South Korea’s top economic and trade officials are flying to Washington in a concerted effort to narrow remaining differences with the US over a contentious tariff and investment package, in what officials describe as a decisive stage before the presidents of the two countries meet later this month.

According to Seoul’s presidential office and government ministries on Wednesday, Kim Yong-beom, presidential chief of staff for policy, and Kim Jung-kwan, minister of industry and trade, will depart for Washington, D.C., on Thursday to resume follow-up talks on the US-Korea tariff negotiations.

Deputy Prime Minister and Finance Minister Koo Yoon-cheol left a day earlier to attend the IMF and World Bank annual meetings, while Trade Minister Yeo Han-koo has been in the US since Tuesday coordinating working-level discussions.

The four senior economic officials are expected to meet their US counterparts, including US Commerce Secretary Howard Lutnick and Treasury Secretary Scott Besent, in what Seoul sources described as “all-out” diplomacy ahead of the APEC leaders’ summit in Korea’s historic city of Gyeongju at the end of October.

The two governments are seeking to bridge differences over Korea’s proposed $350 billion investment fund, which has become the main sticking point in the tariff talks.

UP FRONT IN CASH

Washington has pushed for a significant share of the fund to be provided up front in cash, arguing it would demonstrate Seoul’s commitment to long-term US industrial cooperation.

Seoul, however, has opposed the idea, citing risks to financial stability and foreign exchange volatility, and instead proposed a phased approach combining direct investment and guarantees.

US negotiators have recently shown “some understanding” of Korea’s position, according to officials familiar with the discussions.

“With the APEC summit approaching, both sides recognize that it is time to make tangible progress,” Wi Sung-lac, national security adviser, said on Wednesday.

The concentrated round of meetings in the US this week underscores how the tariff and investment negotiations have become a litmus test for the Korea-US economic alliance, which has deepened through cooperation on semiconductors, critical minerals and supply-chain resilience.

Seoul officials privately said the outcome could shape the tone of the Gyeongju APEC summit, determining whether US President Donald Trump and Korean President Lee Jae Myung can announce a breakthrough or face another extension of talks.

“The next ten days will decide whether we can lock in a deal,” said a senior official in Seoul.

TALKS STALLED OVER STRUCTURE OF $350 BILLION INVESTMENT PACKAGE

Tariff negotiations between Seoul and Washington have stalled over how to structure the headline $350bn Korean investment package, which was agreed upon in principle in July as part of a broader deal to lower reciprocal tariffs.

Washington had pledged to reduce its planned tariffs on Korean imports from 25% to 15%, while Seoul promised large-scale investments in US manufacturing and supply-chain projects.

However, disagreement has persisted over the composition of the funding.

Seoul has sought to cap direct cash investment at about 5% of the total, relying mainly on credit guarantees and loans rather than large up-front equity injections.

The US side, meanwhile, is pressing for a Japan-style “blank cheque” approach, allowing Washington to dictate the size and timing of cash transfers for individual projects.

People familiar with the talks said the Korean delegation is expected to present a “revised proposal” aimed at protecting its financial stability amid growing concerns over foreign exchange volatility.

The proposal reportedly includes a demand for an open-ended US–Korea currency swap arrangement, a measure Seoul regards as essential to buffer any liquidity shocks arising from the investment program.

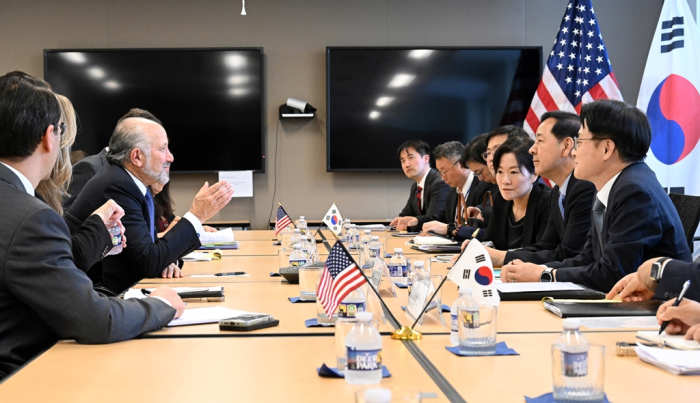

Washington has not dismissed the idea outright, with Lutnick said to have shown “some understanding” of Korea’s market anxiety during his meeting with Korean Industry Minister Kim on Oct. 4 in New York.

Foreign Minister Cho Hyun confirmed in Parliament earlier this week that “the US side has come up with new alternatives, which are now under our review.”

REASONS TO COMPROMISE

Analysts said both sides have reasons to compromise.

Korea faces growing uncertainty due to prolonged tariff disputes, while the US, embroiled in intensifying competition with China, needs Seoul’s cooperation to strengthen its shipbuilding and semiconductor supply chains – areas central to Trump’s “Make America Great Again” (MAGA) initiative.

China’s recent sanctions against Korean shipbuilder Hanwha Ocean Co. and its move to weaponize strategic resources such as rare earths have further heightened the urgency for closer US–Korea coordination, according to trade experts.

“China’s backlash against US–Korea supply chain cooperation has, paradoxically, reinforced the importance of that very partnership,” said Jang Sang-sik, head of the International Trade Research Institute at the Korea International Trade Association. “Washington now has more reason to make room for Seoul’s financial realities if it wants the alliance to hold.”

While Seoul’s insistence on a currency swap may be more of a negotiating lever, given that such arrangements fall under the remit of the Federal Reserve rather than the US administration, the broader message, analysts say, is clear: Korea is willing to invest, but only within limits that preserve its economic stability.

Whether that message resonates in Washington this week could determine not only the fate of the $350 billion package but also the tone of the upcoming Trump–Lee meeting at the APEC summit – and, with it, the next phase of the allies’ economic relationship, analysts said.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.