SK Earthon Co., the oil exploration arm of SK Innovation Co., has put its stakes in three oil blocks in Vietnam, estimated to be worth 200 billion won ($140 million), up for sale as part of ongoing efforts to enhance their financial health, according to people with knowledge of the matter on Wednesday.

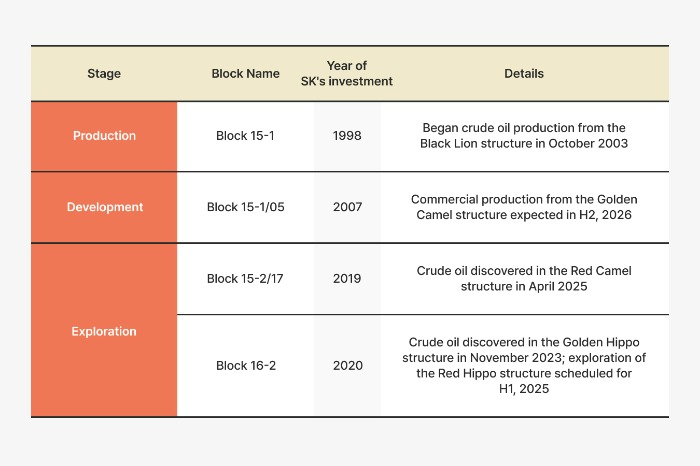

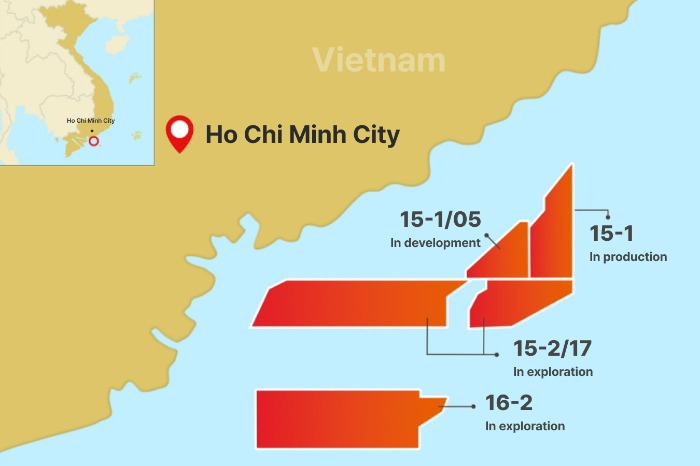

The South Korean company has developed a portfolio of four oil blocks in Vietnam since 1998, jointly with Texas-based Murphy Oil Corp. and Vietnam’s state-run PetroVietnam Exploration Production Corporation (PVEP).

SK Earthon holds a 25% stake in the four oil development and exploration blocks, including its flagship Block 15-1 already in oil production.

Murphy Oil own 40% of the blocks, while PVEP hold the remaining 35% stake.

Block 15-1 is excluded from the portfolio offered for sale, being managed by SC Securities Co.

The 15-1 field has produced over 400 million barrels of oil as of the end of 2023, making it the second-largest cummulative oil producer in the Southeast Asian country.

The 15-2/17 block in the exploration stage is believed to contain more than 170 million barrels of recoverable oil, equivalent to about 18 percent of South Korea’s annual petroleum consumption, according to Vietnamese media reports.

Petroleum industry officials say SK Earthon is seeking to capitalize on the oil field assets to hedge against the risks in resource development, which often require several hundred millions of dollars in investment and take more than a decade to bring online.

Still, they warn SK’s divestment may not be a smooth sailing.

“Valuations for producing oil blocks can be roughly estimated by multiplying projected output over the next 25 years by global crude price forecasts,” said a South Korean petroleum industry official.

“But it’s a different story for blocks still in the development or exploration phase. High investment costs and inherent risks make valuation far more complex.”

He added that SK Earthon’s divestment would also require consent from its joint venture partners, a factor that could complicate negotiations.

By Jun-Ho Cha

chacha@hankyung.com

Yeonhee Kim edited this article.