South Korean steel giant POSCO Holdings Inc. is seeking to sell its entire stake in a Chinese stainless steel joint venture as it faces growing competition with Chinese steelmakers amid a supply glut.

Industry sources said on Friday POSCO Holdings, the parent of Korea’s top steelmaker POSCO, plans to sell its stake in POSCO Zhangjiagang Stainless Steel Co. (PZSS), a JV with Shagang Group, China’s second-largest steel producer also known as Shasteel.

POSCO Holdings and POSCO China own a combined 82.53% stake in the JV, with Shagang Group holding the remaining stake.

POSCO has chosen a Korean accounting firm as the lead manager of the sale and started reaching out to investors for the deal estimated at about 500 billion won ($361 million), sources said.

If selling the entire stake, including that owned by Shagang, is not feasible, POSCO is considering selling a 50% stake and continuing the business via joint management, according to sources.

‘LITTLE POSCO’ IN CHINA

Established in 1997 in Zhangjiagang, Jiangsu province, PZSS is a large facility capable of producing 1.1 million tons of stainless steel annually – about half the volume of POSCO’s Korean production.

Industry officials said POSCO is selling out of PZSS amid the Chinese government’s push for steel self-sufficiency by urging local steelmakers to take a greater role in supply, creating a supply glut amid a slowdown in the country’s construction sector.

Stainless steel is widely used in construction materials, automobiles, home appliances and aircraft components.

Billed as “little POSCO” because the JV had an integrated steel production facility capable of processing raw iron into expensive steel, PZSS once was a cash cow.

Built with over 1 trillion won in investment, the Zhangjiagang plant was considered a successful example of POSCO’s overseas expansion, generating hundreds of billions of won annually until 2010.

However, with the rapid rise of Chinese steel producers in the following years, PZSS began to lose money.

PZSS produced 1.134 million tons of stainless steel in 2019 but reduced its production volume to 839,000 tons last year.

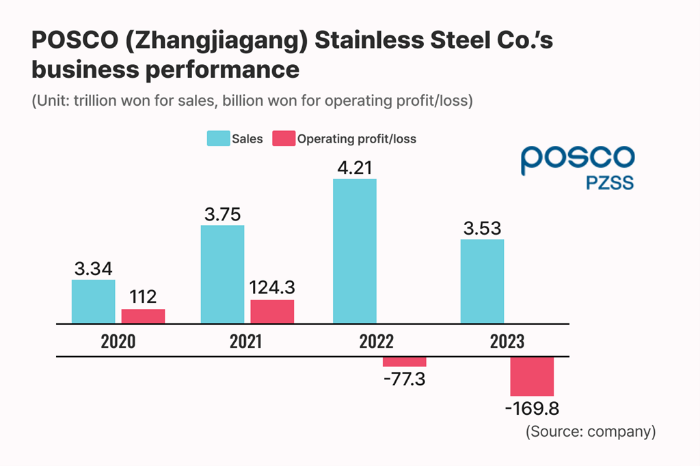

The JV’s operating loss more than doubled to 170 billion won in 2023 from 77.3 billion won in 2022.

LOSING TECH LEAD

POSCO’s technological lead over Chinese rivals has also dwindled.

Analysts said China’s Tsingshan Holding Group, the world’s largest stainless steel producer, has quickly narrowed its technology gap with POSCO.

“With Chinese steel companies growing stronger, PZSS is now at a disadvantage in terms of price competitiveness,” said a POSCO official.

China’s 43 stainless steel producers churned out a combined 28.21 billion tons of the product in the first nine months of the year, some 15% more than the country’s demand of 24.17 million tons.

CHAIRMAN CHANG’S RESTRUCTURING DRIVE

Chang In-hwa, chairman and chief executive of POSCO Group, has vowed to take drastic cost-cutting measures to counter difficulties caused by global steel oversupply and the intensifying US-China trade war.

He also promised to seek mergers and acquisitions in promising sectors beyond the steel and battery materials within his three-year term to secure new growth engines.

The steelmaking group has been selling non-core assets and unprofitable businesses to improve its financial status and secure funds for future growth drivers.

POSCO Holdings said in July it aims to raise 2.6 trillion won through restructuring by 2026.

For this, POSCO plans to sell or liquidate as many as 120 non-core assets and unprofitable businesses.

The conglomerate aims to achieve 200 trillion won in market capitalization by 2030 from the current 70 trillion won.

The CEO said in April that POSCO will take drastic cost-cutting measures to counter economic difficulties while reinforcing new businesses, including POSCO Future M Co., a battery materials affiliate.

Of 38 overseas affiliates, 13 POSCO companies fell into the red last year. Of those loss-making units, PZSS posted the highest losses in 2023.

POSCO’s corporations in Argentina and Turkey posted some 70 billion won in losses, respectively, last year.

CHINA EXIT

Analysts said some Korean companies are moving to pull out of China due to increased geopolitical uncertainty following Donald Trump’s win in the US presidential election.

The US has tightened restrictions on Chinese steel products as part of its protectionist measures.

While emphasizing his America First policy, Trump pledged to impose over 60% punitive tariffs on Chinese steel imports.

POSCO has collaborated with its partner Shagang Group for more than 27 years in China.

Korea’s two other major steelmakers, Hyundai Steel Co. and Dongkuk Steel Mill Co., are also considering pulling out of China, sources said.

By Ji-Eun Ha and Jun-Ho Cha

hazzys@hankyung.com

In-Soo Nam edited this article.