South Korea reported a current account surplus for 21 straight months in January but with a moderated gain largely due to a contraction in a goods account surplus on fewer shipments of its mainstay export items, chips and cars, to overseas markets.

Asia’s No. 4 economy’s current account surplus reached $2.94 billion in January, extending the profit streak for the 21st month in a row, Bank of Korea data showed on Friday.

The excess edged down from $3.05 billion in the same month of last year, while contracting to about one-fourth a surplus of $12.37 billion in the previous month.

The current account is the broadest measure of Korea’s trade with the rest of the world.

The decrease was mainly due to waning goods account surplus, driven by a fall in exports with fewer working days in January when the Lunar New Year holiday fell, said the central bank.

However, it remains to be seen how fast Korea’s exports will recover this year after strong exports drove the country’s current account surplus for 2024 to more than triple from a year earlier.

Late last month, the central bank slashed this year’s growth forecast for heavy export-reliant Korea’s economy to 1.5% from the previous 1.9%, citing the ongoing political turmoil in the wake of the short-lived martial law declaration in December and looming US tariff threats on the country’s mainstay export items, semiconductors and cars.

LESS GOODS ACCOUNT SURPLUS

Korea’s goods account surplus stood at $2.50 billion in the first month of this year, down from $4.36 billion a year ago and $10.43 a month ago.

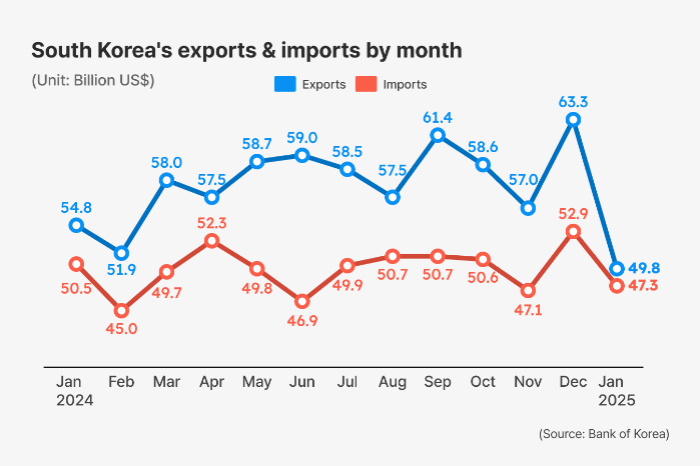

Over the same period, the country’s exports shrank 9.1% on-year to $49.81 billion, marking the first on-year fall in exports since September 2023 with a drop of 1.6%. Imports also declined 6.2% to $47.31 billion.

Shipments of the country’s core export item, semiconductors, added 7.2% year-over-year to $10.22 billion, but the growth slowed compared with a 52.8% jump a year ago.

Vehicle exports decreased 19.2% on-year to $4.83 billion, reversing from a 24.8% gain a year ago while accelerating decline from a 5.9% shortfall the prior month.

Shipments to China, the European Union, the US, Japan and Southeast Asia reduced by 14.0%, 11.6%, 9.4%, 7.7% and 3.8%, respectively.

Due to a fall in energy prices, the country’s commodity imports dwindled by 9.8%, while imports of consumer goods declined 10.3%.

TRAVEL ACCOUNT DEFICIT WIDENS

The services account posted a $2.06 billion deficit in January, narrowing from the previous month’s loss of $2.11 billion and $2.86 billion the year prior.

The travel account deficit, however, widened to $1.68 billion from a shortfall of $1.51 billion a year ago and $950 million a month ago.

January’s primary income account, which tracks wages of foreign workers and dividend payments overseas, logged a profit of $2.62 billion, nearly halved from a $4.76 billion surplus last December due to a decline of dividend income to $1.90 billion from $3.59 billion.

Koreans’ securities investment overseas rose by $12.55 billion, while foreigners’ investment in Korean stocks and bonds decreased by $290 million.

In the financial account, Koreans’ overseas direct investment shrank by $940 million in January, while foreigners’ investment in the country rose by $1.23 billion.

By Jin-gyu Kang

josep@hankyung.com

Sookyung Seo edited this article.