POSCO Group, South Korea’s largest steel and energy raw materials trader, has embarked on the process to acquire a controlling stake, worth around 7 trillion won ($5 billion), in HMM Co., the country’s top ocean carrier, in a bid to enter the shipping industry and secure a new growth engine, according to investment banking sources on Thursday.

POSCO Holdings Inc. began studying HMM as an acquisition target in late 2024. It has recently signed advisory contracts with Samil PwC and Boston Consulting Group, as well as a law firm, to assess HMM’s business, said people with knowledge of the matter.

POSCO is now drawing up detailed plans to buy control of the container shipping company.

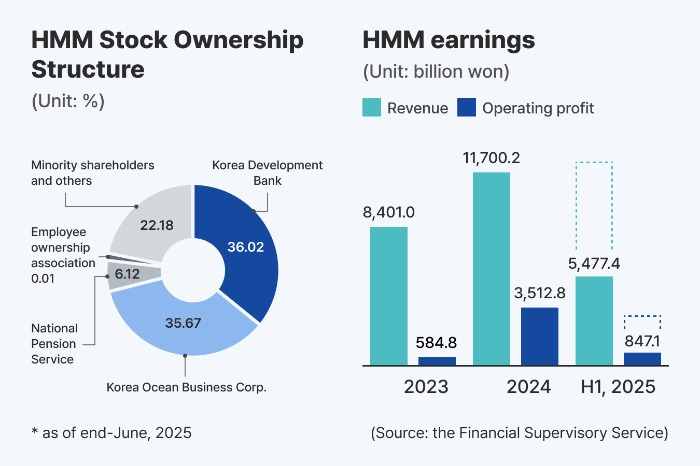

HMM, with a market value of 23 trillion won, is a majority owned by the Korea Development Bank (KDB) and the Korea Ocean Business Corporation (KOBC).

The steel giant is targeting HMM shares held by KDB, equivalent to a 36.02% stake of its outstanding shares, in a strategic move to shield from logistics disruptions arising from US tariff hikes, said the sources.

The state-run bank’s stake in the shipping company is expected to fall to the low-30% range after HMM’s share buyback this month.

“We are currently evaluating whether (the acquisition of HMM) would generate synergy with our group’s existing businesses. At this stage, no decision has been made regarding a potential bid,” said a POSCO official.

KDB and KOBC have sought to divest HMM to recoup taxpayer money. They rescued the company, formerly Hyundai Merchant Marine Co., from bankruptcy with a public fund injection in 2016 during a shipping industry downturn.

However, their attempt to offload HMM fell apart in early 2024 after Harim Co., the country’s leading poultry processor and then the preferred buyer, walked away from a $5 billion deal to buy a 57.9% stake in HMM in a consortium with Seoul-based JKL Partners.

A key reason for the deal’s collapse was the conditions attached: the sellers sought to retain a say in HMM management after the transacion, a demand Harim rejected.

JOINT MANAGEMENT

POSCO is considering jointly managing HMM with KOBC, the second-largest shareholder currently with a 35.67% stake, according to the sources.

With KOBC unwilling to divest its 35.7% stake in HMM in the near future, POSCO has no plans to acquire shares from the state-run body given its financial burden, said people familiar with the situation.

NEW GROWTH ENGINE

POSCO had been touted as the strongest candidate for HMM whenever the shipping company was put on the market. But it had flatly denied its interest, citing no business synergy.

Industry observers said that POSCO now views HMM as a new growth engine to offset the slowdown in the sectors of steel and secondary battery materials – its key business pillars.

As a major trading firm, POSCO imports bituminous coal, steel materials and battery ingredients, which cost 3 trillion won in logistics prices annually across the group.

The group is believed to have enough financial resources to buy KDB’s stake in the container carrier with 7 trillion won in cash and cash equivalents as of the end of June.

If it succeeds in taking control of HMM, it will mark its re-entry into the shipping market since selling its shipping arm to Hanjin Shipping Co. in 1995 and create a mega-sized shipping company capable of competing with global giants like Maersk and MSC.

FALLOUT FROM US TARIFF HIKES

HMM delivered a disappointing earnings shock in the second quarter with a 63.8% plunge in operating profit from the year prior. A decline in shipping rates, triggered by US tariff hikes, dealt a heavy blow to the company.

“The shipping industry is highly exposed to volatility. The US-triggered trade war has heightened uncertainty across the logistics industry,” said a shipping company official.

YET TO BE PUT BACK ON MARKET

KDB aims to restart the sale of HMM as early as this year, but it could be delayed with the post of its CEO remaining empty.

POSCO may compete with HD Hyundai Heavy Group and Hanjin Group, an aviation and transportation group in vying for the shipping company.

The shipbuilding and transportation groups are said to be interested in HMM, while Harim Group is understood to maintain interest in the shipping firm.

Under the current law, HMM cannot be sold in a proprietary deal and must go through a competitive bidding process.

By Jong-Kwan Park, Da-Eun Choi and Jun-Ho Cha

pjk@hankyung.com

Yeonhee Kim edited this article.