UBS Group AG, the frontrunner in South Korea’s M&A market last year, retained the top position in the country’s buyout advisory market in the first quarter of this year after leading a 1.78 trillion won ($1.2 billion) deal to sell the country’s No. 1 car rental and leasing company Lotte Rental Co.

In the same period, KB Securities Co. again dominated capital market deals after arranging this year’s biggest initial public offering of LG CNS Co. in Korea.

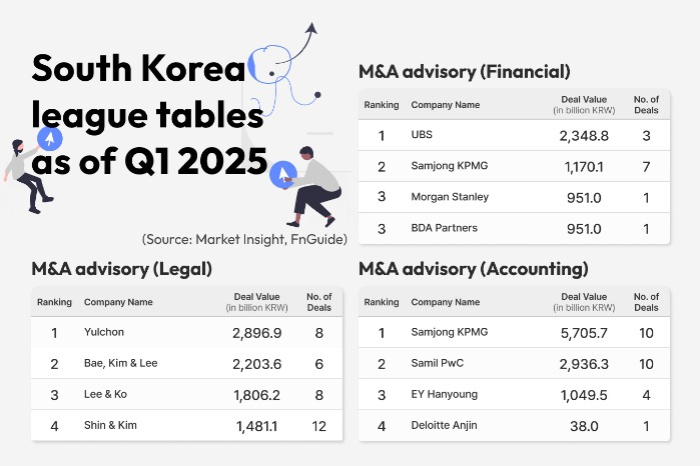

According to the league tables by The Korea Economic Daily’s capital market news outlet Market Insight and Seoul-based financial data provider FnGuide Inc. announced this week, the Switzerland-headquartered multinational investment bank topped Korea’s M&A financial advisor list for the January-March period of this year after managing a total of three deals worth 2.35 trillion won.

Its lead was driven by the sale of the assets under Korea’s retail-to-chemicals conglomerate Lotte Group’s companies.

UBS advised the sale of Lotte Rental’s 63.5% stake to Affinity Equity Partners, which closed in the first quarter of this year, as well as Lotte Chemical Corp.’s selloff of a 75.01% stake in Lotte Chemical Pakistan Ltd. (LCPL) to AsiaPak Investments and Montage Oil.

It also advised on the sale of Affinity Equity Partners’ 9.05% stake in Kyobo Life Insurance Co. to SBI Group at 234,000 won apiece earlier this month.

The runner-up was Samjong KPMG, which led seven deals worth 1.17 trillion won in total after advising on the MG Korean Federation of Community Credit Cooperatives’ (KFCC) acquisition of a local financing and finance leasing firm, M Capital Co., for 467.0 billion won.

Morgan Stanley and BDA Partners tied for third place after each managed MBK Partners’ buyout of Japanese substrate firm FICT for 951 billion won as the buyer and seller side advisor, respectively.

NEW STAR AND INCUMBENT LEADER

Thanks to the Lotte Rental deal, Korean law firm Yulchon LLC lifted the trophy in the M&A advisory legal service sector in the first quarter, marking its first lead on the list in a decade.

It advised a total of eight deals worth 2.89 trillion won, including Lotte Rental’s stake sale to Affinity Equity Partners and Hyundai Wia Corp.’s offloading of its machine tool business to an SMEC-Rylson Private Equity consortium for 340 billion won.

Bae, Kim & Lee LLC ranked No. 2 after advising Affinity Equity’s acquisition of Lotte Rental stake. It managed six deals worth 2.20 trillion won in the first three months of this year.

Korea’s biggest law firm, Kim & Chang, however, descended to fifth place after its stellar year last year. It advised seven deals in the January-March period worth 1.26 trillion won.

Lee & Ko and Shin & Kim finished in third and fourth, respectively, after each handled eight cases valued at 1.81 trillion won and 12 cases worth 1.48 trillion won.

Samjong KPMG was crowned in the league table for Korea’s M&A accounting after leading 10 deals worth 5.71 trillion won.

It widened its lead further from the runner-up Samil PwC by doubling the gap between them.

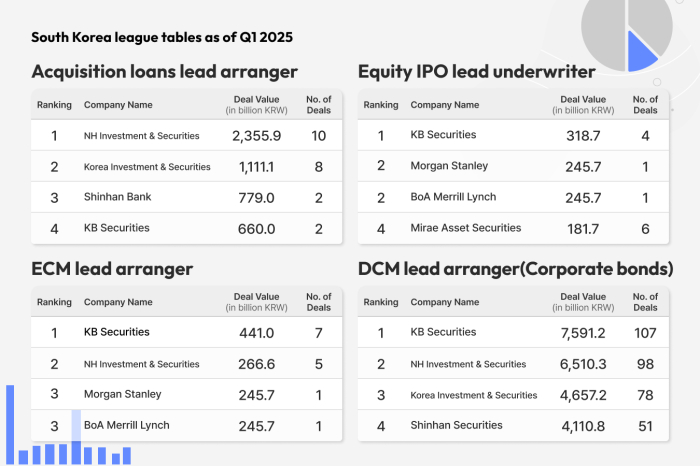

In the acquisition loan arrangement, NH Investment & Securities Co. topped the market with 10 deals worth 2.36 trillion won.

The total buyout deal value in Korea for the first quarter ended in March stood at 9.42 trillion won, 67% higher than the same period of last year, when the market grappled with one of the worst buyout deal droughts.

Despite the recovery, it still lagged far behind the 2021- 2023 heyday, when the buyout market thrived thanks to low interest rates.

KB SECURITIES CHAMPIONED BOTH ECM AND DCM

KB Securities, the brokerage unit of the leading Korean financial institution KB Financial Group, continued commanding the country’s equity capital market (ECM) and debt capital market (DCM) in the first three months of this year.

It arranged seven deals in the ECM market worth 441 billion won, including the much-anticipated new blockbuster listing, LG CNS, which went public to raise 1.2 trillion won in February.

The securities firm also arranged rights offerings of Hyundai Bioscience Co. and other small and mid-cap firms’ share sales.

It was trailed by NH Investment & Securities, which managed five deals worth 266.6 billion won, including a 162 billion won rights offering by Hyundai Motor Securities Co. It also arranged IPOs of TXR Robotics Co. and Dongbang Medical Co.

Morgan Stanley and Merrill Lynch came in third, respectively, after joining the LG CNS IPO underwriting. Mirae Asset Securities Co. and Samsung Securities Co., which jointly advised the public listing of Seoul Guarantee Insurance Co., ranked No. 5 and No. 6.

In the DCM market, KB Securities retook the throne after arranging 107 corporate debt sales valued at 7.59 trillion won. It even championed across other types of debt sales.

NH Investment & Securities finished second with 98 deals worth 6.51 trillion won, which included debt sales of LG Chem Ltd., Korean Air Lines Co. and POSCO.

The steelmaking unit of POSCO Holdings Inc.’s bond sale was jointly arranged by KB Securities, Korea Investment & Securities Co. and other underwriters.

Korea Investment & Securities ranked No. 3 with 78 deals worth 4.66 trillion won, including debt sales by LG Energy Solution Ltd. and SK Hynix Inc.

By Jong-Kwan Park, Seok-Cheol Choi, Jeong-Cheol Bae and Da Eun Choi

pjk@hankyung.com

Sookyung Seo edited this article.