Samsung Electronics Co. is supplying a new high-performance image sensor featuring nanoprism technology to China’s Xiaomi, as the South Korean tech giant steps up efforts to take on Sony Corp.’s dominance in the fast-growing image sensor market.

The sensor, ISOCELL JNP, is designed to improve low-light photography by capturing more light per pixel – a key demand as smartphones get thinner and camera modules smaller.

Samsung, the world’s largest memory chipmaker, began mass production of the image sensors in the second quarter, recently supplying the product in large volume to Xiaomi, people familiar with the matter said on Monday.

The deal marks the first time Samsung, also a leading smartphone maker, has supplied ISOCELL JNP to a rival mobile phone maker.

The mass production marks Samsung’s return to the premium mobile sensor space after a year-long development hiatus. In June 2024, the company unveiled three premium image sensors, including ISOCELL JN5.

The latest model, ISOCELL JNP, is now embedded in Xiaomi’s latest Civi 5 Pro smartphone, a high-end handset that targets photography-focused users.

While the base specifications of the sensor – 50 megapixels, 0.64-micron pixel size and 1/2.8-inch optical format – appear standard, its standout feature is the industry-first nanoprism structure within the micro-lens, which allows neighboring pixels to share light from different wavelengths, enhancing image brightness and sharpness in dim conditions, sources said.

“This architecture boosts light sensitivity by 25% compared to our previous JN5 sensor,” said a source at Samsung Electronics.

He said Samsung is addressing the growing industry challenge of “sensor slimming” driven by the race to develop sleeker smartphones.

TACTICAL SHIFT IN MOBILE OPTICS

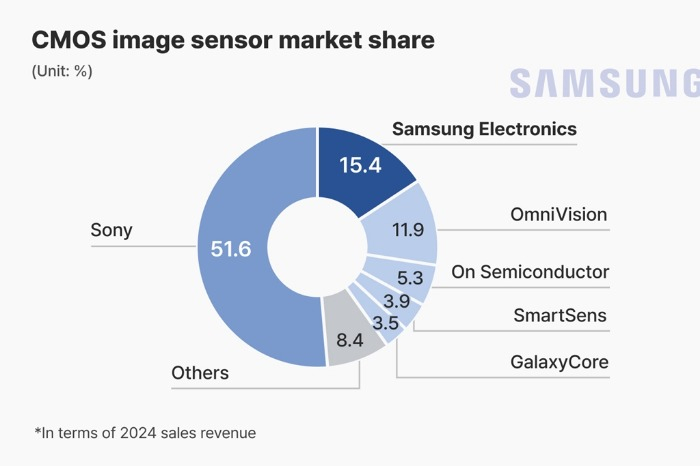

Samsung’s latest move signals a renewed push in the lucrative image sensor market, long dominated by Japan’s Sony, which holds a 51.6% share as of 2024, according to market research firm Omdia.

Samsung remains a distant second with 15.4%, while China’s OmniVision is gaining ground, with its share rising to 11.9% from 10.9% in 2023.

The strategic supply to Xiaomi, a major rival to Samsung’s mobile division, underscores the Korean tech giant’s willingness to compete on sensor tech even with customers who compete with its own Galaxy series smartphones.

Sources said Samsung is also aiming to diversify its client base by targeting North American tech companies for mobile sensor supply starting next year.

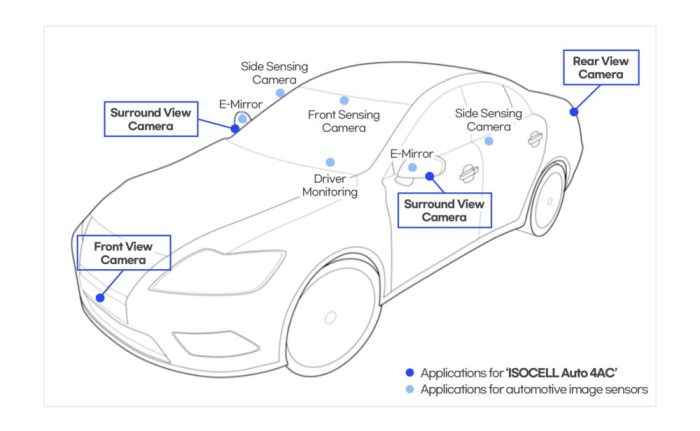

Beyond smartphones, Samsung plans to expand into automotive-grade sensors for the autonomous vehicles and robotics sectors, where demand for high-performance imaging is soaring.

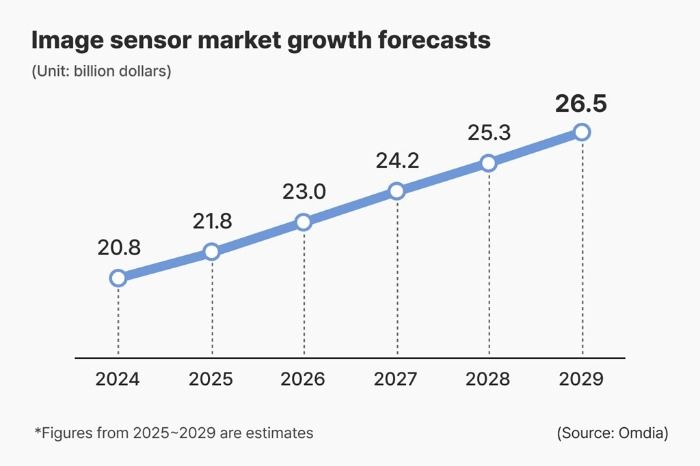

The global complementary metal-oxide semiconductor (CMOS) image sensor market is projected to grow to $26.5 billion by 2029 from $20.8 billion in 2024, according to Omdia.

NANOPRISM: SMALL LENS, BIG AMBITION

At the core of Samsung’s latest innovation is a structural rethinking of how each pixel handles incoming light.

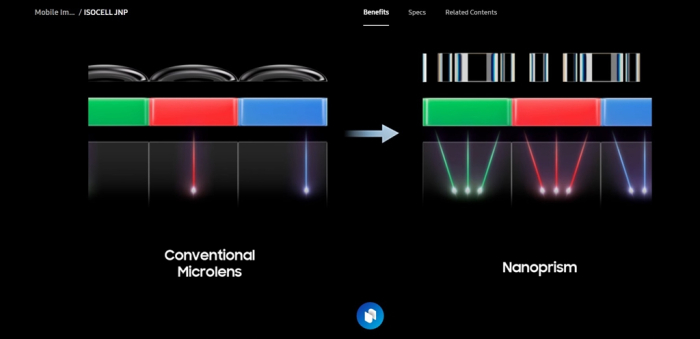

Conventional sensors feature color filters over each pixel that allow only one of red, green, or blue light to pass through – a design that inherently limits light collection.

Samsung’s nanoprism introduces a fine-tuned light guide within the micro-lens that can redirect parts of the light spectrum to adjacent pixels, effectively boosting signal generation without increasing sensor size.

That allows for clearer photos under challenging lighting, a critical differentiator for phone makers.

“Improving image clarity without increasing module thickness is one of the toughest challenges in optics,” said a Seoul-based semiconductor analyst. “Samsung’s approach offers a viable path forward, especially as foldables and ultra-thin phones become mainstream.”

A NEW FRONT IN SAMSUNG-SONY RIVALRY

The sensor breakthrough comes as Samsung is ramping up its broader chip ambitions amid weakness in its traditional memory business.

While it trails Sony in image sensors, it hopes for breakthroughs in technologies such as nano-prism.

With its ISOCELL JNP supplies to Xiaomi and talks ongoing with US tech majors, Samsung is betting that technical innovation, not just scale, can redraw the competitive map.

Analysts said Sony’s long-standing relationships with Apple Inc. and its mastery of custom sensor designs for premium devices offer it a formidable lead. Yet, as image sensors find applications far beyond phones – into cars, drones and industrial robots – Samsung sees plenty of room to grow.

Samsung’s image sensor clients include Xiaomi, Oppo, Vivo and Lenovo.

“The race is about who can bring the most light into the smallest space — and do it reliably at scale,” said an industry analyst.

By Jeong-Soo Hwang

hjs@hankyung.com

In-Soo Nam edited this article.