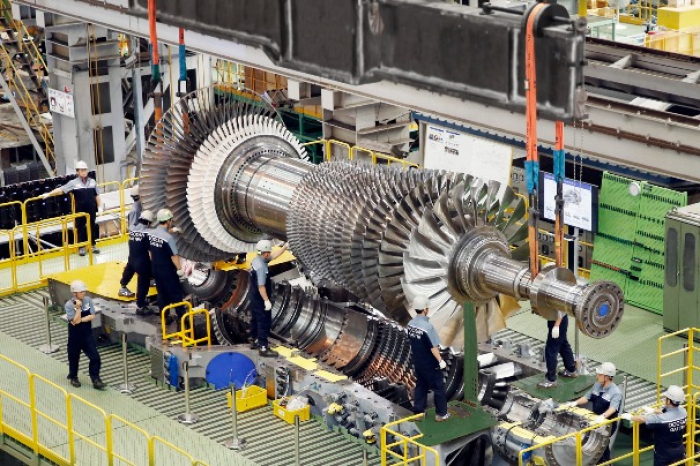

Doosan Group on Tuesday cancelled Doosan Bobcat Co.’s merger with Doosan Robotics Inc. again after President Yoo Suk Yeol’s failed martial law attempt pummeled South Korean financial markets, particularly nuclear energy stocks, on increased uncertainty about the country’s nuclear energy policy.

The botched merger would thwart Doosan Enerbility Co.’s plan to reduce debts and attract fresh capital to prepare for a boom in the nuclear power market buoyed by Yoon’ ambition to grow the country’s nuclear power industry.

Bobcat was supposed to be spun off from Enerbility, its largest shareholder with a 46% stake, and then taken over by Robotics. Through the deal, Enerbility planned to transfer Bobcat’s 700 billion won ($490 million) in debts to Robotics.

But a plunge in the share prices of Enerbility and Roboics below their buyback prices led an increasing number of shareholders to turn their back on the deal and ask for share repurchases, said the two companies in regulatory filings.

“Due to unexpected changes in the external environment … the stock prices of the companies involved in the spin-off and merger have fallen sharply in a short period of time, significantly widening the gap between the stock prices and the buyback prices,” Enerbility said in a filing.

“It seems almost certain the number of shareholders exercising buyback rights will exceed our projections,” it added.

Doosan Robotics’ share price plunged 9.06% to end at 52,200 won, far below its buyback price of 80,472 won per share. It marked its lowest finish since late November 2023.

Shares in Doosan Enerbility edged down 1.15% to close at 17,180 won, lower than its buyback at 20,890 won per share. It was heavily sold-off after Yoon’s martial law declaration repealed by parliament a few hours later.

Doosan Corp. and its stakeholders own 30.67% of Enerbility. Including the National Pension Service’s 6.85% stake, foreign and minority shareholders hold 64.56% of Enerbility’s outstanding shares.

In comparison, Bobcast closed up 1.5% at 43,200 won, with the broader Kospi index up 2.43% at 2,417,84.

If buyback requests surpass 4.5% of Enerbility’s outstanding shares, it would surpass 600 billion won ($420 million), the maximum amount the company earmarked for share repurchase.

“For Doosan, which resumed the merger process after scrapping it due to opposition from the Financial Supervisory Service in July, martial law decree is like a thunderstorm,” said a nuclear industry official.

The merger had met with a strong backlash from shareholders, who argue the merger between loss-making Robotics and cash cow Bobcat fails to properly reflect the latter’s enterprise value and would hurt minority shareholders’ interests.

After twists and turns of the deal, Doosan finally cleared a regulatory hurdle after revising their merger ratio in favor of minority shareholders.

A spin-off of Enerbility that owns Bobcat was supposed to be merged into Robotics at a ratio of 1:0.043, up from the previously proposed 1:0031 ratio.

By Hyung-Kyu Kim

khk@hankyung.com

Yeonhee Kim edited this article.