South Korea’s leading alternative data service provider Hankyung Aicel Inc. is poised to transform companies’ and investors’ business and investment decision-making processes with its unique value-added information and actionable insights.

The Korea Economic Daily, South Korea’s No. 1 financial news outlet in terms of revenue, announced on Monday that it has recently started offering KED Aicel services.

KED Aicel is the alternative data service brand of Hankyung Aicel, which is renamed from Aicel Technologies Inc. after The Korea Economic Daily last October acquired the data firm from US-based policy and global intelligence provider FiscalNote Holdings Inc. for $8.50 million.

Founded in Seoul in 2016, Aicel Technologies was the pioneer of the Korean alternative data market and has rapidly broadened its client base, covering not only local corporations and investors but also top-tier multinational asset managers with a focus on the Korean market.

Under the new parent, the data service will strive to reach out to a bigger group of clients at home and abroad with its proprietary “alpha-capturing” datasets, which will provide unique value and actionable insights.

HIGH-VALUE ADDED INFORMATION AND INSIGHTS

Alternative data is collected from non-traditional sources beyond company filings and brokerage research notes.

Such datasets include credit card transactions, social media commentary, product reviews, geolocation or climate data, shipping data and satellite imagery, which companies and investors can use to make decisions on business and trading ideas. They also contain information that can move share prices.

Its demand has soared in recent years as the importance of well-refined unconventional information is growing rapidly in the investment world chasing after higher returns.

Deloitte lately forecast that the global revenue of alternative data providers will jump to $137 billion in 2030 from $11 billion in 2024 at a compound annual growth rate of 66%.

Such nontraditional datasets were mainly used by hedge funds about a decade ago but are now actively sought after by all types of investment companies ranging from investment banks to insurers, to private equity firms, to venture capital firms.

According to a survey done by US law firm Lowenstein Sandler in 2023, 62% of the 109 respondents, mainly hedge funds, PEFs and VCs, said they used alternative data, up 31% from the prior year.

Thanks to more players and better technologies to refine unconstructed, raw information, the alternative data market is set to expand bigger, leading alternative data revenue to outpace traditional data sales in 2029, according to Deloitte.

Kim Min, chief executive of Hankyung Aicel who was also the CEO of formerly Aicel Technologies, expects more companies will seek alternative data to make important business and investment decisions in Korea.

FROM EXPORT TO CREDIT CARD TRANSACTION DATA

KED Aicel offers its core products, Korea’s trade and credit card transaction data, faster than any other conventional data services, according to the company.

It updates Korean companies’ export data every 10 days and credit card transaction data every week.

With the fast-paced update in export data, investors and companies can obtain reliable information about the latest industry trends in Korea’s mainstay export items – semiconductors, electronic parts and components, steel and batteries.

Its credit card transaction data is amassed from about 300 companies and more than 700 brands, which is tantamount to more than 20 million credit card users’ transaction data.

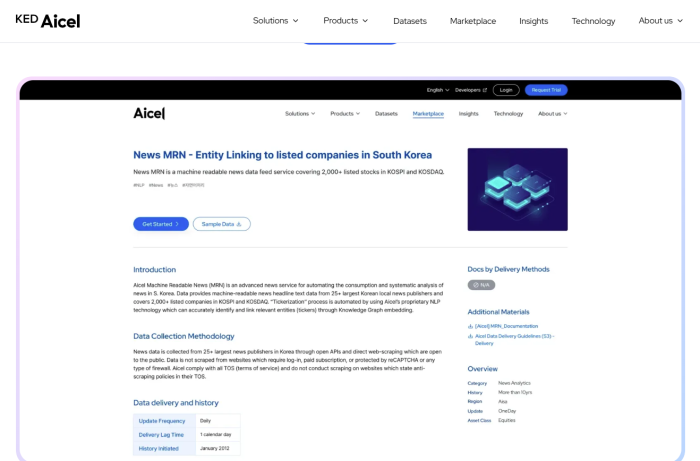

Besides them, KED Aicel provides a broader scope of information in real-time, encompassing news, insights, app traffic, macro and micro economic data, as well as tailored capital market and industry information catering to diverse clients’ demands.

Its users can also use capital market-dedicated AI Copilot service to learn up-to-date and reliable information about investment.

Hankyung Aicel said it plans to expand its product portfolio through active partnerships with other data companies with high-quality information.

KED Aicel supports secure file transfer protocol (SFTP), application programming interface (API) and Amazon S3 to deliver its services to customers.

Clients without those systems can access KED Aicel services via Hankyung Aicel’s business intelligence platform BigFinance, which is a software-as-a-service program.

By Tae-Ho Lee

thlee@hankyung.com

Sookyung Seo edited this article.