Samsung Electronics Co.’s new contract chipmaking or foundry business chief said on Monday he will go all-in to improve the company’s advanced 2-nanometer chip processing technology and secure more clients to take on bigger foundry rival Taiwan Semiconductor Manufacturing Co.

In his inaugural message to Samsung employees as head of its foundry business, Han Jin-man said he will pursue a “two-track strategy” to narrow its technology gap with TSMC and fend off competition with fast-followers, including China’s Semiconductor Manufacturing International Corp., better known as SMIC.

Samsung, the world’s No. 1 memory chipmaker, last month promoted Han, executive vice president of its US semiconductor business, to president and named him to lead its foundry business, which has been incurring substantial losses for years.

He previously worked in design teams for DRAM and flash memory and led solid-state drive development and strategic marketing.

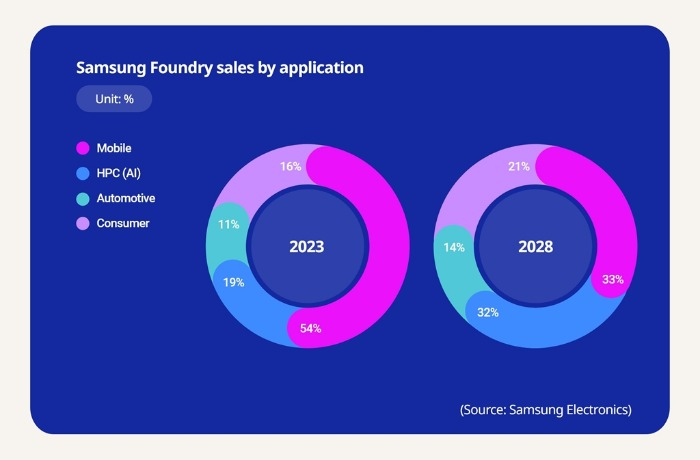

The new Samsung foundry leader will be tasked with securing large companies such as Qualcomm, AMD and Nvidia as its clients.

‘RELIEF PITCHER’

The South Korean tech giant last month reshuffled its top brass in a sweeping move as it faces an uphill battle against memory competitor SK Hynix Inc. and foundry rival TSMC.

Samsung has also created the chief technology officer (CTO) position for its foundry business to strengthen its contract chipmaking business.

Nam Seok-woo, the new foundry CTO, was previously president and head of FAB Engineering & Operations. Samsung said he is an expert in semiconductor process development and manufacturing with extensive experience in memory process and foundry manufacturing technology.

Nam and Han, Samsung’s two foundry chiefs, will be tasked with closing Samsung’s widening gap with foundry leader TSMC.

RAMP-UP OF 2-NANOMETER PROCESS NODE PRODUCTION

On Monday, Han said he will focus on improving the yield of its cutting-edge 2-nm process and expanding clients for mature processes.

He also emphasized the importance of a “rapid ramp-up” of foundry production using the 2-nm process.

“Although we were the first to transition to the gate-all-around (GAA) process, we still have significant shortcomings in commercialization,” he said.

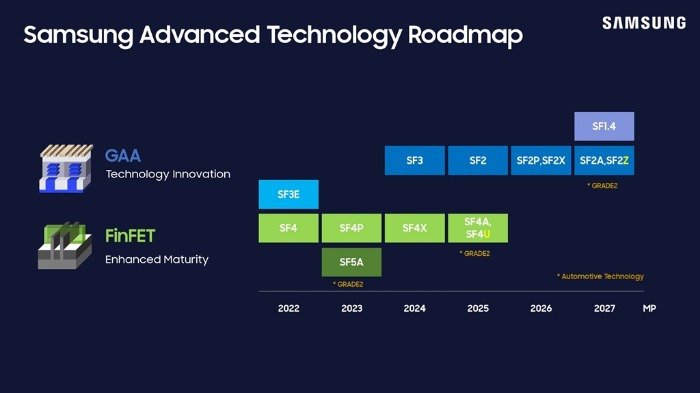

In June 2022, Samsung became the first chipmaker to mass-produce 3-nm chips using its GAA technology.

In the foundry market, however, Samsung is struggling to catch up with TSMC, which counts companies such as Nvidia, Goole and Apple as its clients.

According to market research firm TrendForce, TSMC’s foundry market share rose to 64.9% in the third quarter from 62.3% in the second quarter.

TSMC is said to begin mass production of 2-nm products next year, further solidifying its lead.

CHASED BY FAST-FOLLOWERS

While fighting an uphill battle against TSMC, Samsung is witnessing the emergence of fast-followers.

Industry watchers said Samsung faces increasing competition from Chinese players like SMIC, whose market share gap with Samsung has narrowed to 3.3 percentage points in the third quarter from 5.8 percentage points in the previous quarter.

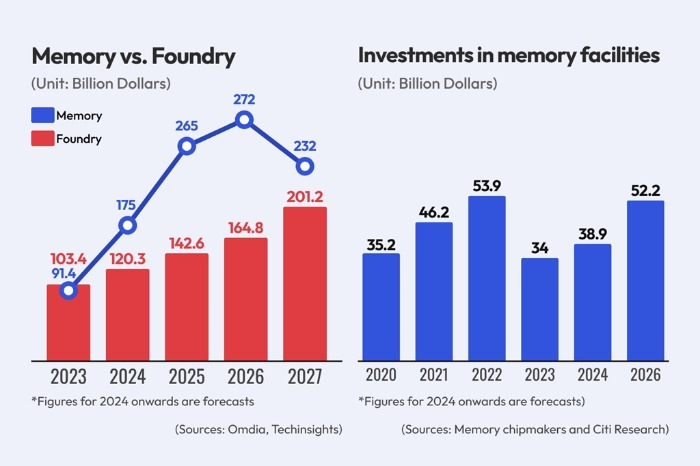

To improve the profitability of its foundry business, which has been posting more than 1 trillion won ($700 million) in quarterly losses, Samsung plans to expand its client base for mature processes of 10 nm and above.

As part of such efforts, Samsung overhauled its foundry organization, replacing executives in its design platform development team to hold them accountable for the low production yields of its mobile processor, the Exynos 2500.

Samsung earlier planned to equip the Galaxy S25 smartphone due next year with Qualcomm Inc.’s Snapdragon 8 and Samsung’s Exynos 2500. But it changed its plan and decided to use only the Snapdragon 8 Series for the Galaxy S25.

Last year, Samsung said it aims to move to more advanced 1.4 nm chip processing technology by 2027.

Chipmaking processes carry a numerical label that loosely denotes the size of the transistors that can be packed on a chip. The number refers to the thickness of the circuitry that can be drawn on the transistor. The lower the number, the more advanced the technology.

With demand for high-performance chips rising, competition for technology advancement is also fierce, particularly between TSMC and Samsung.

While Samsung’s production tech is based on GAA transistor architecture for its microfabrication process, TSMC mainly uses a different technology in the fin field-effect transistor (FinFET) structure.

By Chae-Yeon Kim

why29@hankyung.com

In-Soo Nam edited this article.