Four major duty-free shop operators in South Korea on Thursday posted operating losses in the third quarter, marking the first time for all the duty-free store leaders to bleed red ink for a quarter in almost two years.

Korean duty-free shops, once golden gooses for retailers, are showing no signs of recovery and likely to widen losses in the coming quarters. They are struggling with a decline in spending by travelers, especially Chinese group tourists and climbing rents, said industry observers.

Business licensing fees owed to customs office will add to their burden. The South Korean government brought the fees set in proportion to sales back to the original level after a reduction in 2020-2023. Money-losing duty-free stores need to pay the fees as well.

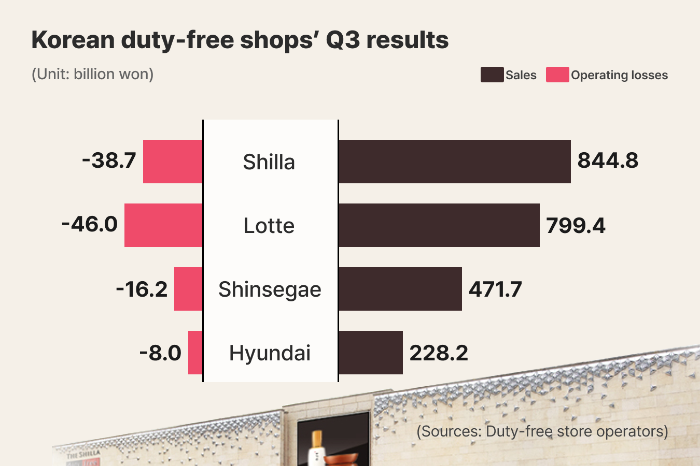

Lotte Duty-Free Shop, operated by Hotel Lotte Co., racked up losses for the fifth straight quarter, which widened to 46.0 billion won ($33 million) in the July-September period. That compared with a 36.2 billion won shortfall in the same period.

Shilla Duty-Free, under Hotel Shilla Co., chalked up a 38.7 billion operating loss during the same period. Duty-free stores operated by Shinseg Corp. and Hyundai Department Store Co. also suffered losses in the third quarter.

It was the first time the four leading duty-free shop companies in the country posted losses in a single quarter since the fourth quaretr in 2022 in the aftermath of the COVID-19 outbreak.

To fight the downturn, Lotte Duty-Free has shifted into an emergency management mode since June and offered voluntary redundancies in August.

Shinsegae DF Co., the operator of Shinsegae Duty Free, recently set up an emergency management task force team directly under its top management. Hyundai Duty Free, formerly Hyundai Department Store Duty Free, replaced its chief executive in October.

Rents are going higher at stores inside Incheon International Airport, their key location. The airport operator started charging rents in proportion to passenger numbers from 2022, doing away with the fixed rent system. Accordingly, the more people use the airport, the higher the rent.

The number of foreign shoppers at duty-free stores inside Incheon International Airport soared tenfold to 6.02 million in 2023 from 660,000 in 2021. But their combined sales contracted to 11 trillion won, versus 17 trillion won over the same period, according to the Korea Duty-Free Shop Association.

Based on the number of departing passengers at 35 million in 2019, Shilla, Shinsegae and Hyundai are estimated to pay a rent of a combined 700 billion-800 billion won to Incheon International Airport annually.

Lotte Duty-Free withdrew from the main air gateway to South Korea, in 2023.

Returning Chinese travelers gave little boost to their sales.

There were fewer shuttle traders from China, who travel to Korea in group tours to buy items at duty-free shops en mass and resell them in China, than before COVID-19. Most of them are individual travelers looking for bang for their buck.

INVENTORIES

Due to declining sales, inventories built up. Stockpiles at the four duty-free store operators increased 17.4% to 2.30 trillion won as of the end of June, compared with 1.96 trillion won at the end of last year.

For cosmetics, they had to sell them at the cost of margins before their expiration dates. They buy the products in cash and need to clear the inventories themselves.

The ascent of Chinese duty-free stores in mainland China put a damper on Korean retailers. The neighboring country has built the world’s largest duty-free shopping mall in Hainan, the nation’s tourist destination and sharply increased shoppers’ purchase limits in the area.

By Ji-Yoon Yang

yang@hankyung.com

Yeonhee Kim edited this article.