The National Pension Service (NPS), South Korea’s state-run pension fund and the country’s largest institutional investor, likely has incurred some $5 million in missed gains due to its currency risk hedging aligned with the government’s foreign exchange policy.

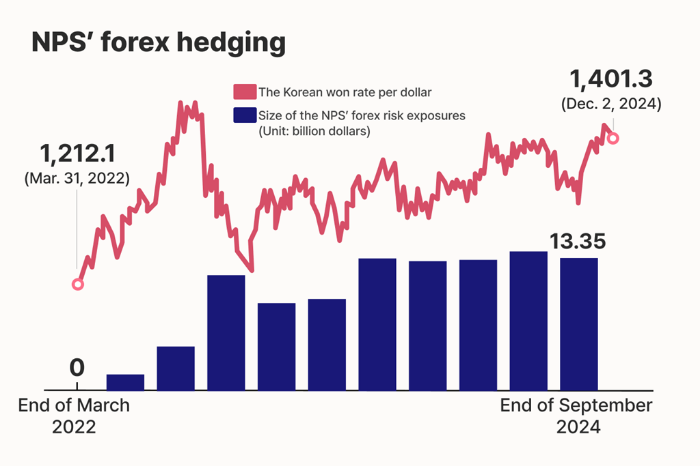

According to investment banking industry sources, the NPS in November reported to the fund management committee, the state fund’s top decision-making body, that its currency exposure ratio out of the fund’s total foreign assets of $48.55 billion was 2.75%, or $13.35 billion, as of the end of September.

Since 2022, the state pension fund has been betting on a decline in the dollar-won exchange rate from around the 1,350 won range, believing that the Korean won would strengthen going forward. The NPS engaged in currency hedging by selling forward exchange contracts.

The dollar’s value, however, has risen 3.8% over the past two years, meaning the NPS has lost foreign exchange gain opportunities.

Had the NPS not hedged its dollar-won currency risk, it would have generated an additional $500 million in foreign asset operation gains, sources said.

Now that the foreign exchange rate is hovering around 1,400 won per dollar, with an upward bias, the NPS’s potential losses are expected to grow even larger, industry officials said.

URGED BY THE GOVERNMENT?

Sources said the government might have influenced the NPS’ betting on the dollar’s weakness and related hedging.

As the exchange rate hovered around 1,400 won at the time, the government requested that pension funds increase their hedging ratio in November 2022.

The NPS then raised its tactical hedging scale by about $7.3. The state pension fund also raised its strategic hedging ratio to 10% from 0%.

Tactical hedging refers to adjustments made at the discretion of the NPS fund management committee, while strategic hedging involves setting a uniform hedging ratio for all its overseas assets.

With the dollar-won exchange rate again heading north, above 1,400 won, the government is set to request further support from the NPS, sources said.

The Ministry of Economy and Finance is said to begin discussions with the NPS soon, ahead of the expiration of the heightened strategic hedging this month.

Separately, the Bank of Korea is in talks with the NPS to expand the size of foreign exchange swaps.

Critics are questioning whether it is appropriate for the government to mobilize the NPS for its foreign exchange market stabilization policy.

“If the NPS’ betting on the won’s gains and related hedging was made on its own, it’s their fault. But if the government nudged it, that’s a problem,” said an industry official.

Last month, the US Treasury Department reinstated Korea on its foreign exchange monitoring watchlist, a year after it removed Asia’s No. 4 economy from the list.

The dollar-won rate was moving at 1,402.9 in late Tuesday trade in Seoul.

By Byeong-hwa Ryu

hwahwa@hankyung.com

In-Soo Nam edited this article.