Cash holdings at South Korean companies have soared to their highest-ever level, data showed on Monday. They are stepping up efforts to raise cash through asset sales, bond issues and rights offerings, while tightening their belts to brace for a further slowdown in Asia’s No. 4 economy.

With some leading Korean business groups suffering liquidity shortages, domestic companies are seeking to increase their cash reserves, taking advantage of plenty of market liquidity.

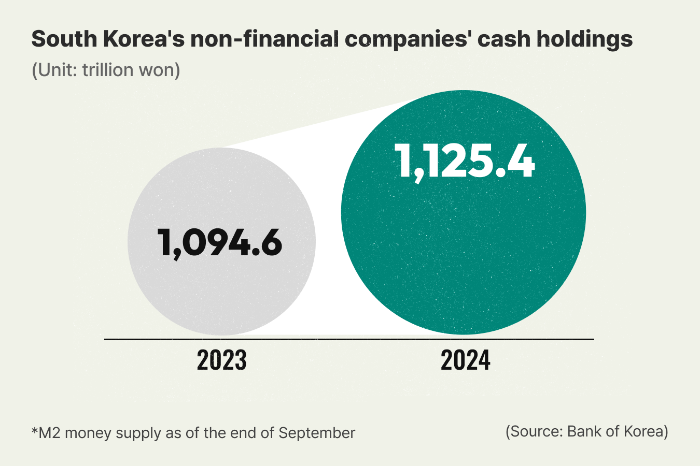

Cash reserves at the country’s non-financial companies swelled by 30 trillion won over the past year to a record 1,125,4 trillion won ($801 billion) in terms of M2 money supply as of the end of September, according to the Bank of Korea and the Korea Financial Investment Association (KOFIA).

M2 is a measure of money supply, including cash, demand and savings deposits readily convertible to cash.

The country’s top 10 non-financial companies, including Samsung Electronics Co., Hyundai Motor Co., SK Hynix Inc. and LG Energy Solution Ltd. hoard a combined 170.9 trillion won in cash as of the end of September, an increase by 7.5 trillion won compared with the end of 2023.

Samsung made up the lion’s share, sitting on 103.8 trillion won in cash and cash equivalents, an increase by 12.0 trillion won over the same period.

BOND SALES

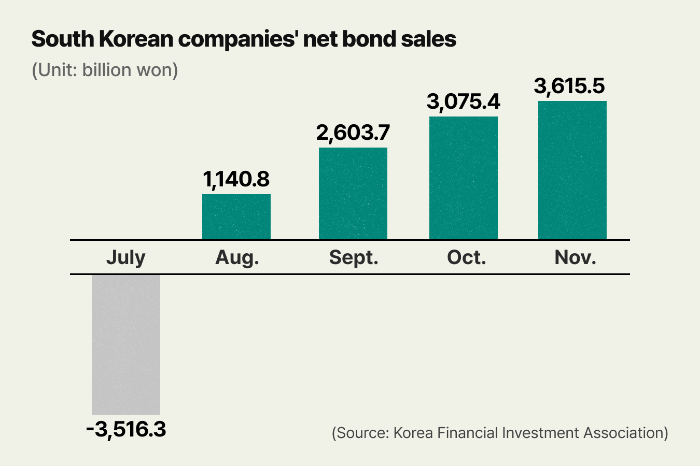

Domestic companies’ bond sales rose to a net 18.3 trillion won after redemptions this year, an 81.3% surge from the year prior, as of Dec. 2, according to the KOFIA.

Their net bond issues in November shot up to a record 3.6 trillion won, the largest-ever amount for a month of November in the country.

The rising amount of net bond sales is deemed unusual around year’s end when they close books.

But falling interest rates after the Bank of Korea’s interest rate cuts for two straight months in November are boding well for corporate debt sales. Bond investors are keen to lock in current yields before interest rates slide further next year.

Analysts expect the domestic bond market to stay buoyant through the end of this year.

“Interest rate cuts lowered the burden of bond sales, providing a good opportunity for companies to replenish their ammunition,” said Choi Sung-jong, an analyst at NH Investment & Securities.

Refiner S-Oil Corp. and KT Corp. recently sold more bonds than planned after their new debts were six-times oversubscribed. The two companies raised 300 billion won and 200 billion won in bond sales, respectively.

SK Telecom Co. and Hanwha Life Insurance Co. joined them to sell bonds. Internet network provider SK Broadband Co. has brought forward its new bond issues to the fourth quarter of this year from early next year.

The yield on South Korea’s three-year corporate bonds with a AA- rating has decreased to 3.1%, the lowest level since hitting 3.163% at market close on March 25, 2022.

ASSET SALES

They are also putting properties and illiquid assets up for sale to prepare against heavy swings in the foreign exchange market.

The Korean won currency has softened past the psychologically important barrier of 1,400 won to the dollar amid uncertainties surrounding Donald Trump’s return to the White House next month.

A total of 39 companies, including Korean Air Lines Co., Taeyoung Engineering & Construction Co., Korea Line Corp., KG Donbgu Steel Co. and Hanil Cement Co., disclosed their plans to sell assets such as land, factory, aircraft and golf course to the regulatory Financial Supervisory Service (FSS) this year.

In comparison, 25 domestic companies released similar plans to the FSS last year.

IPOs

Large business groups are also tapping the IPO market to take some of their units public. IT company LG CNS Co., cutting tool maker DN Solutions Co. and Lotte Global Logistics Co. have filed prospectuses with the Korea Exchange for preliminary reviews of IPOs. They aim to go public next year.

By Ik-Hwan Kim and Hyun-Ju Jang

lovepen@hankyung.com

Yeonhee Kim edited this article.