MBK Partners’ takeover bid for Korea Zinc Inc. aims to improve corporate governance and shareholder value at the world’s largest lead and zinc smelter, the private equity firm’s founder and Chairman Michael ByungJu Kim said.

“To put it simply, it’s all about governance and shareholder value,” Kim said in response to a question from a Korea Economic Daily reporter on Monday while attending the groundbreaking event for a library named after him in Seoul.

The Kim ByungJu Library is a Seoul city-operated library partially financed by his 30 billion won ($22 million) donation. It is scheduled for completion in February 2027.

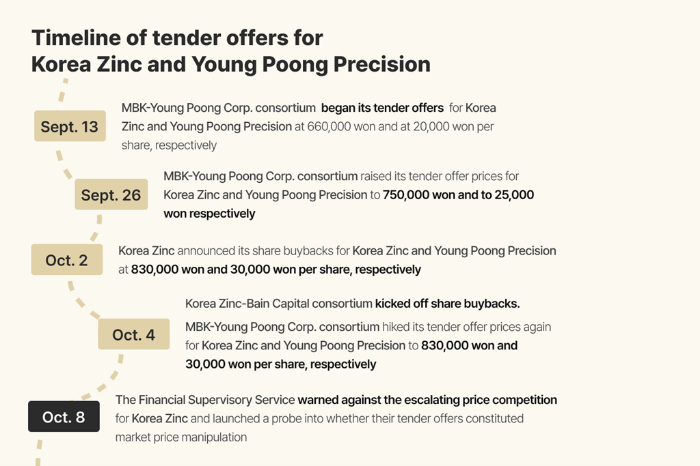

His comments mark MBK’s first official response to the MBK-Young Poong Corp. alliance’s bid to acquire a controlling stake in Korea Zinc – a tender offer that began Sept. 13.

In its defense against the bid, Korea Zinc partnered with US private equity firm Bain Capital.

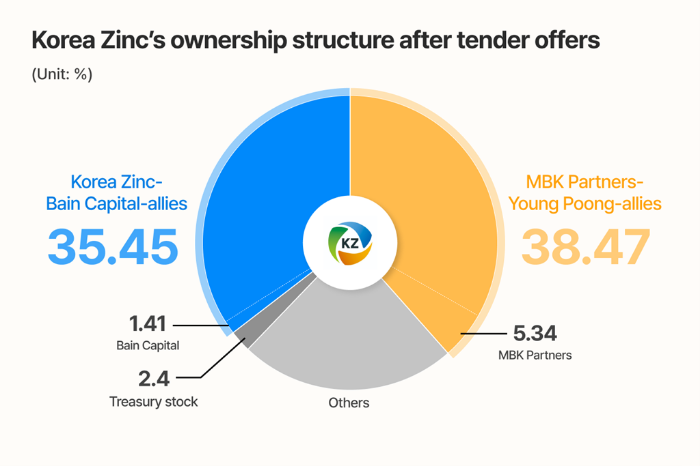

Industry watchers said Korea Zinc’s battle against the MBK-led group looks set to escalate into a lengthy proxy battle owing to the slight margin between their shareholdings.

The MBK-led coalition’s stake exceeds that of Korea Zinc and its allied shareholders by about 3 percentage points, meaning neither side secures a majority.

MBK, a private equity firm focused on Northeast Asia, argued that Korea Zinc’s current governance structure is problematic. Young Poong owns 33.1% of Korea Zinc as its largest shareholder, but Chairman Choi’s Firm exercises management control with his 1.84% stake.

HANKOOK & COMPANY

MBK Partners has a history of challenging such governance issues, as seen in its dispute with Hankook & Company Co. last year.

MBK was engaged in an aborted bid to take over Hankook & Company, the holding company of Korea’s largest tire maker Hankook Tire & Technology Co.

Back then, the PEF criticized Hankook’s weak governance and the legal risks faced by its majority shareholders, which it argued were hurting the firm’s corporate value.

Industry watchers said MBK is expected to continue its governance reform-related investments.

In his annual letter sent to limited partners (LPs) in April, Kim referred to Toshiba Corp. as an example.

Pressured by activist funds, Toshiba was eventually acquired by Japan Industrial Partners (JIP), a private equity firm.

MBK’s Kim said: “The fact that Toshiba was driven to the brink of sale due to shareholder and independent director pressure suggests that any Japanese company could face similar pressure from activist funds. Such shareholder activism has provided PEFs with the opportunity to become a white knight to support management.”

By Jong-Kwan Park

pjk@hankyung.com

In-Soo Nam edited this article.