Samsung Electronics Co.’s operating profit in the second quarter missed market expectations, with a 56% on-year fall, as its mainstay semiconductor business showed no sign of recovery amid delayed deliveries of its high bandwidth memory (HBM) chips to the world’s largest artificial intelligence chip maker, Nvidia Corp.

According to the company’s preliminary earnings guidance on Tuesday, the South Korean memory chip giant projected 4.6 trillion won ($3.4 billion) in operating profit in the April-June quarter, down 55.9% from the same period last year and 31.2% from the prior quarter.

The result came in below the market consensus of 6.7 trillion won compiled by Yonhap Infomax, a Seoul-based financial information provider.

This marks the first time Samsung’s operating profit has dipped below 5 trillion won since the fourth quarter of 2023, when it reported 2.8 trillion won. This is also the lowest second-quarter profit in two years.

Sales reached 74 trillion won, down 0.1% year-over-year and 6.5% quarter-over-quarter.

The company blamed a large one-off inventory loss reserve – a financial allowance set aside to account for potential losses in the value of inventory – at the Device Solutions (DS), which oversees the company’s semiconductor business, for the bigger-than-expected operating shortfall.

A sharp gain in the Korean currency against the US dollar last month, coupled with US tariffs, also reduced the export value of its products across divisions, Samsung added.

The won averaged 1,365.15 per dollar in June versus 1,457.92 in March, according to data from the Bank of Korea.

The company did not disclose detailed performance of each division, but brokerages forecast sales of Samsung’s another core product, smartphones, may have plateaued in the quarter due to the waning impact of its new flagship model, the Galaxy S25, released earlier this year. TV sales also remained stagnant due to weak demand.

Market analysts project the DS division’s operating profit to come below 2 trillion won in the second quarter.

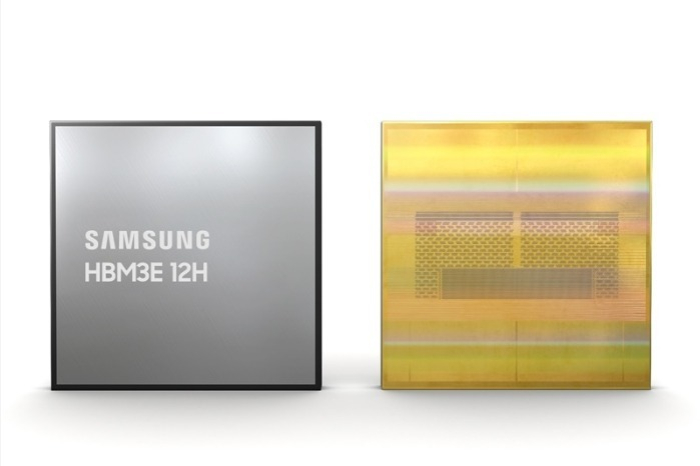

Samsung has not yet passed Nvidia’s quality test for its HBM chips, although it has supplied some to other clients, such as Advanced Micro Devices Inc. (AMD).

BOTTOM IN Q2

Samsung expects an improvement in earnings later this year, citing ongoing individual quality tests of its HBM chips with different clients and shipments of its premium chips to clients other than Nvidia.

In its non-memory business, it also expects a recovery in utilization rates on improved demand in the second quarter.

Market analysts likewise believe Samsung’s business may have hit bottom in the second quarter, expecting a recovery in its mainstay memory business in the latter half.

“Samsung’s operating profit is expected to recover gradually after bottoming out in the second quarter,” said Roh Geun-chang, research head at Hyundai Motor Securities Co.

“The loss is expected to narrow starting in the third quarter on a rise in HBM sales following the supply of the 12-layer HBM3E to AMD, new foundry contracts and improved cost efficiency.“

Samsung Electronics shares traded up 0.2% at 61,850 won in early morning session on Tuesday.

By Sookyung Seo

skseo@hankyung.com

Jennifer Nicholson-Breen edited this article.