Seoul. “In some cases, you have advisers cold-calling owners with ‘we already have a buyer lined up’ –it’s that competitive.”

By Da-Eun Choi

max@hankyung.com

In-Soo Nam edited this article.