Woori Financial Group Inc., South Korea’s fourth-largest financial services provider, has received conditional approval from the country’s top financial regulator to acquire Tongyang Life Insurance Co. and ABL Life Insurance Co.

The acquisition will significantly expand Woori’s footprint in the non-banking sector and bring the financial group’s total assets closer to 600 trillion won ($427 billion).

The Financial Services Commission (FSC) gave the green light on Friday after an eight-month review following Woori’s signing of a share purchase agreement in a 1.55 trillion won deal with China’s Dajia Insurance Group Co. last August.

The deal marks a key step in Woori’s broader strategy to diversify its portfolio from a heavy reliance on its core banking operations into the non-banking business.

Despite regulatory headwinds that threatened to derail the transaction – including a downgrade in Woori’s management rating by the financial watchdog, the Financial Supervisory Service (FSS), in March to the third grade, meaning inappropriate for M&A activities – the FSC has conditionally approved the deal, with three requirements: strengthened internal audit and controls, improved corporate governance and a restructured financial framework.

The watchdog’s decision signals a turning point for Woori, the smallest of Korea’s four major financial holding firms, which has long lagged behind peers like KB, Shinhan, and Hana in developing a fully integrated financial ecosystem spanning banking, insurance and securities.

WOORI NOW IN UPPER ECHEOLON OF KOREA’S FINANCIAL CIRCLE

Last August, Woori signed a deal to acquire Tongyang Life and ABL Life from Dajia Insurance, the revamped entity of China’s embattled Anbang Insurance Group, to bolster its non-banking business.

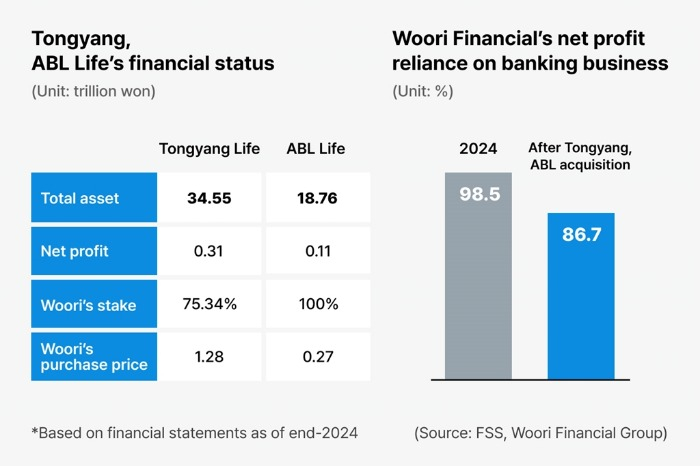

Woori said at the time it would pay Dajia 1.28 trillion won for a 75.34% stake in Tongyang Life and 265.4 billion won for a 100% stake in ABL Life.

Tongyang ranked sixth among 22 domestic life insurers in terms of insurance premiums, following Samsung Life Insurance Co., Kyobo Life Insurance Co., Hanwha Life Insurance Co., Shinhan Life Insurance Co. and NH NongHyup Life Insurance Co.

With Woori Financial’s assets standing at 525 trillion won at the end of last year, plus Tongyang Life and ABL Life together bringing about 52 trillion won in assets, the deal will push the group into the upper echelons of Korea’s financial sector by asset size.

Now that Tongyang and ABL are under its arm, Woori is expected to strengthen its non-banking business by seeking synergy with Woori Investment & Securities Co., which launched on Aug. 1, 2024.

The brokerage unit launched after merging the online fund sales platform Korea Foss Securities Co., which Woori acquired last May, with Woori Investment Bank, the country’s last merchant bank to deal mainly in commercial loans and real estate project financing.

FULL-CIRCLE MOMENT FOR CHAIRMAN YIM

The move also marks a full-circle moment for Woori Chief Executive and Chairman Yim Jong-yong, who took the helm at the financial group in March 2023.

A decade ago, as chairman of domestic rival NH Financial Group, Yim orchestrated the acquisition of Woori Investment & Securities Co. – the crown jewel of Woori at the time – helping NH become one of Korea’s most diversified financial groups. Woori Investment was later renamed NH Investment & Securities Co.

That transaction, however, left Woori stripped of key non-bank units and overly dependent on its commercial banking arm.

More than 90% of Woori Financial Group’s profits come from its banking services business.

Since taking the helm at Woori, Yim has spearheaded an aggressive turnaround strategy through M&As and strived to improve shareholder returns.

Analysts said the next phase of Woori’s overhaul will likely focus on creating synergies from its expanded portfolio.

Market watchers expect an eventual merger between Tongyang and ABL Life to streamline operations and integrate back-office functions.

Still, analysts caution that successful integration will require deft execution and sustained regulatory compliance.

Woori has been under tight government scrutiny following last year’s illegal loan scandal involving relatives of former Woori Financial Chairman Sohn Tae-seung.

In August 2024, the FSS found that Woori affiliates had improperly lent 35 billion won to relatives of former Chairman Sohn.

Earlier this year, the FSS said Yim should keep his post through to the end of his term and lead the banking group’s efforts to improve its corporate governance and risk management.

Yim has come under growing pressure to resign, taking responsibility for the case and a series of other unlawful loans.

He is slated to end his three-year term next year.

By Eui-Jin Jeong and Hyung-gyo Seo

justjin@hankyung.com

In-Soo Nam edited this article.