South Korean companies are postponing bond issues and initial public offerings on chilled investor sentimen in the aftermath of President Yoon Suk Yeol’s failed martial law decree last week.

In a desperate effort to raise money, they offered much higher interest rates and suggest lower valuations. But they failed to whet investor appetite, derailing their plans to set aside more cash to brace for an economic downturn.

For most of this year, the domestic bond market enjoyed abundant liquidity as investors sought to lock in high yields before the arrival of widely expected interest rate cuts next year.

But the tide was turned after Yoon’s martial law imposition on Dec. 3 night, repealed by parliament a few hours later, raised political uncertainty about Asia’s No. 4 economy.

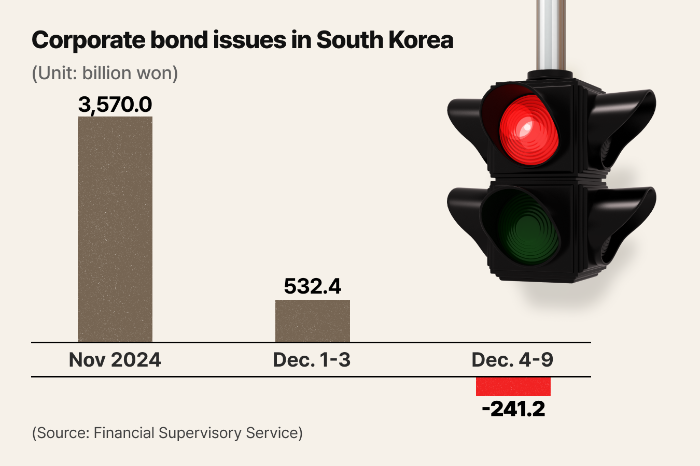

Since Dec, 4 South Korean companies redeemed a net 241.2 billion won ($168 million) in bonds until Dec. 9, according to the Korea Financial Investment Association. That means more debt repayment than new issues.

The figure compared with their debt sales of a net 3.1 trillion won in the whole month of October and a net 3.6 trillion won in November.

A large domestic construction company is said to have sold a three-month paper at an annualized yield of 7% early this week. That is even higher the mid-4% yield, at which it issued another three-month note in late October.

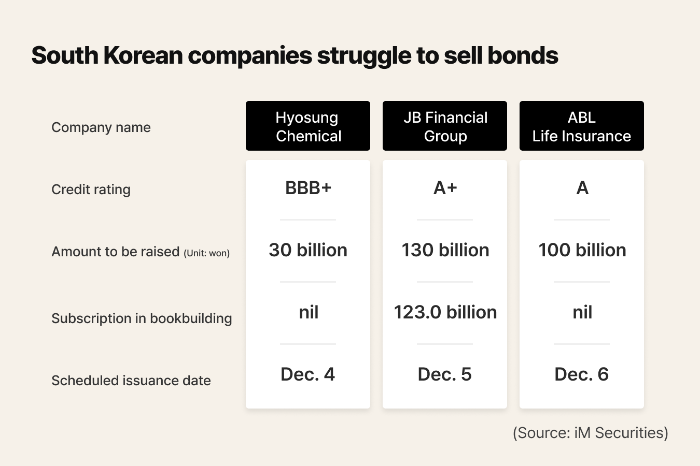

ABL Life Insurance Co. recently scrapped a plan to raise 100 billion won in 10-year subordinated debt rated single A.

Hyosung Chemical Corp. also withdrew a 30-billion-won bond sale at an annualized yield of 7.7%. The one-year bond was rated triple A.

No investors subscribed for the issues during bookbuilding, said industry officials.

“Until last month, there was a strong demand for high-interest-rate, non-investment grade corporate bonds. But the atmosphere has reversed,” said Kim Myung-sil, a researcher at iM Securities.

“Investors are shifting to treasuries and blue-chip corporate bonds in search of safe-haven assets,” he added.

Some institutional investors are said to steer clear of bonds issued by chemical, petrochemical chemical and construction companies, which are suffering a prolonged industry slump. There are foreign funds prearing to flee the domestic bond market, said a debt capital market head at a local brokerage firm.

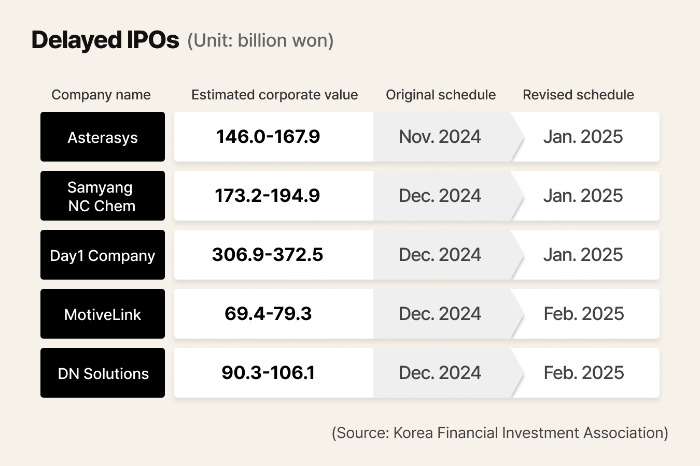

Amid the country’s political leadership vacuum, five Korean companies, including machine tool maker DN Solutions Co., recently put off stock market listings to next year.

Still, it remains uncertain when they will revisit IPOs with the benchmark stock index hovering around its lowest point in more than 11 months.

On Monday, the benchmark Kospi index broke below the 2,400 level for the first time since Jan. 20, 2023

By Hyeong-Gyo Suh, Ik-hwan Kim and Seok-Cheol Choi

seogyo@hankyung.com

Yeonhee Kim edited this article.