Samsung and Coupang are jumping into the global stablecoin race, backing US firms building digital payment rails, while debate over digital money drags on at home, hinting at their preemptive move to stake out a position on one of finance’s fastest-moving frontiers.

According to sources in the cryptocurrency market on Tuesday, Samsung Next, the venture capital arm of Samsung Electronics Co., joined a $58 million Series B round for Rain, a US fintech startup offering a stablecoin infrastructure platform.

The size of Samsung’s investment wasn’t disclosed.

Founded in 2021, Rain currently offers a single integration point for fintechs, banks and marketplaces to embed stablecoins into their products and operations, covering money-in and storage to spending and payouts across cards, wallets and payment programs.

It has been a member of Visa’s pilot program for stablecoin settlement since April, and reported a tenfold jump in transaction volume from January to August. More than 100 organizations, including Nuvei, Dakota and MPCValut, now use its platform.

Rain is also exploring new lines of business, including tokenizing credit card receivables and deploying smart contracts, or self-executing digital agreements on a blockchain.

Industry analysts say Samsung’s investment hints at a potential use of stablecoins in its own payment services, such as Samsung Pay and Samsung Wallet.

“If Samsung integrates stablecoins into the Samsung Pay network, it could give the company a real competitive edge,” said a person familiar with the company’s payment business, adding that the company is exploring a range of options.

Analysts also estimate Samsung could save more than $100 million annually in internal cross-border transactions among its affiliates if it adopts stablecoins.

COUPANG BETS ON BLOCKCHAIN

Korea’s e-commerce giant Coupang Inc. is also ramping up its venture into cryptocurrency.

It has recently joined Stripe and Paradigm as an initial design partner for Tempo, a new Layer-1 blockchain specifically for stablecoin and real-world payments.

Other partners include Visa, Anthropic, Deutsche Bank, OpenAI, Shopify and Standard Chartered, among others.

Considering that Tempo aims to pave the way for broader enterprise use of blockchain-based financial services, analysts say Coupang’s participation signals a willingness to integrate stablecoin technology into its own payment operations, potentially unlocking major cost savings.

The Korean e-commerce operator, which reaped 41 trillion won ($29.7 billion) in revenue last year, could save as much as 300 billion won annually if it adopts stablecoins for payment processing and cross-border remittance.

The company pays fees to card issuers and payment gateways, while incurring heavy costs to transfer funds to its US headquarters.

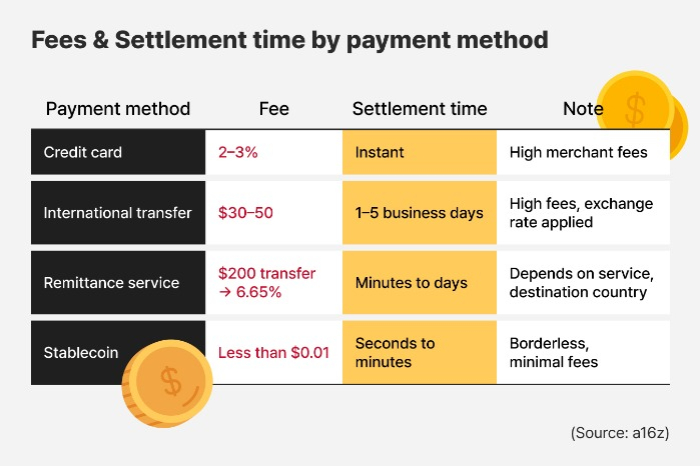

Stablecoin transactions, by contrast, cost a fraction of traditional fees.

Domestic payments can be cut in half, and international transfers can be settled instantly for about $1 each. Even after accounting for infrastructure expenses, Coupang could still save 230 billion to 300 billion won a year, according to analyst estimates.

“Stablecoins could significantly reduce transaction costs,” said Kim Min-seung, head of research at Korbit, a Korean crypto exchange. “Samsung and Coupang’s latest moves show a strategic effort to embrace the new order of digital finance.”

FAST-PACED GLOBAL STABLECOIN RACE

The push by the two Korean giants to plug into overseas stablecoin networks underscores how quickly global adoption is advancing, outpacing the slower policy debate back home.

Ark Investment expects the global stablecoin market to expand rapidly, with supply projected to jump five- to tenfold over the next five years.

In its Big Ideas 2025 report, the firm forecast that total stablecoin supply could reach $1.4 trillion by 2030, reflecting a compound annual growth rate of 38%.

Stablecoins could make up 0.9% of global M2 money supply within five years, up from 0.17% in 2024.

M2 is a gauge of the US money supply that includes M1 – cash, coins, checkable deposits and travelers’ checks – along with savings accounts, small time deposits under $100,000 and retail money market fund shares.

At the current pace of growth, stablecoins could rank as the world’s 13th-largest currency by supply, according to the US investment firm.

“Companies naturally look to stablecoins for cost savings,” said Kang Hyoung-goo, a professor of the department of finance at Hanyang University Business School.

“But it’s a shame that major corporations are turning to dollar-based stablecoins before a (Korean) won-based ecosystem has even taken shape.”

In Korea, debate continues over who should be allowed to issue stablecoins, even as other countries move to institutionalize the market.

The US has already passed the Genius Act, which brings stablecoin issuers under the Bank Secrecy Act and permits both banks and non-financial firms to issue digital coins.

The Bank of Korea has pushed to restrict issuance of won-based stablecoins to banks, while critics argue a broader pool of issuers is needed to jumpstart the ecosystem.

Korean lawmakers are preparing to debate a series of related bills in the National Assembly.

By Mi-Hyun Jo, Chae-Yeon Kim and Hun-Hyoung Ha

mwise@hankyung.com

Sookyung Seo edited this article.