The National Pension Service (NPS), South Korea’s state-run pension fund and the country’s largest institutional investor, is posting sharply reduced investment returns this year, weighed down by losses in overseas equities amid heightened global uncertainty and shifting US trade policy.

The NPS said in a regulatory filing on Friday that it posted a provisional return of 0.92% on its investments through the end of April.

The subdued performance comes in stark contrast to last year’s 15% annual return, which marked the fund’s second consecutive year of record earnings.

The pension fund’s 2025 cumulative return rate stood at 0.85% at the end of January, rising to 1.02% at the end of February before sliding back to 0.87% at the end of March.

WEAKNESS IN OVERSEAS EQUITY PORTFOLIO

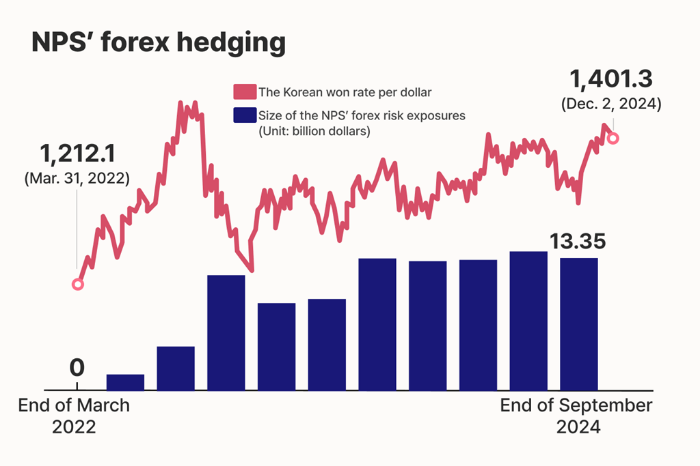

The downturn has been largely driven by weakness in the fund’s overseas equity portfolio, which previously contributed significantly to its performance.

In 2024, the NPS posted a 34.32% return rate from its overseas stock investment, propelling the fund’s overall gains.

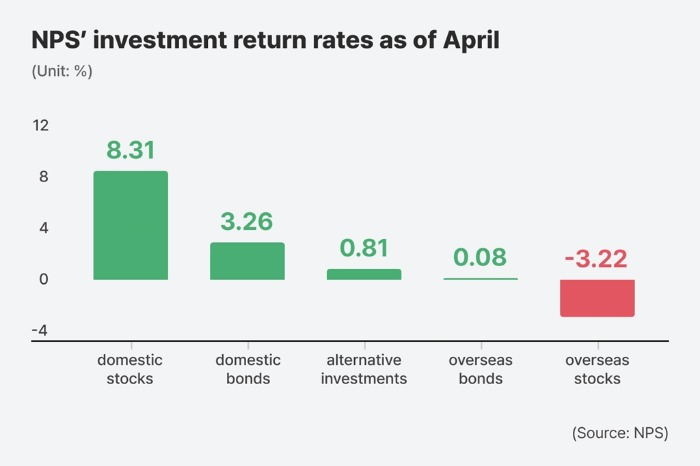

But this year, the fund’s foreign equity holdings have turned negative, delivering a return of minus 3.22% as of April.

In contrast, domestic equities returned an 8.31% gain in April, boosted by attractive valuations and the strong performance of blue-chip stocks.

“The domestic market benefited from improved fundamentals,” the NPS noted. “But overseas equity markets suffered from growing concerns over US tariff policies and stagflation risks.”

The fund saw moderate gains from domestic bonds, which returned 3.26%, while foreign bonds yielded a marginal 0.08% gain.

Alternative investments, including real estate, infrastructure and private equity, posted a 0.81% return, although that figure excludes fair value adjustments and mainly reflects income from dividends, interest and currency-related valuation changes.

CHALLENGING MACROECONOMIC ENVIRONMENT

The NPS’s performance is closely watched both domestically and internationally, given its outsized presence in global capital markets and its role in supporting Korea’s super-aged population.

Analysts said the fund’s ability to navigate increasingly volatile global markets will be key to sustaining returns as it enters a challenging macroeconomic environment.

The fund’s total assets under management reached 1,228.4 trillion won ($904.6 billion) as of end-April, up 1.28% from the end of 2024.

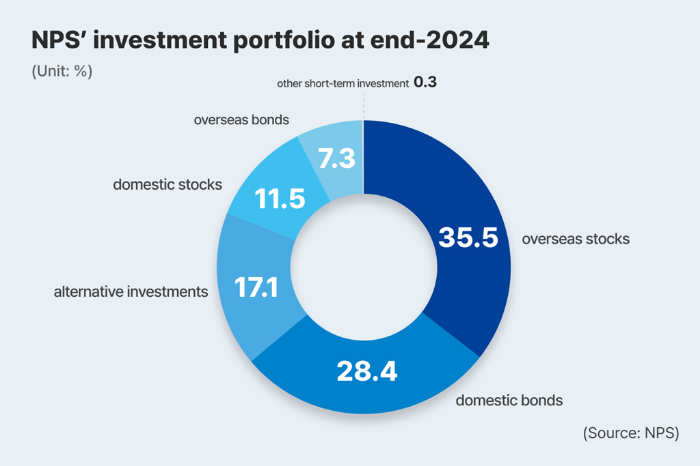

By asset class, the fund holds 156.1 trillion won in domestic stocks, 424.7 trillion won in foreign equities, 340.4 trillion won in domestic bonds, 91.3 trillion won in overseas bonds, 212.5 trillion won in alternative investments and 2.4 trillion won in other short-term investments.

By Gyeong-Jin Min

min@hankyung.com

In-Soo Nam edited this article.