Samsung Electronics Co. is likely to deliver weaker-than-expected results for the second quarter, with operating profit estimated to decline by more than 15% from the first quarter weighed down by disappointing semiconductor and smartphone sales, according to industry sources on Tuesday.

However, analysts said its earnings have bottomed out and are expected to rebound in the second half of this year.

It is likely to gain new growth momentum from the release of revamped smartphone models and the start of mass production of the industry’s most advanced DRAM — the sixth-generation 10-nanometer DRAM (1c DRAM) — a project seen as critical to its turnaround efforts.

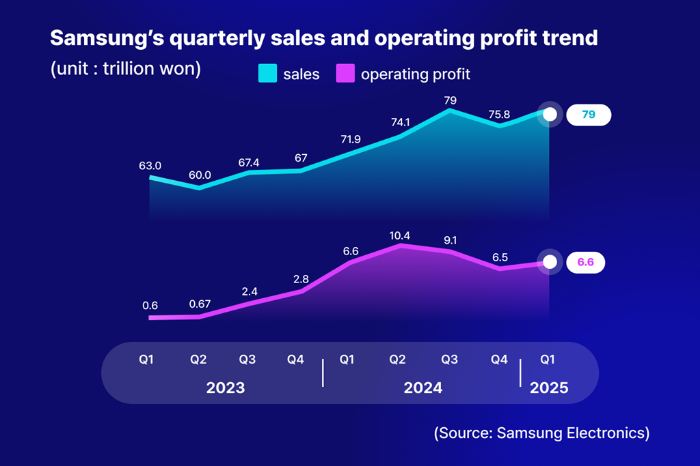

Operating profit at South Korea’s most valuable company is estimated to be in the mid-5 trillion won ($3.7 billion) range in the second quarter, compared to 6.69 trillion won in the first quarter.

The estimate falls short of the consensus forecast of 6.78 trillion won and is about half of 10.4 trillion won recorded a year earlier.

Samsung faced headwinds from the Trump administration’s tariff hikes, which drove up raw material costs, while geopolitical risks in the Middle East pushed logistics costs higher.

HIGH-BANDWIDTH MEMORY

The Device Solutions division overseeing its semiconductor business is likely to report less than 1 trillion won in operating profit, down from 1.1 trillion won in the first quarter.

In the high-bandwidth memory (HBM) market, Samsung trails behind local rival SK Hynix Inc., the major supplier of artificial intelligence chips to Nvidia Corp., the world’s largest fabless AI chip designer.

Samsung has recently started delivering 12-layer HBM3E memory to AMD and Broadcom Inc. But it has yet to secure an order from Nvidia for the most advanced AI chip currently in mass production.

The South Korean chipmaker has also suffered a setback after Nvidia chose Micron as its second supplier of HBM3E, the fifth generation of HBM, following SK Hynix.

It lost Google LLC, its long-time foundry customer, who has switched to TSMC, the world’s largest contract chipmaker.

DRAMs

Its DRAM business also underperformed. Prices of NAND Flash memory and solid-state drives designed for corporate customers failed to rise as much as expected.

In comparison, prices of double date rate 4 (DDR 4) chips have surged on supply shortage concerns, but the segment accounts for less than 10% of Samsung’s DRAM sales.

To play catch-up, Samsung is betting big on 1c DRAM, used as a core die, or a component for HBM4 and DRAM. HBM4 is the sixth generation of HBM.

1c DRAM is an advanced model of the 1b DRAM — the fifth-generation 10-nanometer DRAM mainly used by its HBM competitors. Samsung plans to begin mass production of 1c DRAM at the end of this year, after the latest DRAM passed internal quality tests on June 30.

FOUNDRY ON 2-NANOMETER PROCESS

Samsung’s foundry business is expected to stage a rebound in the second half by securing Qualcomm Inc. as a new customer. The foundry division racked up about 2 trillion won in losses in the first and second quarters, respectively.

Qualcomm is said to be considering outsourcing the manufacturing of next-generation application processors (APs) to be embedded in Samsung’s Galaxy phones to Samsung, using the Korean chip giant’s thinnest chip fabrication process – 2 nanometer.

SMARTPHONE, DISPLAY SALES

Samsung’s smartphone sales in the second quarter were weaker than expected as well, despite the May launch of the Galaxy S25 Edge, its thinnest AI-powered phone.

It is now gearing up to revive its phone sales with the release of new foldable models — Galaxy Z Fold and Z Flip 7 — at its Galaxy Unpacked event in New York on July 8.

For the Galaxy Z Flip7, the company will use Exynos 2500 AP, produced with the 3 nm process, for models to be sold in Korea.

In the second half, Samsung will begin mass production of Exynos 2600, a revamped application processor, for the Galaxy S26 series — set to launch in 2026, using the 2 nm node.

Sluggish smartphone sales dragged down earnings at its display division, which is estimated to have dropped from first-quarter levels.

By Jeong-Soo Hwang, Chae-Yeon Kim and Ui-Myung Park

hjs@hankyung.com

Yeonhee Kim edited this article.